|

| 1 |  |

The measure of the squared deviations of a security's returns from its expected return is called the: |

|  | A) | mean. |

|  | B) | correlation coefficient. |

|  | C) | standard deviation. |

|  | D) | covariance. |

|  | E) | variance. |

|

|

|

| 2 |  |

Which of the following relate the performance of one to security to that of another security?

I. correlation

II. variance

III. covariance

IV. standard deviation |

|  | A) | I only |

|  | B) | I and IV only |

|  | C) | II and III only |

|  | D) | I and III only |

|  | E) | II, III, and IV only |

|

|

|

| 3 |  |

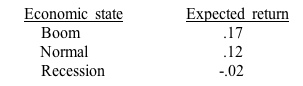

A stock has the following expected rates of return. Each state of the economy is equally likely to occur. What is the variance of these returns?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070991242/401693/ch10_q03.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070991242/401693/ch10_q03.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

|

|  | A) | .004802 |

|  | B) | .005138 |

|  | C) | .006467 |

|  | D) | .007410 |

|  | E) | .009700 |

|

|

|

| 4 |  |

The common stock of Olsen Shipping has an expected rate of return of 15.42 percent and a variance of .007248. What is the standard deviation of the returns on this stock? |

|  | A) | 91 percent |

|  | B) | 8.51 percent |

|  | C) | 08 percent |

|  | D) | 13 percent |

|  | E) | 47 percent |

|

|

|

| 5 |  |

Which one of the following statements is correct? |

|  | A) | The variance is easier to understand than the standard deviation. |

|  | B) | When comparing securities, low-variance securities are high-standard deviation securities. |

|  | C) | A negative variance security has less volatility that a positive variance security. |

|  | D) | The correlation is the square root of the covariance. |

|  | E) | The correlation coefficient must be greater than or equal to -1 and equal to or less than +1. |

|

|

|

| 6 |  |

Parker Sisters stock has an expected return of 12.8 percent with a standard deviation of 7.6 percent. Lowry Brothers stock has an expected return of 16.3 percent and a standard deviation of 13.9 percent. The covariance of the returns on these two stocks is 0.001842. What is the correlation coefficient? |

|  | A) | .083409 |

|  | B) | .088286 |

|  | C) | .163667 |

|  | D) | .174366 |

|  | E) | .182121 |

|

|

|

| 7 |  |

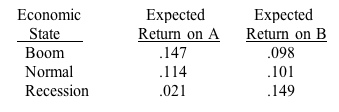

Two stocks have the following expected returns given various states of the economy. Each state of the economy has an equal chance of occurrence. What is the covariance of the returns on these two stocks?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070991242/401693/ch10_q07.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070991242/401693/ch10_q07.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a>

|

|  | A) | -.001221 |

|  | B) | -.001327 |

|  | C) | -.001384 |

|  | D) | -.001942 |

|  | E) | -.001973 |

|

|

|

| 8 |  |

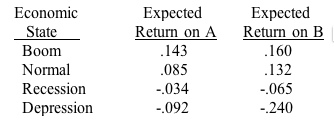

The investment manager of Babson Securities is studying the relationship of stock A to stock B. Given the various states of the economy, the expected returns for each stock are shown below. Each state of the economy has an equal chance of occurring. What is the covariance of the returns on these two stocks?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070991242/401693/ch10_q08.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0070991242/401693/ch10_q08.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a>

|

|  | A) | .008023 |

|  | B) | .011419 |

|  | C) | .014680 |

|  | D) | .016071 |

|  | E) | .017414 |

|

|

|

| 9 |  |

Currently, Sand Stone Gems has a return of 15.6 percent for the year and has an average return for the past ten years of 12.1 percent. Meanwhile, Deep Creek Mines has a return of 6.7 percent for the year and an average return for the past ten years of 9.1 percent. Given this, you can assume that the: |

|  | A) | standard deviation of the returns on Sand Stone Gems is negative. |

|  | B) | standard deviation of the returns on Deep Creek Mines is negative. |

|  | C) | covariance of the returns on these two stocks is negative. |

|  | D) | covariance of the returns on these two stocks is zero. |

|  | E) | correlation of the returns on these two stocks is zero. |

|

|

|

| 10 |  |

If the rates of return on two stocks are unrelated, the covariance of the two stocks should be: |

|  | A) | -100. |

|  | B) | -1. |

|  | C) | 0. |

|  | D) | 1. |

|  | E) | 100. |

|

|