Apply your critical-thinking ability to the knowledge you’ve gained. These cases will provide you an opportunity to develop your research, analysis, judgment, and communication skills. You will also work with other students, integrate what you’ve learned, apply it in real-world situations, and consider its global and ethical ramifications. This practice will broaden your knowledge and further develop your decision-making abilities. |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_1913.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_1913.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> |

In 1934, Congress created the Securities and Exchange Commission (SEC) and gave the commission both the power and responsibility for setting accounting and reporting standards in the United States. Required: - Explain the relationship between the SEC and the various private sector standard-setting bodies that have, over time, been delegated the responsibility for setting accounting standards.

- Can you think of any reasons why the SEC has delegated this responsibility rather than set standards directly?

| Judgment Case 1-1

The development of accounting standards lLO3 |

Internet access to the World Wide Web has provided a wealth of information accessible with our personal computers. Many chapters in this text contain Real World Cases that require you to access the web to research an accounting issue. The purpose of this case is to introduce you to the Internet home page of the Securities and Exchange Commission (SEC) and its EDGAR database. Required: - Access the SEC home page on the Internet. The web address is www.sec.gov.

- Choose the subaddress “About the SEC.” What are the two basic objectives of the 1933 Securities Act?

- Return to the SEC home page and access EDGAR. Describe the contents of the database.

| Research Case 1-2

Accessing SEC information through the Internet lLO3 |

The purpose of this case is to introduce you to the information available on the website of the Financial Accounting Standards Board (FASB). Required: Access the FASB home page on the Internet. The web address is www.fasb.org. Answer the following questions. - Describe the mission of the FASB.

- Who are the current Board members? Briefly describe their backgrounds.

- How are topics added to the FASB’s technical agenda?

- How many standards have been issued by the FASB? What topic is addressed in the most recently issued standard?

- How many Exposure Drafts are currently outstanding? What topics do they address?

| Research Case 1-3

Accessing FASB information through the Internet lLO4 |

Economic reforms in the People’s Republic of China are moving that nation toward a market-driven economy. China’s accounting practices must also change to accommodate the needs of potential investors. In an article entitled “Institutional Factors Influencing China’s Accounting Reforms and Standards,” Professor Bing Xiang analyzes the changes in the accounting environment of China during the recent economic reforms and their implications for the development of accounting reforms. Required: - In your library or from some other source, locate the indicated article in Accounting Horizons, June 1998.

- Briefly describe the economic reforms that led to the need for increased external financial reporting in China.

- Conformity with International Accounting Standards was specified as an overriding objective in formulating China’s accounting standards. What is the author’s opinion of this objective?

| Research Case 1-4

Accounting standards in China lLO3, LO4 |

Some theorists contend that companies that create pollution should report the social cost of that pollution in income statements. They argue that such companies are indirectly subsidized as the cost of pollution is borne by society while only production costs (and perhaps minimal pollution fines) are shown in the income statement. Thus, the product sells for less than would be necessary if all costs were included. Assume that the FASB is considering a standard to include the social costs of pollution in the income statement. The process would require considering both relevance and reliability of the information produced by the new standard. Your instructor will divide the class into two to six groups depending on the size of the class. The mission of your group is to explain how the concepts of relevance and reliability relate to this issue. Required: Each group member should consider the question independently and draft a tentative answer prior to the class session for which the case is assigned. In class, each group will meet for 10 to 15 minutes in different areas of the classroom. During that meeting, group members will take turns sharing their suggestions for the purpose of arriving at a single group treatment. After the allotted time, a spokesperson for each group (selected during the group meetings) will share the group’s solution with the class. The goal of the class is to incorporate the views of each group into a consensus answer to the question. | Communication Case 1-5

Relevance and reliability lLO6, LO6, LO6 |

One of your friends is a financial analyst for a major stock brokerage firm. Recently she indicated to you that she had read an article in a weekly business magazine that alluded to the political process of establishing accounting standards. She had always assumed that accounting standards were established by determining the approach that conceptually best reflected the economics of a transaction. Required: Write a one to two-page article for a business journal explaining what is meant by the political process for establishing accounting standards. Be sure to include in your article a discussion of the need for the FASB to balance accounting considerations and economic consequences. | Communication Case 1-6

Accounting standard setting lLO4 |

It is the responsibility of management to apply accounting standards when communicating with investors and creditors through financial statements. Another group, auditors, serves as an independent intermediary to help ensure that management has in fact appropriately applied GAAP in preparing the company’s financial statements. Auditors examine (audit) financial statements to express a professional, independent opinion. The opinion reflects the auditors’ assessment of the statements’ fairness, which is determined by the extent to which they are prepared in compliance with GAAP. Some feel that it is impossible for an auditor to give an independent opinion on a company’s financial statements because the auditors’ fees for performing the audit are paid by the company. In addition to the audit fee, quite often the auditor performs other services for the company such as preparing the company’s income tax returns. Required: How might an auditor’s ethics be challenged while performing an audit? | Ethics Case 1-7

The auditors’ responsibility lLO4 |

Generally accepted accounting principles do not require companies to disclose forecasts of any financial variables to external users. A friend, who is a finance major, is puzzled by this and asks you to explain why such relevant information is not provided to investors and creditors to help them predict future cash flows. Required: Explain to your friend why this information is not routinely provided to investors and creditors. | Judgment Case 1-8

Qualitative characteristics lLO6, LO6, LO6 |

Mary McQuire is trying to decide how to invest her money. A friend recommended that she buy the stock of one of two corporations and suggested that she should compare the financial statements of the two companies before making a decision. Required: - Do you agree that Mary will be able to compare the financial statements of the two companies?

- What role does the auditor play in ensuring comparability of financial statements between companies?

| Judgment Case 1-9

GAAP, comparability, and the role of the auditor lLO4, LO6, LO6, LO6 |

Statement of Financial Accounting Concepts No. 2, “Qualitative Characteristics of Accounting Information,” includes a discussion of the pervasive constraint cost effectiveness. Assume that the FASB is considering revising an important accounting standard. Required: - What is the desired benefit from revising an accounting standard?

- What are some of the possible costs that could result from a revision of an accounting standard?

- What does the FASB do in order to assess possible benefits and costs of a proposed revision of an accounting standard?

| Judgment Case 1-10

Cost effectiveness lLO6, LO6, LO6 |

A new client, the Wolf Company, asks your advice concerning the point in time that the company should recognize revenue from the rental of its office buildings. Renters usually pay rent on a quarterly basis at the beginning of the quarter. The owners contend that the critical event that motivates revenue recognition should be the date the cash is received from renters. After all, the money is in hand and is very seldom returned. Required: - Describe the two criteria that must be satisfied before revenue can be recognized.

- Do you agree or disagree with the position of the owners of Wolf Company? Support your answer.

| Judgment Case 1-11

The realization principle lLO8 |

Revenues measure the accomplishments of a company during the period. Expenses are then matched with revenues to produce a periodic measure of performance called net income. Required: - Explain what is meant by the phrase matched with revenues.

- Describe the four approaches used to implement the matching principle and label them 1 through 4.

- For each of the following, identify which matching approach should be used to recognize the cost as expense.

- The cost of producing a product.

- The cost of advertising.

- The cost of monthly rent on the office building.

- The salary of an office employee.

- Depreciation on an office building.

| Analysis Case 1-12

The matching principle lLO8 |

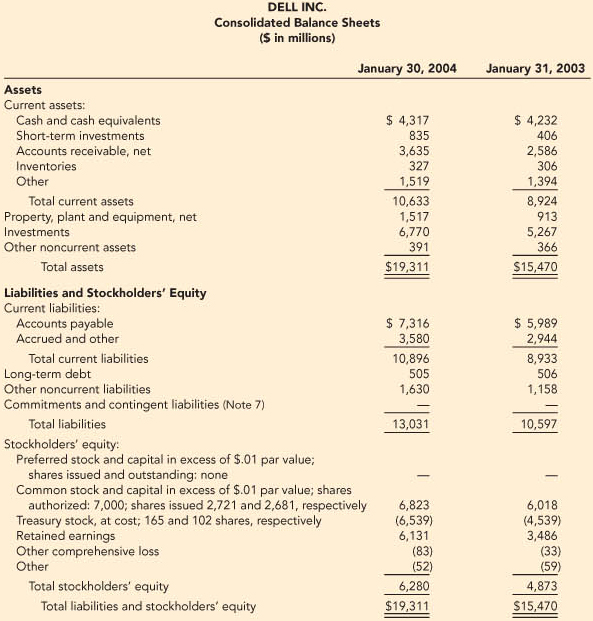

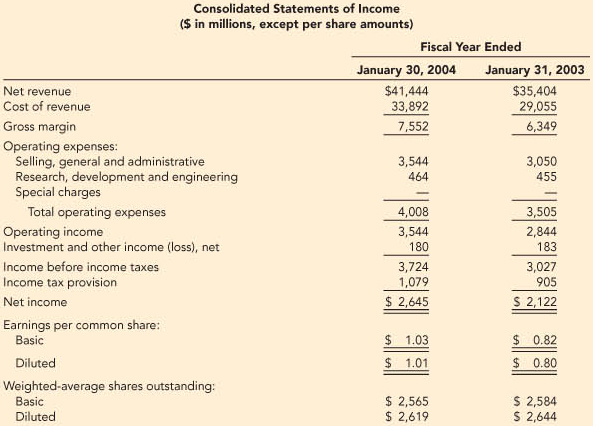

Selected financial statements from a recent annual report of Dell Inc. follow. Use these statements to answer the following questions. Required: - The company’s fiscal year ends on what date?

- What amounts did Dell report for the following items for the fiscal year ended January 30, 2004?

- Total net revenues

- Total operating expenses

- Net income

- Total assets

- Total stockholders’ equity

- How many shares of common stock did the company have issued on January 30, 2004?

- Why do you think Dell reports more than one year of data in its financial statements?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_0728.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_0728.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_0742.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072994029/0073130087_001_0742.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| Real World Case 1-13

Elements; disclosures; Dell Inc. lLO6, LO6, LO6, LO8 |