(See related pages)

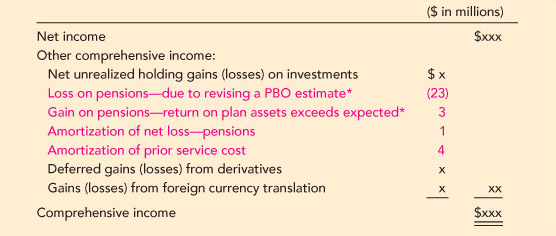

Comprehensive income, as you may recall from Chapter 4, is a more expansive view of income than traditional net income. In fact, it encompasses all changes in equity other than from transactions with owners.18 So, in addition to net income, comprehensive income includes up to four other changes in equity. A statement of comprehensive income is demonstrated in Illustration 17-5, highlighting the presentation of the components of other comprehensive income pertaining to Global’s pension plan.

* From Illustration 17-4

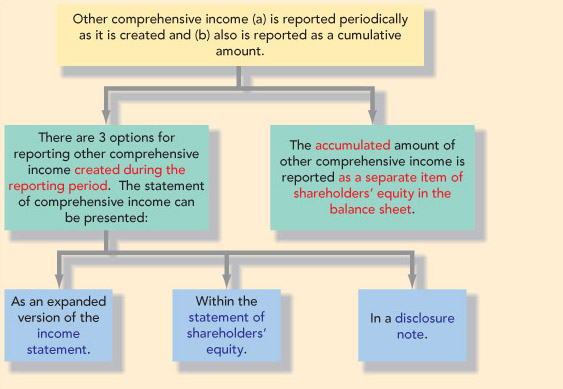

Other comprehensive income (OCI) items are reported both (a) as they occur and (b) as an accumulated balance as shown in Illustrations 17–6 and 17–7.19

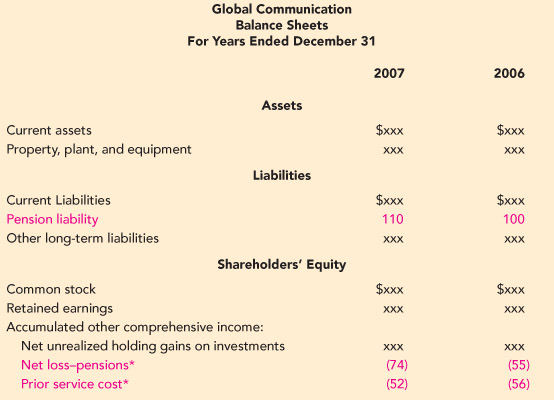

In addition to reporting the gains or losses (and other elements of comprehensive income) that occur in the current reporting period, we also report these amounts on a cumulative basis in the balance sheet. Comprehensive income includes (a) net income and (b) other comprehensive income. Notice that we report net income that occurs in the current reporting period in the income statement and also report accumulated net income (that hasn’t been distributed as dividends) in the balance sheet as retained earnings. Similarly, we report other comprehensive income as it occurs in the current reporting period (see Illustration 17-5) and also report accumulated other comprehensive income in the balance sheet. In its 2007 balance sheet, Global will report the amounts as shown in Illustration 17-7.

Look back to the schedule on page 846 to see how the net loss-pensions increased from $55 million to $74 million during 2007 and the schedule on page 844 to see how the prior service cost decreased from $56 million to $52 million. The pension liability represents the underfunded status of Global’s pension plan on the two dates. 18 Transactions with owners primarily include dividends and the sale or purchase of shares of the company’s stock. 19 The statement of comprehensive income can be reported either (a) as an extension of the income statement, (b) in a disclosure note, or (c) as part of the statement of shareholders’ equity. |