Both Exeter Investors (Maxidrive's new owner) and American Bank (Maxidrive's largest creditor) used Maxidrive's financial statements to learn more about the company before making their purchase and lending decisions. In doing so, Exeter and American Bank assumed that the statements accurately represented Maxidrive's financial condition. As they soon learned, and now have claimed in their lawsuits, the statements were in error.

On its balance sheet,Reports the amount of assets, liabilities, and stockholders' equity of an accounting entity at a point in time. Maxidrive overstated the economic resources it owned and understated its debts to others. On its income statement, Reports the revenues less the expenses of the accounting period. Maxidrive overstated its ability to sell goods for more than the cost to produce and sell them. On its statement of retained earnings,reports the way that net income and the distribution of dividends affected the financial position of the company during the accounting period. Maxidrive overstated the amount of income it reinvested in the company for future growth. On its statement of cash flows,(Cash Flow Statement) reports inflows and outflows of cash during the accounting period in the categories of operating, investing, and financing. Maxidrive overstated its ability to generate from sales of disk drives the cash necessary to meet its current debts.

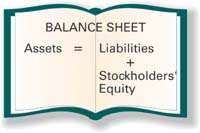

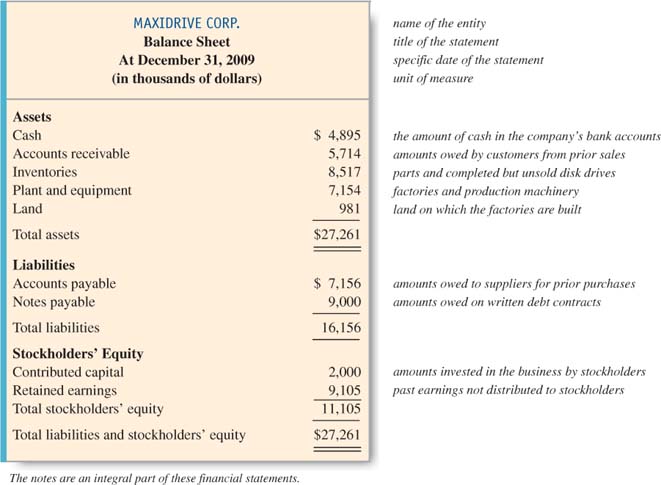

These four financial statements are the basic statements normally prepared by profit-making organizations for use by investors, creditors, and other external decision makers.The four basic statements summarize the financial activities of the business. They can be prepared at any point in time (such as the end of the year, quarter, or month) and can apply to any time span (such as one year, one quarter, or one month). Like most companies, Maxidrive prepares financial statements for investors and creditors at the end of each quarter (known as quarterly reportsThe quarterly report that publicly traded companies must file with the SEC.) and at the end of the year (known as annual reportsThe annual report that publicly traded companies must file with the SEC.). The Balance SheetThe purpose of the balance sheetA (Statement of Financial Position) reports the amount of assets, liabilities, and stockholders' equity of an accounting entity at a point in time. is to report the financial position (amount of assets, liabilities, and stockholders' equity) of an accounting entity at a particular point in time. We can learn a great deal about what the balance sheet reports just by reading the statement from the top. The balance sheet of Maxidrive Corp., presented by its former owners to Exeter Investors, is shown in Exhibit 1.2. Structure Notice that the heading specifically identifies four significant items related to the statement:

Name of the entity, Maxidrive Corp. Title of the statement, Balance Sheet. Specific date of the statement, At December 31, 2009. Unit of measure (in thousands of dollars).

|  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101b.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101b.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

The organization for which financial data are to be collected, called an accounting entity,the organization for which financial data are to be collected. must be precisely defined. On the balance sheet, the business entity itself, not the business owners, is viewed as owning the resources it uses and as owing its debts. The heading of each statement indicates the time dimension of the report. The balance sheet is like a financial snapshot indicating the entity's financial position at a specific point in time—in this case, December 31, 2009—which is stated clearly on the balance sheet. Financial reports are normally denominated in the currency of the country in which they are located. U.S. companies report in U.S. dollars, Canadian companies in Canadian dollars, and Mexican companies in Mexican pesos. Medium-sized companies such as Maxidrive often report in thousands of dollars; that is, they round the last three digits to the nearest thousand. The listing of Cash $4,895 on Maxidrive's balance sheet actually means $4,895,000. | EXHIBIT 1.2 | Balance Sheet |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

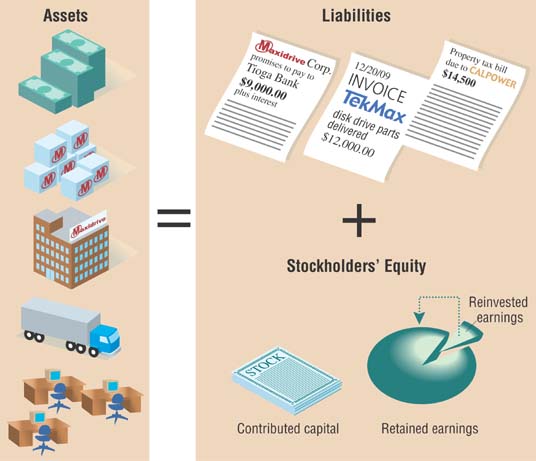

Maxidrive's balance sheet first lists the company's assets. Assets are economic resources owned by the entity. It next lists its liabilities and stockholders' equity. They are the sources of financing or claims against the company's economic resources. Financing provided by creditors creates a liability. Financing provided by owners creates owners' equity. Since Maxidrive is a corporation, its owners' equity is designated as stockholders' equity.1 Since each asset must have a source of financing, a company's assets must, by definition, equal the combined total of its liabilities and stockholders' equity. This basic accounting equation,(balance sheet equation): Assets = Liabilities + Stockholders' Equity. often called the balance sheet equation, is written:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0101.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0101.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101c.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101c.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

The basic accounting equation shows what we mean when we refer to a company's financial position: the economic resources that the company owns and the sources of financing for those resources.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_p0102.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_p0102.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Elements Assets are the economic resources owned by the company. Maxidrive lists five items under the category Assets. The exact items listed as assets on a company's balance sheet depend on the nature of its operations. But these are common names used by many companies. The five items listed by Maxidrive are the economic resources needed to manufacture and sell disk drives to companies such as Dell. Each of these economic resources is expected to provide future benefits to the firm. To prepare to manufacture the drives, Maxidrive first needed cash to purchase land on which to build factories and install production machinery (plant and equipment). Maxidrive then began purchasing parts and producing disk drives, which led to the balance assigned to inventories. When Maxidrive sells its disk drives to Dell and others, it sells them on credit and receives promises to pay called accounts receivable, which are collected in cash later. Every asset on the balance sheet is initially measured at the total cost incurred to acquire it. For example, the balance sheet for Maxidrive reports Land, $981; this is the amount paid (in thousands) for the land when it was acquired. Balance sheets do not generally show the amounts for which the assets could currently be sold. Liabilities are the company's debts or obligations. Under the category Liabilities, Maxidrive lists two items. The accounts payable arise from the purchase of goods or services from suppliers on credit without a formal written contract (or a note). The notes payable result from cash borrowings based on a formal written debt contract with lending institutions such as banks. Stockholders' equity indicates the amount of financing provided by owners of the business and earnings. The investment of cash and other assets in the business by the owners is called contributed capital. The amount of earnings (profits) reinvested in the business (and thus not distributed to stockholders in the form of dividends) is called retained earnings. In Exhibit 1.2, the Stockholders' Equity section reports two items. The two founding stockholders' investment of $2,000,000 is reported as contributed capital. Maxidrive's total earnings (or losses incurred) less all dividends paid to the stockholders since formation of the corporation equaled $9,105,000 and is reported as retained earnings. Total stockholders' equity is the sum of the contributed capital plus the retained earnings. | FINANCIAL ANALYSIS | Interpreting Assets, Liabilities, and Stockholders' Equity on the Balance Sheet |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Assessment of Maxidrive's assets was important to its creditor, American Bank, and its prospective investor, Exeter, because assets provide a basis for judging whether the company has sufficient resources available to operate. Assets were also important because they could be sold for cash in the event that Maxidrive went out of business. Exeter Investors was interested in Maxidrive's debts because of its concern about whether the company has sufficient sources of cash to pay its debts. Maxidrive's debts were also relevant to American Bank's decision to lend money to the company because existing creditors share American Bank's claim against Maxidrive's assets. If a business does not pay its creditors, the creditors may force the sale of assets sufficient to meet their claims. The sale of assets often fails to cover all of a company's debts, and some creditors may take a loss. Maxidrive's stockholders' equity or net worth is important to American Bank because creditors' claims legally come before those of owners. If Maxidrive goes out of business and its assets are sold, the proceeds of that sale must be used to pay back creditors such as American Bank before the owners receive any money. Thus, creditors consider stockholders' equity a protective “cushion.” |

|

| SELF-STUDY QUIZ | Maxidrive's assets are listed in one section and liabilities and stockholders' equity in another. Notice that the two sections balance in conformity with the basic accounting equation. In the following chapters, you will learn that the basic accounting equation is the basic building block for the entire accounting process. Your task here is to verify that the assets of $27,261,000 is correct using the numbers for liabilities and stockholders' equity presented in Exhibit 1.2. Recall the basic accounting equation:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0102.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0102.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

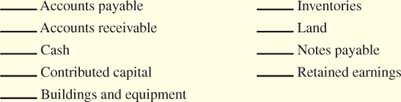

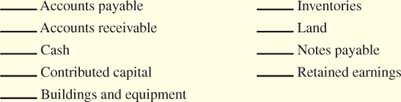

Learning which items belong in each of the balance sheet categories is an important first step in understanding their meaning. Without referring to Exhibit 1.2, mark each balance sheet item in the following list as an asset (A), liability (L), or stockholders' equity (SE).

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg10_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg10_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

After you have completed your answers, check them with the solutions at the bottom of the page.

|

|

The Income StatementStructure The income statementThe (statement of income, statement of earnings, or statement of operations) reports the revenues less the expenses of the accounting period. (statement of income, statement of earnings, or statement of operations) reports the accountant's primary measure of performance of a business, revenues less expenses during the accounting period. While the term profit is used widely for this measure of performance, accountants prefer to use the technical terms net income or net earnings. Maxidrive's net income measures its success in selling disk drives for more than the cost to generate those sales. |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101d.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101d.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

A quick reading of Maxidrive's income statement (Exhibit 1.3) indicates a great deal about its purpose and content. The heading identifies the name of the entity, the title of the report, and the unit of measure used in the statement. Unlike the balance sheet, however, which reports as of a certain date, the income statement reports for a specified period of time (for the year ended December 31, 2009). The time period covered by the financial statements (one year in this case) is called an accounting period.is the time period covered by the financial statements. Notice that Maxidrive's income statement has three major captions, revenues, expenses, and net income. The income statement equation that describes their relationship is

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0103.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0103.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| Self-Study Quiz Solutions | Assets ($27,261,000) = Liabilities ($16,156,000) + Stockholders' Equity ($11,105,000). L, A, A, SE, A, A, A, L, SE (reading down the columns).

|

|

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101e.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101e.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Elements Companies earn revenues from the sale of goods or services to customers (in Maxidrive's case, from the sale of disk drives). Revenues normally are reported for goods or services that have been sold to a customer whether or not they have yet been paid for. Retail stores such as Wal-Mart and McDonald's often receive cash at the time of sale. However, when Maxidrive sells its disk drives to Dell and Apple, it receives a promise of future payment called an account receivable, which later is collected in cash. In either case, the business recognizes total sales (cash and credit) as revenue for the period. Various terms are used in income statements to describe different sources of revenue (e.g., provision of services, sale of goods, rental of property). Maxidrive lists only one, sales revenue, in its income statement. | EXHIBIT 1.3 | Income Statement |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg11_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg11_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

Expenses represent the dollar amount of resources the entity used to earn revenues during the period. Expenses reported in one accounting period may actually be paid for in another accounting period. Some expenses require the payment of cash immediately while some require payment at a later date. Some may also require the use of another resource, such as an inventory item, which may have been paid for in a prior period. Maxidrive lists five types of expenses on its income statement, which are described in Exhibit 1.3. These expenses include income tax expense, which, as a corporation, Maxidrive must pay on pretax income.2 Net income or net earnings (often called “the bottom line”) is the excess of total revenues over total expenses. If total expenses exceed total revenues, a net loss is reported.3 We noted earlier that revenues are not necessarily the same as collections from customers and expenses are not necessarily the same as payments to suppliers. As a result, net income normally does not equal the net cash generated by operations. This latter amount is reported on the cash flow statement discussed later in this chapter. | SELF-STUDY QUIZ |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_p0103.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_p0103.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Learning which items belong in each of the income statement categories is an important first step in understanding their meaning. Without referring to Exhibit 1.3, mark each income statement item in the following list as a revenue (R) or an expense (E).

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg12_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg12_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

During the period 2009, Maxidrive delivered disk drives for which customers paid or promised to pay amounts totaling $37,436,000. During the same period, it collected $33,563,000 in cash from its customers. Without referring to Exhibit 1.3, indicate which of these two amounts will be shown on Maxidrive's income statement as sales revenue for 2009. Why did you select your answer? During the period 2009, Maxidrive produced disk drives with a total cost of production of $27,130,000. During the same period, it delivered to customers disk drives that had cost a total of $26,980,000 to produce. Without referring to Exhibit 1.3, indicate which of the two numbers will be shown on Maxidrive's income statement as cost of goods sold expense for 2009. Why did you select your answer?

After you have completed your answers, check them with the solutions at the bottom of the page. |

|

| Self-Study Quiz Solutions | E, E, R, E (reading down the columns). Sales revenue in the amount of $37,436,000 is recognized. Sales revenue is normally reported on the income statement when goods or services have been delivered to customers who have either paid or promised to pay for them in the future. Cost of goods sold expense is $26,980,000. Expenses are the dollar amount of resources used up to earn revenues during the period. Only those disk drives that have been delivered to customers have been used up. Those disk drives that are still on hand are part of the asset inventory.

|

|

| FINANCIAL ANALYSIS | Analyzing the Income Statement: Beyond the Bottom Line |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Investors such as Exeter and creditors such as American Bank closely monitor a firm's net income because it indicates the firm's ability to sell goods and services for more than they cost to produce and deliver. Investors buy stock when they believe that future earnings will improve and lead to a higher stock price. Lenders also rely on future earnings to provide the resources to repay loans. The details of the statement also are important. For example, Maxidrive had to sell more than $37 million worth of disk drives to make just over $3 million. If a competitor were to lower prices just 10 percent, forcing Maxidrive to do the same, its net income could easily turn into a net loss. These factors and others help investors and creditors estimate the company's future earnings. |

|

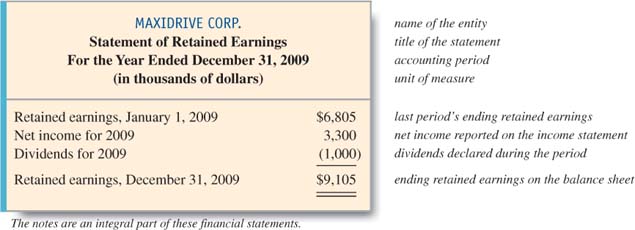

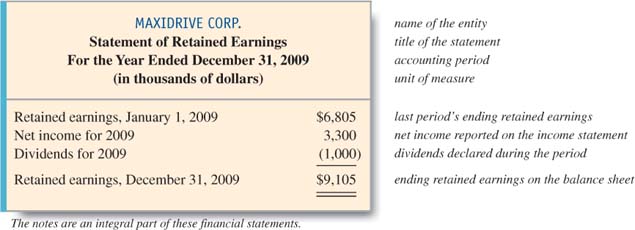

Statement of Retained EarningsStructure Maxidrive prepares A separate statement of retained earnings,reports the way that net income and the distribution of dividends affected the financial position of the company during the accounting period. shown in Exhibit 1.4. The heading identifies the name of the entity, the title of the report, and the unit of measure used in the statement. Like the income statement, the statement of retained earnings covers a specified period of time (the accounting period), which in this case is one year. The statement reports the way that net income and the distribution of dividends affected the company's financial position during the accounting period.4 Net income earned during the year increases the balance of retained earnings, showing the relationship of the income statement to the balance sheet. The declaration of dividends to the stockholders decreases retained earnings.5 The retained earnings equation that describes these relationships is  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0104.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=gif::::/sites/dl/free/0073324833/lib26886_eq0104.gif','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Elements The statement begins with Maxidrive's beginning-of-the-year retained earnings. The current year's net income reported on the income statement is added and the current year's dividends are subtracted from this amount. During 2009, Maxidrive earned $3,300,000, as shown on the income statement (Exhibit 1.3). This amount was added to the beginning-of-the-year retained earnings. Also, during 2009, Maxidrive declared and paid a total of $1,000,000 in dividends to its two original stockholders. This amount was subtracted in computing end-of-the-year retained earnings on the balance sheet. Note that retained earnings increased by the portion of income reinvested in the business ($3,300,000 − $1,000,000 = $2,300,000). The ending retained earnings amount of $9,105,000 is the same as that reported in Exhibit 1.2 on Maxidrive's balance sheet. Thus, the retained earnings statement indicates the relationship of the income statement to the balance sheet. |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101f.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101f.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

| EXHIBIT 1.4 | Statement of Retained Earnings |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg13_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg13_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

| FINANCIAL ANALYSIS | Interpreting Retained Earnings |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Reinvestment of earnings, or retained earnings, is an important source of financing for Maxidrive, representing more than one-third of its financing. Creditors such as American Bank closely monitor a firm's retained earnings statement because the firm's policy on dividend payments to the stockholders affects its ability to repay its debts. Every dollar Maxidrive pays to stockholders as a dividend is not available for use in paying back its debt to American Bank. Investors examine retained earnings to determine whether the company is reinvesting a sufficient portion of earnings to support future growth. |

|

| SELF-STUDY QUIZ | Maxidrive's statement of retained earnings reports the way that net income and the distribution of dividends affected the financial position of the company during the accounting period. In a prior period, Maxidrive's financial statements reported the following amounts: beginning retained earnings $5,510, total assets $20,450, dividends $900, cost of goods sold expense $19,475, net income $1,780. Without referring to Exhibit 1.4, compute ending retained earnings. After you have completed your answer, check it with the solution at the bottom of the page. |

|

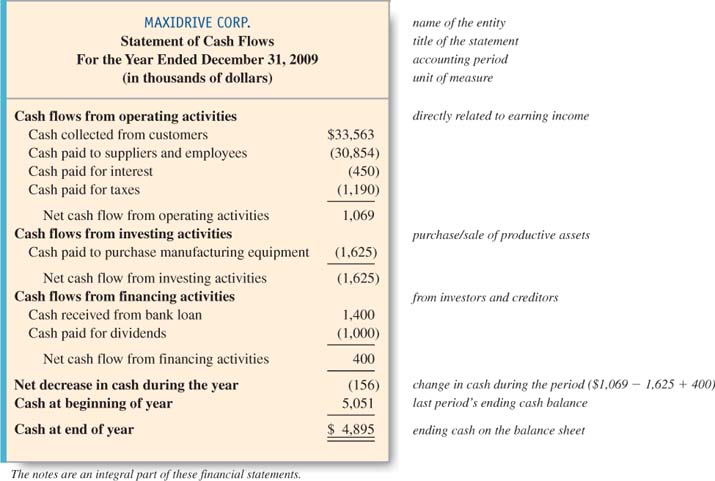

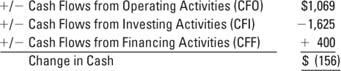

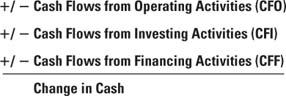

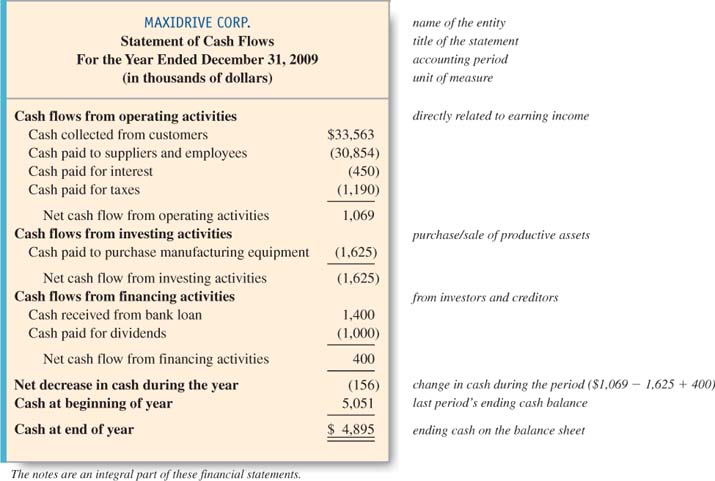

Statement of Cash FlowsStructure Maxidrive's statement of cash flows is presented in Exhibit 1.5. The statement of cash flows(Cash Flow Statement) reports inflows and outflows of cash during the accounting period in the categories of operating, investing, and financing. (cash flow statement) divides Maxidrive's cash inflows and outflows (receipts and payments) into the three primary categories of cash flows in a typical business: cash flows from operating, investing, and financing activities. The heading identifies the name of the entity, the title of the report, and the unit of measure used in the statement. Like the income statement, the cash flow statement covers a specified period of time (the accounting period), which in this case is one year. As discussed earlier in this chapter, reported revenues do not always equal cash collected from customers because some sales may be on credit. Also, expenses reported on the income statement may not be equal to the cash paid out during the period because expenses may be incurred in one period and paid for in another. Because the income statement does not provide information concerning cash flows, accountants prepare the statement of cash flows to report inflows and outflows of cash. The cash flow statement equation describes the causes of the change in cash reported on the balance sheet from the end of last period to the end of the current period:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg15_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg15_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101g.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101g.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

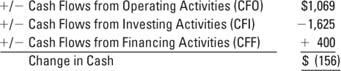

Note that each of the three cash flow sources can be positive or negative.| Self-Study Quiz Solutions | Beginning Retained Earnings ($5,510) + Net Income ($1,780) − Dividends ($900) = Ending Retained Earnings ($6,390). |

|

Elements Cash flows from operating activities are cash flows that are directly related to earning income. For example, when Dell, Apple, and other customers pay Maxidrive for the disk drives it has delivered to them, it lists the amounts collected as cash collected from customers. When Maxidrive pays salaries to its employees in research and development or pays bills received from its parts suppliers, it includes the amounts in cash paid to suppliers and employees.6 Cash flows from investing activities include cash flows related to the acquisition or sale of the company's productive assets. This year, Maxidrive had only one cash outflow from investing activities, the purchase of additional manufacturing equipment to meet growing demand for its products. Cash flows from financing activities are directly related to the financing of the enterprise itself. They involve the receipt or payment of money to investors and creditors (except for suppliers). This year, Maxidrive borrowed an additional $1,400,000 from the bank to purchase most of the new manufacturing equipment. It also paid out $1,000,000 in dividends to the founding stockholders. | EXHIBIT 1.5 | Statement of Cash Flows |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg15_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg15_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

| FINANCIAL ANALYSIS | Interpreting the Cash Flow Statement |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | Many analysts believe that the statement of cash flows is particularly useful in predicting future cash flows that may be available for payment of debt to creditors and dividends to investors. Bankers often consider the Operating Activities section to be most important because it indicates the company's ability to generate cash from sales to meet its current cash needs. Any amount left over can be used to pay back the bank debt or expand the company. Stockholders will invest in a company only if they believe that it will eventually generate more cash from operations than it uses so that cash will become available to pay dividends and expand. |

|

| SELF-STUDY QUIZ | During the period 2009, Maxidrive delivered disk drives to customers who paid or promised to pay a total of $37,436,000. During the same period, it collected $33,563,000 in cash from customers. Without referring to Exhibit 1.5, indicate which of the two amounts will be shown on Maxidrive's cash flow statement for 2009. Your task here is to verify that Maxidrive's cash balance decreased by $156 during the year using the totals for cash flows from operating, investing, and financing activities presented in Exhibit 1.5. Recall the cash flow statement equation:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg16_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg16_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

After you have completed your answers, check them with the solutions at the bottom of the page.

|

|

| Self-Study Quiz Solutions | The firm recognizes $33,563,000 on the cash flow statement because this number represents the actual cash collected from customers related to current and prior years' sales. -

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg16_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg16_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

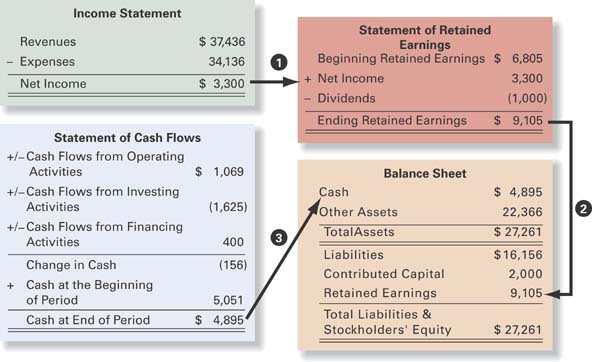

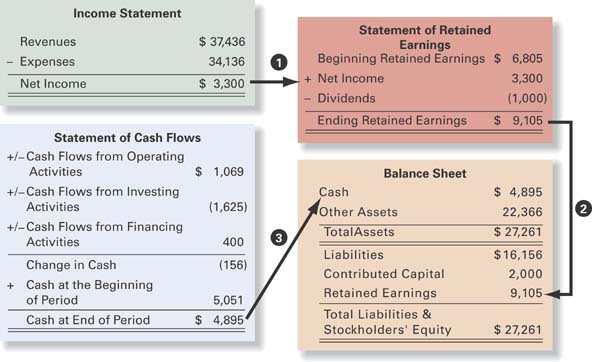

| EXHIBIT 1.6 | Relationships Among Maxidrive's Statements |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_0106.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_0106.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

|

Relationships Among the StatementsOur discussion of the four basic financial statements focused on what elements are reported in each statement, how the elements are related by the equation for each statement, and how the elements are important to the decisions of investors, creditors, and others. We have also discovered how the statements, all of which are outputs from the same system, are related to one another. In particular, we learned:

Net income from the income statement results in an increase in ending retained earnings on the statement of retained earnings. Ending retained earnings from the statement of retained earnings is one of the two components of stockholders' equity on the balance sheet. The change in cash on the cash flow statement added to the beginning-of-the-year balance in cash equals the end-of-year balance in cash on the balance sheet.

Thus, we can think of the income statement as explaining, through the statement of retained earnings, how the operations of the company improved or harmed the financial position of the company during the year. The cash flow statement explains how the operating, investing, and financing activities of the company affected the cash balance on the balance sheet during the year. These relationships are illustrated in Exhibit 1.6 for Maxidrive's financial statements.NotesAt the bottom of each of Maxidrive's four basic financial statements is this statement: “The notes are an integral part of these financial statements.” This is the accounting equivalent of the Surgeon General's warning on a package of cigarettes. It warns users that failure to read the notesprovide supplemental information about the financial condition of a company without which the financial statements cannot be fully understood. (or footnotes) to the financial statements will result in an incomplete picture of the company's financial health. Notes provide supplemental information about the financial condition of a company without which the financial statements cannot be fully understood. There are three basic types of notes. The first type provides descriptions of the accounting rules applied in the company's statements. The second presents additional detail about a line on the financial statements. For example, Maxidrive's inventory note indicates the amount of parts, drives under construction, and finished disk drives included in the total inventory amount listed on the balance sheet. The third type of note provides additional financial disclosures about items not listed on the statements themselves. For example, Maxidrive leases one of its production facilities; terms of the lease are disclosed in a note. Throughout this book, we will discuss many note disclosures because understanding their content is critical to understanding the company. |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101h.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/lib26886_cut0101h.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

A few additional formatting conventions are worth noting here. Assets are listed on the balance sheet by ease of conversion to cash. Liabilities are listed by their maturity (due date). Most financial statements include the monetary unit sign (in the United States, the $) beside the first dollar amount in a group of items (e.g., the cash amount in the assets). Also, it is common to place a single underline below the last item in a group before a total or subtotal (e.g., land). A dollar sign is also placed beside group totals (e.g., total assets) and a double underline below. The same conventions are followed in all four basic financial statements. | FINANCIAL ANALYSIS | Management Uses of Financial Statements |  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/analysis.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> | In our discussion of financial analysis thus far, we have focused on the perspectives of investors and creditors. Managers within the firm also make direct use of financial statements. For example, Maxidrive's marketing managers and credit managers use customers' financial statements to decide whether to extend credit for purchases of disk drives. Maxidrive's purchasing managers analyze parts suppliers' financial statements to see whether the suppliers have the resources to meet Maxidrive's demand and invest in the development of new parts. Both the employees' union and Maxidrive's human resource managers use Maxidrive's financial statements as a basis for contract negotiations over pay rates. The net income figure even serves as a basis for calculating employee bonuses. Regardless of the functional area of management in which you are employed, you will use financial statement data. You also will be evaluated based on the impact of your decisions on your company's financial statement data. |

|

Summary of the Four Basic Financial StatementsWe have learned a great deal about the content of the four basic statements. Exhibit 1.7 summarizes this information. Take a few minutes to review the information in the exhibit before you move on to the next section of the chapter.

1A corporation is a business that is incorporated under the laws of a particular state. The owners are called stockholders or shareholders. Ownership is represented by shares of capital stock that usually can be bought and sold freely. The corporation operates as a separate legal entity, separate and apart from its owners. The stockholders enjoy limited liability; they are liable for the debts of the corporation only to the extent of their investments. Chapter Supplement A discusses forms of ownership in more detail. 2This example uses a 25 percent rate. Federal tax rates for corporations actually ranged from 15 percent to 35 percent at the time this book was written. State and local governments may levy additional taxes on corporate income, resulting in a higher total income tax rate. 3Net losses are normally noted by parentheses around the income figure. 4Other corporations report these changes at the end of the income statement or in a more general statement of stockholders' equity, which we discuss in Chapter 4. 5Net losses are subtracted. 6Alternative ways to present cash flows from operations are discussed in Chapter 5. |