|

| 1 |  |

In general, we would expect that heavily advertised items |

|  | A) | will be of lower quality than items that are not advertised. |

|  | B) | will be of higher quality than items that are not advertised. |

|  | C) | will have no tendency to be of different quality from items that are not advertised. |

|  | D) | will be of lower quality than unadvertised products if the item is a service and of higher quality if the item is a product. |

|

|

|

| 2 |  |

The full-disclosure principle assumes that sellers disclose to buyers even things they are not supposed to tell because |

|  | A) | the buyer will view the seller as a liar if all is not told. |

|  | B) | people are inherently conscientious and cannot live with themselves if they do not tell all. |

|  | C) | the buyer will believe the worst about anything not disclosed. |

|  | D) | sellers are usually outwitted by buyers into telling everything even though it is not in the seller's interest to tell all. |

|

|

|

| 3 |  |

Why do local newspapers often have dating information services while small college newspapers do not? |

|  | A) | College students have more time for search than do people in the working world. |

|  | B) | The high level of student interaction and socializing typical on a college campus lowers the cost of individual information gathering. |

|  | C) | College newspapers are more politicized and less reliable than local newspapers so students do not trust them. |

|  | D) | College students are more outgoing and uninhibited than non college people so they do not need a dating service. |

|

|

|

| 4 |  |

Lee, a 45 year old marathon runner in excellent health with no family history of heart disease, pays more for life insurance than Pete, age 37, who is 40 pounds overweight, is a couch potato, and has lost his older brother to a heart attack. This apparent insurance premium mistake occurs due to |

|  | A) | the lemons principle. |

|  | B) | adverse selection. |

|  | C) | a breakdown in the full disclosure principle. |

|  | D) | statistical discrimination. |

|  | E) | conspicuous consumption. |

|

|

|

| 5 |  |

Many desirable people avoid dating services because they view the process as subject to |

|  | A) | the lemons principle. |

|  | B) | adverse selection. |

|  | C) | the full disclosure principle. |

|  | D) | statistical discrimination. |

|  | E) | conspicuous consumption. |

|

|

|

| 6 |  |

Some people of moderate income make a public display of their lifestyle even though they can not match the Mercedes jet set standard of living. This behavior is likely due to the following combination of explanations. |

|  | A) | statistical discrimination and conspicuous consumption. |

|  | B) | the lemons principle and the full disclosure principle. |

|  | C) | conspicuous consumption and the full disclosure principle. |

|  | D) | adverse selection and the lemons principle. |

|

|

|

| 7 |  |

Use the following information for the next three questions. My watch is worth $100. There is a 25% chance that it will be stolen from the locker room when I play racquetball. My utility function for money is U = (money)2.

On the basis of this information the expected value of my watch is ______ and the expected utility from my watch, given these circumstances, is ________. |

|  | A) | 100: 10,000 |

|  | B) | 75: 7,500 |

|  | C) | 75: 10,000 |

|  | D) | 25: 2,500 |

|

|

|

| 8 |  |

I am able to buy an insurance policy to cover my watch against theft. How much would I be willing to pay for the insurance? |

|  | A) | 13.40 |

|  | B) | 25 |

|  | C) | 15.80 |

|  | D) | 9.90 |

|

|

|

| 9 |  |

The insurance company that insures my watch will not insure it unless I pay a premium of |

|  | A) | $75. |

|  | B) | $15.80 |

|  | C) | $25 |

|  | D) | $13.40 |

|  | E) | none of the above. |

|

|

|

| 10 |  |

If I were risk averse |

|  | A) | I would be willing to pay the insurance company the same amount, but no more than the amount that the risk lover would pay. |

|  | B) | I would be willing to pay the insurance company more than the amount that the risk lover would pay. |

|  | C) | I would not be willing to pay the insurance company as much as the risk lover would pay. |

|  | D) | I could not answer this question without knowing what my specific risk averse utility function for money is. |

|

|

The following two questions relate to the supply and demand graph below.

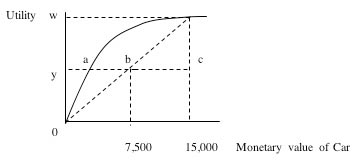

Use the following graph for the next four questions.

|

| 15 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073375942/236468/chap06_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073375942/236468/chap06_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (6.0K)</a>

If you are the owner of the car in the graph above, you are |

|  | A) | risk averse |

|  | B) | a risk lover |

|  | C) | risk neutral |

|  | D) | any one of the above but the graph does not tell which one applies to you. |

|

|

|

| 16 |  |

If I do not buy insurance for my car, and there is a 50% chance that it will be stolen, then I will |

|  | A) | end up with $7,500 in sure value. |

|  | B) | have either 0 or 0w amount of utility but I can not tell which in advance. |

|  | C) | have an expected utility level that is higher than the sure utility I would have if I bought insurance. |

|  | D) | Not be solicited by insurance companies to buy insurance because there is no premium that I am willing to pay that would cover their expected costs of insuring me. |

|

|

|

| 17 |  |

If I decide to buy insurance for my car, the graph above makes it clear that I will not pay a higher premium than ___ to be insured. |

|  | A) | bc |

|  | B) | ac |

|  | C) | yb |

|  | D) | ab |

|

|

|

| 18 |  |

The auto insurance company would be unwilling to insure me if I paid them less than |

|  | A) | bc |

|  | B) | ac |

|  | C) | yb |

|  | D) | ab |

|

|

|

| 19 |  |

If your marginal utility of money is increasing at an increasing rate you will |

|  | A) | get more pleasure from a dollar gained than displeasure from a dollar lost. |

|  | B) | be likely to accept some unfair gambles. |

|  | C) | not buy extended warrantees for most household appliances. |

|  | D) | be classified as a risk lover. |

|  | E) | fit all of the above options since they are consistent with each other. |

|

|

|

| 20 |  |

Someone who is risk neutral |

|  | A) | will buy insurance only if the insurance company sells it at cost. |

|  | B) | sees the expected utility from the expected value of a gamble as greater than the actual utility that would be gained from the money if it were a sure thing. |

|  | C) | has a decreasing marginal utility of income. |

|  | D) | Will never engage in a gamble that has less than a 50% chance of winning. |

|

|