Our task in this chapter was to show why capital structure matters. We did not throw away MM's proposition that capital structure is irrelevant; we added to it. However, we did not arrive at any simple, universal theory of optimal capital structure.

The trade-off theory emphasizes interest tax shields and the costs of financial distress. The value of the firm is broken down as

Value if all-equity-financed + PV (tax shield) − PV (costs of financial distress)

According to this theory, the firm should increase debt until the value from PV(tax shield) is just offset, at the margin, by increases in PV(costs of financial distress).

The costs of financial distress are:

- Bankruptcy costs

- Direct costs such as legal and accounting fees.

- Indirect costs reflecting the difficulty of managing a company undergoing liquidation or reorganization.

- Costs of financial distress short of bankruptcy

- Doubts about a firm's creditworthiness can hobble its operations. Customers and suppliers will be reluctant to deal with a firm that may not be around next year. Key employees will be tempted to leave. Highly leveraged firms seem to be less vigorous product-market competitors.

- Conflicts of interest between bondholders and stockholders of firms in financial distress may lead to poor operating and investment decisions. Stockholders acting in their narrow self-interest can gain at the expense of creditors by playing "games" that reduce the overall value of the firm.

- The fine print in debt contracts is designed to prevent these games. But fine print increases the costs of writing, monitoring, and enforcing the debt contract.

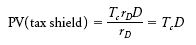

The value of the interest tax shield would be easy to compute if we had only corporate taxes to worry about. In that case the net tax saving from borrowing would be just the marginal corporate tax rate Tc times rDD, the interest payment. If debt is fixed, the tax shield can be valued by discounting at the borrowing rate rD. In the special case of fixed, permanent debt

However, corporate taxes are only part of the story. If investors pay higher taxes on interest income than on equity income (dividends and capital gains), then interest tax shields to the corporation will be partly offset by higher taxes paid by investors. The low (15% maximum) U.S. tax rates on dividends and capital gains have reduced the tax advantage to corporate borrowing.

The trade-off theory balances the tax advantages of borrowing against the costs of financial distress. Corporations are supposed to pick a target capital structure that maximizes firm value. Firms with safe, tangible assets and plenty of taxable income to shield ought to have high targets. Unprofitable companies with risky, intangible assets ought to rely more on equity financing.

This theory of capital structure successfully explains many industry differences in capital structure, but it does not explain why the most profitable firms within an industry generally have the most conservative capital structures. Under the trade-off theory, high profitability should mean high debt capacity and a strong tax incentive to use that capacity.

There is a competing, pecking-order theory, which states that firms use internal financing when available and choose debt over equity when external financing is required. This explains why the less profitable firms in an industry borrow more-not because they have higher target debt ratios but because they need more external financing and because debt is next on the pecking order when internal funds are exhausted.

The pecking order is a consequence of asymmetric information. Managers know more about their firms than outside investors do, and they are reluctant to issue stock when they believe the price is too low. They try to time issues when shares are fairly priced or overpriced. Investors understand this, and interpret a decision to issue shares as bad news. That explains why stock price usually falls when a stock issue is announced.

Debt is better than equity when these information problems are important. Optimistic managers will prefer debt to undervalued equity, and pessimistic managers will be pressed to follow suit. The pecking-order theory says that equity will be issued only when debt capacity is running out and financial distress threatens.

The pecking-order theory stresses the value of financial slack. Without sufficient slack, the firm may be caught at the bottom of the pecking order and be forced to choose between issuing undervalued shares, borrowing and risking financial distress, or passing up positive-NPV investment opportunities.

There is, however, a dark side to financial slack. Surplus cash or credit tempts managers to overinvest or to indulge an easy and glamorous corporate lifestyle. When temptation wins, or threatens to win, a high debt ratio can help: It forces the company to disgorge cash and prods managers and organizations to try harder to be more efficient.