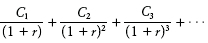

Firms can best help their shareholders by accepting all projects that are worth more than they cost. In other words, they need to seek out projects with positive net present values. To find net present value we first calculate present value. Just discount future cash flows by an appropriate rate r, usually called the discount rate, hurdle rate, or opportunity cost of capital:

Present value (PV) =

Net present value is present value plus any immediate cash flow: Net present value (NPV) = C0 + PV

Remember that C0 is negative if the immediate cash flow is an investment, that is, if it is a cash outflow.

The discount rate r is determined by rates of return prevailing in capital markets. If the future cash flow is absolutely safe, then the discount rate is the interest rate on safe securities such as U.S. government debt. If the future cash flow is uncertain, then the expected cash flow should be discounted at the expected rate of return offered by equivalent-risk securities. (We talk more about risk and the cost of capital in Chapters 7 to 9.)

Cash flows are discounted for two simple reasons: because (1) a dollar today is worth more than a dollar tomorrow and (2) a safe dollar is worth more than a risky one. Formulas for PV and NPV are numerical expressions of these ideas.

Financial markets, including the bond and stock markets, are the markets where safe and risky future cash flows are traded and valued. That is why we look to rates of return prevailing in the financial markets to determine how much to discount for time and risk. By calculating the present value of an asset, we are estimating how much people will pay for it if they have the alternative of investing in the capital markets.

You can always work out any present value using the basic formula, but shortcut formulas can reduce the tedium. We showed how to value an investment that makes a level stream of cash flows forever (a perpetuity) and one that produces a level stream for a limited period (an annuity). We also showed how to value investments that produce growing streams of cash flows.

When someone offers to lend you a dollar at a quoted interest rate, you should always check how frequently the interest is to be paid. For example, suppose that a $100 loan requires six-month payments of $3. The total yearly interest payment is $6 and the interest will be quoted as a rate of 6% compounded semiannually. The equivalent annually compounded rate is (1.03) 2 − 1 = .061, or 6.1%. Sometimes it is convenient to assume that interest is paid evenly over the year, so that interest is quoted as a continuously compounded rate.