|

| 1 |  |

Skewness is a measure of ____________. |

|  | A) | how fat the tails of a distribution are |

|  | B) | the downside risk of a distribution |

|  | C) | the normality of a distribution |

|  | D) | the dividend yield of the distribution |

|  | E) | A and C |

|

|

|

| 2 |  |

When a distribution is positively skewed, ____________. |

|  | A) | standard deviation overestimates risk |

|  | B) | standard deviation correctly estimates risk |

|  | C) | standard deviation underestimates risk |

|  | D) | the tails are fatter than in a normal distribution |

|  | E) | none of the above |

|

|

|

| 3 |  |

A year ago, you invested $2,000 in a savings account that pays an annual interest rate of 6%. What is your approximate annual real rate of return if the rate of inflation was 3% over the year? |

|  | A) | 4% |

|  | B) | 10% |

|  | C) | 7% |

|  | D) | 3% |

|  | E) | none of the above |

|

|

|

| 4 |  |

You purchased a share of stock for $20. One year later you received $1 as dividend and sold the share for $29. What was your holding period return? |

|  | A) | 45% |

|  | B) | 5% |

|  | C) | 50% |

|  | D) | 40% |

|  | E) | none of the above |

|

|

|

| 5 |  |

Other things equal, an increase in the government budget deficit |

|  | A) | drives the interest rate down. |

|  | B) | drives the interest rate up. |

|  | C) | might not have any effect on interest rates. |

|  | D) | increases business prospects. |

|  | E) | none of the above |

|

|

|

| 6 |  |

In words, the real rate of interest is approximately equal to |

|  | A) | the nominal rate times the inflation rate. |

|  | B) | the inflation rate minus the nominal rate. |

|  | C) | the nominal rate minus the inflation rate. |

|  | D) | the inflation rate divided by the nominal rate. |

|  | E) | the nominal rate plus the inflation rate. |

|

|

|

| 7 |  |

An investor purchased a bond 45 days ago for $895. He received $12 in interest and sold the bond for $893. What is the holding period return on his investment? |

|  | A) | 1.52% |

|  | B) | 0.50% |

|  | C) | 1.12% |

|  | D) | 0.08% |

|  | E) | 0.01% |

|

|

|

| 8 |  |

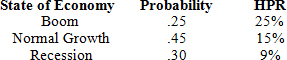

DFI, Inc. has the following probability distribution of holding period returns on its stock. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch5q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch5q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a>

The expected return on DFI's stock is |

|  | A) | 15.7%. |

|  | B) | 12.4%. |

|  | C) | 16.5%. |

|  | D) | 17.8%. |

|  | E) | 11.6%. |

|

|

|

| 9 |  |

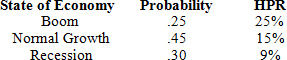

DFI, Inc. has the following probability distribution of holding period returns on its stock. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch5q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch5q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a>

The expected variance of these returns is |

|  | A) | 66.6 |

|  | B) | 35.5 |

|  | C) | 29.4 |

|  | D) | 40.5 |

|  | E) | none of the above |

|

|

|

| 10 |  |

An investment provides a 3% return semi-annually, its effective annual rate is |

|  | A) | 3.00% |

|  | B) | 5.91% |

|  | C) | 6.06% |

|  | D) | 6.09% |

|  | E) | none of the above |

|

|