|

| 1 |  |

Beta books typically rely on the __________ most recent monthly observations to calculate regression parameters. |

|  | A) | 12 |

|  | B) | 36 |

|  | C) | 60 |

|  | D) | 120 |

|  | E) | none of the above |

|

|

|

| 2 |  |

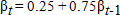

Suppose the following equation best describes the evolution of β over time: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch8q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (4.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch8q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (4.0K)</a>

If a stock had a β of 0.6 last year, you would forecast the β to be _______ in the coming year. |

|  | A) | 0.45 |

|  | B) | 0.60 |

|  | C) | 0.70 |

|  | D) | 0.75 |

|  | E) | none of the above |

|

|

|

| 3 |  |

According to the index model, covariances among security pairs are |

|  | A) | due to the influence of a single common factor represented by the market index return. |

|  | B) | related to industry-specific events. |

|  | C) | usually positive. |

|  | D) | extremely difficult to calculate. |

|  | E) | A and C |

|

|

|

| 4 |  |

In a single factor model, the return on a stock in a particular period will be related to |

|  | A) | macroeconomic events. |

|  | B) | firm-specific events. |

|  | C) | the error term. |

|  | D) | both a and b. |

|  | E) | both a and c. |

|

|

|

| 5 |  |

Consider the single-index model. The alpha of a stock is 0%. The return on the market index is 16%. The risk-free rate of return is 5%. The stock earns a return that exceeds the risk-free rate by 11% and there are no firm-specific events affecting the stock performance. The β of the stock is |

|  | A) | 1.0. |

|  | B) | 0.75. |

|  | C) | 2.0. |

|  | D) | 1.5. |

|  | E) | 1.50. |

|

|

|

| 6 |  |

Suppose you held a well-diversified portfolio with a very large number of securities, and that the single index model holds. If the σ of your portfolio was 0.20 and σ M was 0.16, the β of the portfolio would be approximately |

|  | A) | 0.9. |

|  | B) | 1.25. |

|  | C) | 1.85. |

|  | D) | 0.56. |

|  | E) | none of the above |

|

|

|

| 7 |  |

Security returns |

|  | A) | are usually positively correlated with each other. |

|  | B) | are based on both macro events and firm-specific events. |

|  | C) | are based on firm-specific events only. |

|  | D) | A and B |

|  | E) | A and C |

|

|

|

| 8 |  |

Assume that stock market returns do not resemble a single-index structure. An investment fund analyzes 100 stocks in order to construct a mean-variance efficient portfolio constrained by 100 investments. They will need to calculate ____________ covariances. |

|  | A) | 45 |

|  | B) | 100 |

|  | C) | 4,950 |

|  | D) | 10,000 |

|  | E) | none of the above |

|

|

|

| 9 |  |

The beta of GM stock has been estimated as 1.2 using regression analysis on a sample of historical returns. A commonly used adjustment technique would provide an adjusted beta of |

|  | A) | 1.20. |

|  | B) | 1.32. |

|  | C) | 1.13. |

|  | D) | 1.0. |

|  | E) | none of the above |

|

|

|

| 10 |  |

The index model for stock A has been estimated with the following result: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch8q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077861671/1018530/Ch8q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a>

If σM = 0.25 and R2A = 0.25, the standard deviation of return of stock A is _________. |

|  | A) | 0.2025 |

|  | B) | 0.2500 |

|  | C) | 0.4500 |

|  | D) | 0.8100 |

|  | E) | none of the above |

|

|