|

| 1 |  |

Which of the following costs should be included as part of the cost of merchandise inventory? |

|  | A) | Import duties |

|  | B) | Freight |

|  | C) | Storage |

|  | D) | Insurance |

|  | E) | All of the above |

|

|

|

| 2 |  |

Which of the following methods of assigning costs to both inventory and cost of goods sold are in conformity with generally accepted accounting principles (GAAP)? |

|  | A) | Specific identification |

|  | B) | FIFO and LIFO |

|  | C) | Weighted average |

|  | D) | All of the above |

|  | E) | None of the above |

|

|

|

| 3 |  |

Which of the following statements is true concerning the effects of inventory methods? |

|  | A) | LIFO assigns the lowest amount to cost of goods sold during times of rising prices. |

|  | B) | LIFO assigns the highest amount to cost of goods sold during times of rising prices, yielding the lowest net income. |

|  | C) | FIFO assigns the highest amount of cost of goods sold during times of rising prices, yielding the highest net income. |

|  | D) | Weighted average assigns the highest amount of cost of goods sold during times of rising prices. |

|  | E) | None of the above. |

|

|

|

| 4 |  |

During periods when purchase costs regularly rise, which of the following is true? |

|  | A) | FIFO will yield the highest net income. |

|  | B) | LIFO will yield the lowest net income. |

|  | C) | Weighted average yields results between FIFO and LIFO. |

|  | D) | All of the above. |

|  | E) | None of the above. |

|

|

|

| 5 |  |

Inventory at the end of the current period was erroneously understated. Which of the following is true as a result? |

|  | A) | Net income for the current year is overstated. |

|  | B) | The cost of goods sold for the current year is understated. |

|  | C) | Retained earnings at the end of the current year is overstated. |

|  | D) | Net income at the end of the following year will be overstated. |

|  | E) | Retained earnings at the end of the following year will be overstated. |

|

|

|

| 6 |  |

Which of the following is true about errors in the ending inventory? |

|  | A) | If ending inventory is overstated, cost of goods sold is understated, and net income is overstated. |

|  | B) | If ending inventory is understated, cost of goods sold is understated, and net income is understated. |

|  | C) | If ending inventory is overstated, cost of goods sold is understated, and net income is understated. |

|  | D) | If ending inventory is understated, cost of goods sold is understated, and net income is overstated. |

|  | E) | If ending inventory is understated, cost of goods sold is overstated, and net income is overstated. |

|

|

|

| 7 |  |

Which of the following is true about errors in the beginning inventory? |

|  | A) | If beginning inventory is overstated, cost of goods sold is overstated, and net income is overstated. |

|  | B) | If beginning inventory is understated, cost of goods sold is understated, and net income is understated. |

|  | C) | If beginning inventory is overstated, cost of goods sold is overstated, and net income is understated. |

|  | D) | If beginning inventory is understated, cost of goods sold is overstated, and net income is understated. |

|  | E) | If beginning inventory is understated, cost of goods sold is overstated, and net income is overstated. |

|

|

|

| 8 |  |

Beginning inventory totals $100,000 and ending inventory totals $140,000 for the period and net sales are $800,000 and cost of goods sold is $600,000. What is the inventory turnover ratio? |

|  | A) | 2.00 |

|  | B) | 2.25 |

|  | C) | 5.0 |

|  | D) | 6.67 |

|  | E) | None of the above |

|

|

|

| 9 |  |

Beginning inventory totals $100,000 and ending inventory totals $140,000 for the period and net sales are $800,000 and cost of goods sold is $600,000. What are the days' sales in inventory (to the nearest hundredth)? |

|  | A) | 22.25 |

|  | B) | 32.50 |

|  | C) | 55.33 |

|  | D) | 60.65 |

|  | E) | 85.17 |

|

|

|

| 10 |  |

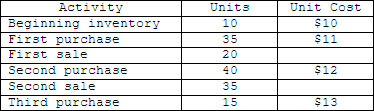

Abba Company maintains a perpetual inventory system and uses the specific identification method of assigning costs. Purchases and sales of inventory during the period are as follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a>

When the ending inventory was counted and identified, it was determined that 5 units of the beginning inventory, 10 units of the first purchase, 15 units of the second purchase, and 15 units of the third purchase were not sold. What is the value of its ending inventory?

|

|  | A) | $465 |

|  | B) | $475 |

|  | C) | $515 |

|  | D) | $535 |

|  | E) | None of the above |

|

|

|

| 11 |  |

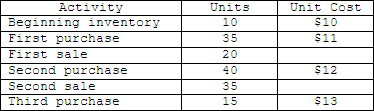

Abba Company maintains a perpetual inventory system and uses the first-in, first out (FIFO) method of assigning costs. Purchases and sales of inventory during the period are as follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (50.0K)</a>

What is the value of its cost of goods sold?

|

|  | A) | $395 |

|  | B) | $555 |

|  | C) | $605 |

|  | D) | $675 |

|  | E) | None of the above |

|

|

|

| 12 |  |

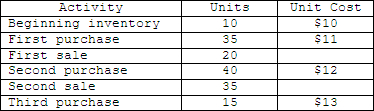

Abba Company maintains a perpetual inventory system and uses the last-in, first out (LIFO) method of assigning costs. Purchases and sales of inventory during the period are as follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (51.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (51.0K)</a>

What is the value of its ending inventory?

|

|  | A) | $485 |

|  | B) | $555 |

|  | C) | $520 |

|  | D) | $540 |

|  | E) | None of the above |

|

|

|

| 13 |  |

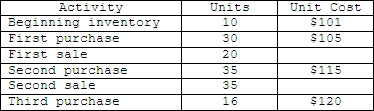

Abba Company maintains a perpetual inventory system and uses the weighted average method of assigning costs. Purchases and sales of inventory during the period are as follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (52.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (52.0K)</a>

What is the value of its ending inventory? |

|  | A) | $3,744.00 |

|  | B) | $3,978.00 |

|  | C) | $4,140.00 |

|  | D) | $6,063.75 |

|  | E) | $6,325.00 |

|

|

|

| 14 |  |

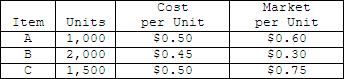

Lipton Hardware prepared the following schedule of cost and market per unit information for its three items of merchandise inventory. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q14.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (34.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025389/874722/Q14.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (34.0K)</a>

What is the value of the inventory if the lower-of-cost-or-market (LCM) rule is applied to each item individually?

|

|  | A) | $1,267.50 |

|  | B) | $1,850.00 |

|  | C) | $2,080.00 |

|  | D) | $2,580.00 |

|  | E) | None of the above |

|

|

|

| 15 |  |

Which of the following statements about U.S. GAAP and IFRS is not true: |

|  | A) | Both U.S. GAAP and IFRS require companies to write down inventory when its value falls below the cost presently recorded. |

|  | B) | Neither U.S. GAAP nor IFRS allow inventory to be adjusted upward beyond the original cost. |

|  | C) | Both U.S. GAAP and IFRS allow reversals of inventory write downs up to the original acquisition cost. |

|  | D) | Only U.S. GAAP allows LIFO cost flow assumption while IFRS does not. |

|  | E) | All of the above. |

|

|