|

| 1 |  |

In a partnership liquidation, how is the final allocation of business assets made to the partners? |

|  | A) | equally |

|  | B) | according to the profit and loss ratio |

|  | C) | according to the balances of the partners' loan and capital accounts |

|  | D) | according to the initial investments made by the partners |

|  | E) | according to the method stipulated by the partnership agreement |

|

|

|

| 2 |  |

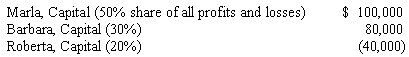

A partnership is in the process of liquidating and is currently reporting the following capital balances. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q2_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q2_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

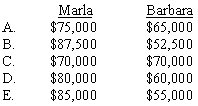

Roberta has indicated that the $40,000 deficit will be covered by a forthcoming contribution. However, the two remaining partners have asked to receive the $140,000 in cash that is presently available. How much of this money should each partner be given? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (7.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|

|

| 3 |  |

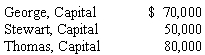

A partnership is considering the possibility of liquidation because one of the partners, Stewart, is insolvent. Capital balances at the current time are as follows, and profits and losses are divided on a 6:3:1 basis, respectively. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Stewart's creditors have filed a $60,000 claim against the partnership's assets. The partnership currently holds assets reported at $300,000 and liabilities of $100,000. If the assets can be sold for $150,000, what is the minimum amount that Stewart's creditors would receive? |

|  | A) | $60,000 |

|  | B) | $50,000 |

|  | C) | $30,000 |

|  | D) | $5,000 |

|  | E) | zero |

|

|

|

| 4 |  |

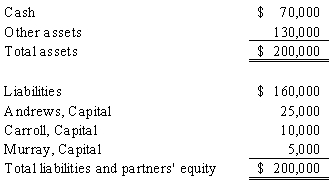

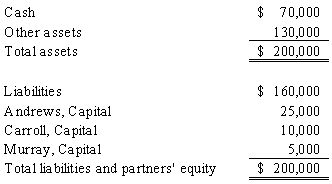

The following condensed balance sheet is for the partnership of Andrews, Carroll, and Murray, who share profits and losses in the ratio of 6:2:2, respectively. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q4_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q4_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

Which partner is most vulnerable to a loss? |

|  | A) | Andrews |

|  | B) | Carroll |

|  | C) | Andrews and Carroll are equally vulnerable |

|  | D) | Murray |

|  | E) | Andrews and Murray are equally vulnerable |

|

|

|

| 5 |  |

The following condensed balance sheet is for the partnership of Andrews, Carroll, and Murray, who share profits and losses in the ratio of 6:2:2, respectively. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q5_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q5_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

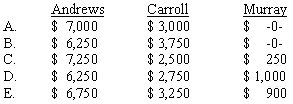

If the other assets are sold for $100,000, how should the available cash be distributed? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (10.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|

|

| 6 |  |

Which one of the following statements is incorrect regarding a predistribution plan? |

|  | A) | A predistribution plan is developed by simulating a series of losses that are just large enough to eliminate, one at a time, all of the partners' claims to cash. |

|  | B) | A predistribution plan recognizes that the individual capital accounts exhibit differing degrees of sensitivity to losses. |

|  | C) | A predistribution plan serves as a guideline for all future cash payments in a liquidation. |

|  | D) | A predistribution plan is prepared at the end of a liquidation to confirm actual cash distributions. |

|  | E) | A series of absorbed losses forms the basis for the predistribution plan. |

|

|

|

| 7 |  |

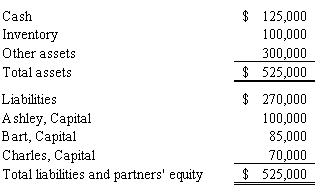

The following condensed balance sheet is for the Ashley, Bart, and Charles partnership. The partners share profits and losses in the ratio of 5:3:2, respectively. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a>

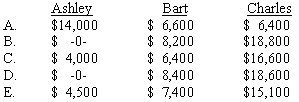

The partners have decided to liquidate the business. Liquidation expenses are estimated to be $8,000. The other assets are sold for $180,000. What distribution can be made to the partners? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|

|

| 8 |  |

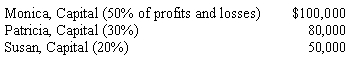

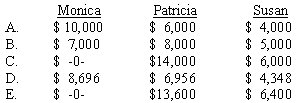

A partnership has the following capital balances: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q8_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q8_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

If the partnership is to be liquidated and $20,000 becomes immediately available, who gets the money? <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/944342/Ch10_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a>

|

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|  | E) | E |

|

|

|

| 9 |  |

Protecting the interests of partnership creditors is a significant duty because: |

|  | A) | the Uniform Partnership Act requires that they be paid in full. |

|  | B) | a partnership never has secured creditors, and therefore they have no recourse for collection. |

|  | C) | the partners are limited in liability to the amount they have contributed. |

|  | D) | partnership creditors are not permitted to receive information about the bankruptcy proceedings, since the partnership is not incorporated. |

|  | E) | the Uniform Partnership Act specifies that they have first priority to the assets held by the partnership at dissolution. |

|

|

|

| 10 |  |

Stanley, a partner of the Newtown partnership, made a loan to the partnership. The partnership is now in liquidation. Which one of the following statements is incorrect regarding the status of this loan during the liquidation process? |

|  | A) | The loan must be repaid before any cash distribution is made to the other partners, even if Stanley does not have a sufficient amount of capital to absorb all possible losses. |

|  | B) | The loan has a lower priority than obligations to outside creditors. |

|  | C) | If the partner has a negative safe capital balance, a portion or even all of the loan should be retained as an offset against the capital account. |

|  | D) | The loan is accounted for in liquidation as if it were a component of the partner's capital. |

|  | E) | If Stanley is insolvent and reports a negative capital balance, the handling of the loan becomes significant. |

|

|

|

| 11 |  |

In accounting for the liquidation of a partnership, cash payments to partners after all creditors' claims have been satisfied, but before final cash distribution, should be according to: |

|  | A) | Profit and loss ratios. |

|  | B) | Capital account balances. |

|  | C) | Relative share of gain or loss on liquidation. |

|  | D) | Ratio of capital contributions by partners. |

|  | E) | Safe payment computations. |

|

|

|

| 12 |  |

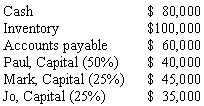

The partnership of Paul, Mark, and Jo is liquidating and the ledger shows the following balances: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q12_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q12_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

If all available cash is distributed immediately: |

|  | A) | Paul, Mark, and Jo would receive $26,667 each. |

|  | B) | Paul, Mark, and Jo would receive $6,667 each. |

|  | C) | Paul would receive $10,000 and Mark and Jo would each receive $5,000. |

|  | D) | Mark would receive $15,000 and Jo would receive $5,000. |

|  | E) | None of the partners can receive any of the cash until loss of inventory is determined. |

|

|

|

| 13 |  |

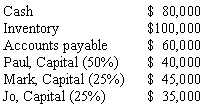

The partnership of Paul, Mark, and Jo is liquidating and the ledger shows the following balances: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q13_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025397/940453/ch15_q13_item_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

If no distributions have been made and the inventory is sold for $80,000, cash should be distributed: |

|  | A) | Paul, Mark, and Jo would receive $33,333 each. |

|  | B) | Paul, Mark, and Jo would receive $26,667 each. |

|  | C) | Paul would receive $50,000 and Mark and Jo would each receive $25,000. |

|  | D) | Paul would receive $40,000, Mark would receive $45,000 and Jo would receive $35,000. |

|  | E) | Paul would receive $30,000, Mark would receive $40,000 and Jo would receive $30,000. |

|

|

|

| 14 |  |

A guideline for the cash distributions to be made to the partners during a liquidation is called: |

|  | A) | Proposed schedule of liquidation. |

|  | B) | Marshalling of assets. |

|  | C) | Safe payments. |

|  | D) | Predistribution plan. |

|  | E) | Partnership agreement. |

|

|

|

| 15 |  |

A partnership is liquidating and one of the partner's capital accounts has a deficit balance. What should happen? |

|  | A) | The deficit balance should be removed from the accounting records and the remaining partners would share in any additional profits. |

|  | B) | The partner with the deficit should contribute enough personal assets to eliminate the deficit balance. |

|  | C) | The other partners must file a legal suit against the partner with a deficit. |

|  | D) | The other partners should contribute personal assets to eliminate the deficit balance. |

|  | E) | The partner with the highest capital balance should allocate enough dollars to eliminate the deficit balance. |

|

|