|

| 1 |  |

Product costing system design or selection: |

|  | A) | is not an easy task. |

|  | B) | requires an understanding of the nature of the business. |

|  | C) | should provide useful cost information for strategic and operational decision needs. |

|  | D) | should be cost effective in design and selection. |

|  | E) | All the above answers are correct. |

|

|

|

| 2 |  |

__________ is a product costing system that accumulates costs and assigns them to specific jobs, customers, projects or contracts. |

|  | A) | Process costing |

|  | B) | Operational costing |

|  | C) | Job costing |

|  | D) | None of the above |

|

|

|

| 3 |  |

The reason for normalizing factory overhead cost is to avoid the fluctuations in cost per unit per period resulting from changes in the volume of units: |

|  | A) | sold in the period. |

|  | B) | produced in the period. |

|  | C) | in beginning inventory for the period. |

|  | D) | in ending inventory for the period. |

|

|

|

| 4 |  |

Digger Company uses the Materials Inventory account to record both direct and indirect materials. During the month of June, the company has the following cost information: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a>

The ending materials inventory cost is: |

|  | A) | $440,000 |

|  | B) | $120,000 |

|  | C) | $360,000 |

|  | D) | $80,000 |

|  | E) | $200,000 |

|

|

|

| 5 |  |

The two main advantages of using predetermined factory overhead rates are to provide more accurate unit cost information and to: |

|  | A) | simplify the accounting process. |

|  | B) | provide cost information on a timely basis. |

|  | C) | insure transmission of correct data. |

|  | D) | extend use of the cost data. |

|  | E) | adjust for variances in data sources. |

|

|

|

| 6 |  |

Direct materials and direct labor costs total $240,000, conversion costs total $200,000, and factory overhead costs total $400 per machine hour. If 300 machine hours were used for Job #500, what is the total manufacturing cost for Job #500? |

|  | A) | $120,000 |

|  | B) | $240,000 |

|  | C) | $320,000 |

|  | D) | $360,000 |

|  | E) | $560,000 |

|

|

|

| 7 |  |

If estimated annual factory overhead is $400,000, estimated annual direct labor hours are 200,000, actual July factory overhead is $41,000, and actual July direct labor hours are 19,000, then overhead is: |

|  | A) | $3,000 overapplied. |

|  | B) | $900 overapplied. |

|  | C) | $1,600 underapplied. |

|  | D) | $900 underapplied. |

|  | E) | $3,000 underapplied. |

|

|

|

| 8 |  |

No matter which method is used, underapplied or overapplied overhead usually is adjusted only: |

|  | A) | at the end of a year. |

|  | B) | if the difference exceeds $1,000 or one percent of total overhead. |

|  | C) | when the company's profit projections require an adjustment. |

|  | D) | when directed to do so by the Internal Revenue Service. |

|

|

|

| 9 |  |

Which of the following statements is correct assuming that factory overhead has been underapplied by an insignificant amount of $2,000 for the year? |

|  | A) | Debit Cost of Goods Sold for $2,000. |

|  | B) | Debit Cost of Goods Sold, Finished Goods Inventory, and WIP Inventory for a prorated portion of the $2,000. |

|  | C) | Credit Cost of Goods Sold for $2,000. |

|  | D) | Credit Cost of Goods Sold, Finished Goods Inventory, and WIP Inventory for a prorated portion of the $2,000. |

|

|

|

| 10 |  |

A firm that produces one or a few homogeneous products of similar size and cost is most likely to use: |

|  | A) | Job costing. |

|  | B) | Operation costing. |

|  | C) | Actual costing. |

|  | D) | Process costing. |

|

|

|

| 11 |  |

Legal and Wright, a St. Louis-based CPA firm, has the following budget of estimated costs for 2007: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Direct labors cost (chargeable hours) is 80% of total compensation paid to professional staff. The remaining compensation for professional staff is for training and other activities which are considered part of overhead.What is the predetermined overhead rate for Legal and Wright based on direct labor costs? |

|  | A) | 200% of direct labor costs |

|  | B) | 120% of direct labor costs |

|  | C) | 80% of direct labor costs |

|  | D) | 150% of direct labor costs |

|

|

|

| 12 |  |

Operation costing is a hybrid cost system that uses __________ to assign direct materials costs and __________ to assign conversion costs to products or services. |

|  | A) | job order costing; process costing |

|  | B) | a departmental approach; job order costing |

|  | C) | a departmental approach; process costing |

|  | D) | process costing; job order costing |

|

|

|

| 13 |  |

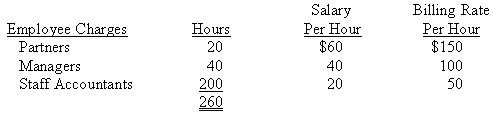

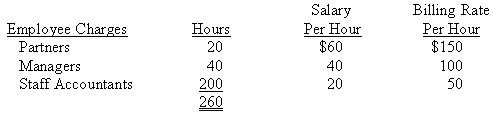

Able, CPA firm had the following information pertaining to Harry Carter, a client: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a>

Overhead is applied at 130% of direct labor costs.What is the total revenue generated from Harry Carter? |

|  | A) | $10,400 |

|  | B) | $26,000 |

|  | C) | $17,000 |

|  | D) | $6,800 |

|

|

|

| 14 |  |

Able, CPA firm had the following information pertaining to Harry Carter, a client: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966299/ch04_q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a>

Overhead is applied at 130% of direct labor costs.What is the amount of overhead cost applied to Harry Carter's job? |

|  | A) | $8,840 |

|  | B) | $6,800 |

|  | C) | $15,640 |

|  | D) | $22,100 |

|

|

|

| 15 |  |

Normal spoilage is of two types |

|  | A) | Spoilage that is common to all jobs and spoilage that is inherent in all jobs |

|  | B) | Spoilage that can be identified with specific jobs and spoilage that is common to all jobs |

|  | C) | Spoilage that can be identified with specific jobs and spoilage that could have been prevented |

|  | D) | Spoilage that could not have been prevented, and spoilage that could have been prevented |

|

|