|

| 1 |  |

A company using the traditional volume-based overhead assignment (allocation) method will tend to: |

|  | A) | overstate the cost of low volume products. |

|  | B) | understate the cost of high volume products. |

|  | C) | understate the cost of low volume products. |

|  | D) | understate the cost of all products. |

|  | E) | Both a and b are correct. |

|

|

|

| 2 |  |

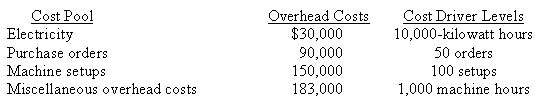

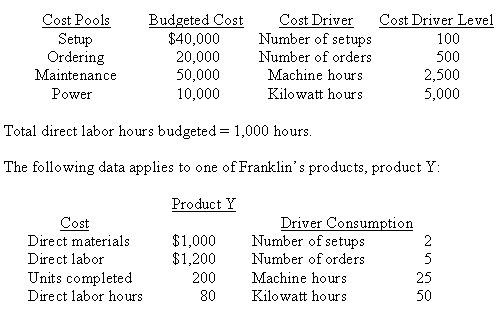

Harry Company has established the following overhead cost pools and cost drivers for the month of July: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

Expected direct labor costs for July is 20,000 hours at $10 per hour. Product X100 consumed 800 kilowatt hours, 5 orders, 10 setups, 90 machine hours, and 1,800 direct labor hours. Additionally it required $25,000 of materials. What is the overhead rate assuming that the firm is using a volume-based procedure and that direct labor hours will be its cost driver? |

|  | A) | $4.50 per DLH |

|  | B) | $22.65 per DLH |

|  | C) | $18.30 per DLH |

|  | D) | $3.00 per DLH. |

|

|

|

| 3 |  |

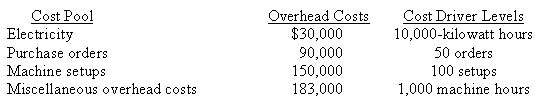

Harry Company has established the following overhead cost pools and cost drivers for the month of July: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

Expected direct labor costs for July is 20,000 hours at $10 per hour. Product X100 consumed 800 kilowatt hours, 5 orders, 10 setups, 90 machine hours, and 1,800 direct labor hours. Additionally it required $25,000 of materials. What is the overhead rate per purchase order using activity-based costing? |

|  | A) | $1,830 |

|  | B) | $1,500 |

|  | C) | $1,800 |

|  | D) | $4.50 |

|  | E) | $22.65 |

|

|

|

| 4 |  |

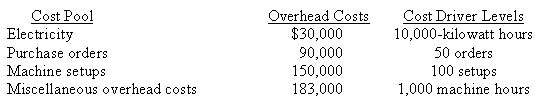

Harry Company has established the following overhead cost pools and cost drivers for the month of July: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

Expected direct labor costs for July is 20,000 hours at $10 per hour. Product X100 consumed 800 kilowatt hours, 5 orders, 10 setups, 90 machine hours, and 1,800 direct labor hours. Additionally it required $25,000 of materials. What is the amount of total costs assigned to product X100 assuming that the firm is using a volume-based procedure? |

|  | A) | $83,770 |

|  | B) | $40,770 |

|  | C) | $496,000 |

|  | D) | $85,870 |

|

|

|

| 5 |  |

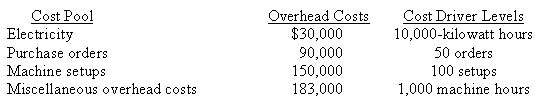

Harry Company has established the following overhead cost pools and cost drivers for the month of July: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966298/ch5_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

Expected direct labor costs for July is 20,000 hours at $10 per hour. Product X100 consumed 800 kilowatt hours, 5 orders, 10 setups, 90 machine hours, and 1,800 direct labor hours. Additionally it required $25,000 of materials. What is the amount of total costs assigned to product X100 assuming that the firm is using activity-based costing? |

|  | A) | $83,770 |

|  | B) | $42,870 |

|  | C) | $496,000 |

|  | D) | $85,870 |

|

|

|

| 6 |  |

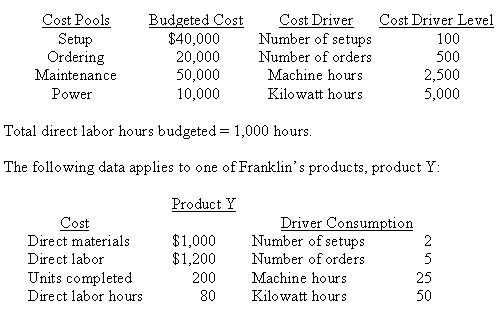

Franklin Company has identified the following cost drivers for its expected overhead costs for the year: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966302/ch05_q6_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (59.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966302/ch05_q6_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (59.0K)</a>

If the activity-based cost drivers are used to allocate overhead cost, the total overhead cost of Product Y will be: |

|  | A) | $1,500 |

|  | B) | $1,600 |

|  | C) | $2,200 |

|  | D) | $2,800 |

|  | E) | $3,800 |

|

|

|

| 7 |  |

Franklin Company has identified the following cost drivers for its expected overhead costs for the year: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966302/ch05_q7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (59.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025532/966302/ch05_q7_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (59.0K)</a>

If the activity-based cost drivers are used to allocate overhead cost, the total cost of Product Y will be: |

|  | A) | $3,700 |

|  | B) | $3,900 |

|  | C) | $2,200 |

|  | D) | $3,800 |

|

|

|

| 8 |  |

Time-driven activity-based costing is an adaption of ABC costing that: |

|  | A) | assigns resource costs directly to cost objects, rather than first assigning costs to activities. |

|  | B) | assigns resource costs to certain activities which in turn are assigned to other activities. |

|  | C) | increases the number of resource cost centers, which allows more direct tracing of resource costs to products and services. |

|  | D) | All of the above is correct. |

|

|

|

| 9 |  |

What ABC/M tool is used to answer the following critical question?What do we do to sustain the organization and meet the specification of the products and service we provide to customers? |

|  | A) | Activity analysis |

|  | B) | Activity-based costing |

|  | C) | Performance Measurement |

|  | D) | Total Quality Management |

|

|

|

| 10 |  |

Which of the following is a true statement? |

|  | A) | ABC/M applications are not commonly used by manufacturing firms. |

|  | B) | ABC/M applications are only used by manufacturing firms. |

|  | C) | ABC/M applications are not commonly used by governmental units. |

|  | D) | ABC/M are commonly used in most industries. |

|

|

|

| 11 |  |

__________ identifies customer service activities, cost drivers, and the profitability of individual customers or groups of customers. |

|  | A) | Customer revenue analysis |

|  | B) | Customer cost analysis |

|  | C) | Customer value assessment |

|  | D) | Customer profitability analysis |

|

|

|

| 12 |  |

Which of the following is a customer batch-level cost category? |

|  | A) | Order processing is $1 per item. |

|  | B) | Monthly billing is $5 per statement. |

|  | C) | Salaries and fringe benefits are $100,000 per month. |

|  | D) | Restocking is $5 per item. |

|  | E) | Order taking is $30 per order. |

|

|

|

| 13 |  |

Customer costs can be classified into all of the following categories, except: |

|  | A) | Customer batch-level costs. |

|  | B) | Distribution-channel profits. |

|  | C) | Sales-sustaining costs. |

|  | D) | Customer-sustaining costs. |

|

|

|

| 14 |  |

Customer lifetime value (CLV) is: |

|  | A) | The net future value of all estimated future profits from the customer. |

|  | B) | The estimated future profits from the customer. |

|  | C) | The net present value of all estimated future profits from the customer. |

|  | D) | The net present value of all estimated profits over the past 10 years. |

|

|

|

| 15 |  |

Successful ABC/M implementation requires close cooperation among the management accountant and: |

|  | A) | engineers. |

|  | B) | manufacturing managers. |

|  | C) | operating managers. |

|  | D) | All of the above is correct. |

|  | E) | None of the above is correct. |

|

|

|

| 16 |  |

Resource consumption accounting (RCA) is an adaption of ABC costing that: |

|  | A) | assigns resource costs directly to cost objects, rather than first assigning costs to activities. |

|  | B) | assigns resource costs to certain activities which in turn are assigned to other activities. |

|  | C) | increases the number of resource cost centers, which allows more direct tracing of resource costs to products and services. |

|  | D) | All of the above is correct. |

|

|

|

| 17 |  |

Multi-stage ABC is an adaption of ABC costing that: |

|  | A) | assigns resource costs directly to cost objects, rather than first assigning costs to activities. |

|  | B) | assigns resource costs to certain activities which in turn are assigned to other activities. |

|  | C) | increases the number of resource cost centers, which allows more direct tracing of resource costs to products and services. |

|  | D) | All of the above is correct. |

|

|