|

| 1 |  |

How would an increase in the Accounts Receivable account of a company from $40,000 at the beginning of the year to $60,000 at the end of the year be shown on the company's statement of cash flows prepared under the indirect method? |

|  | A) | As an addition to net income of $20,000 in order to arrive at cash flows from operating activities |

|  | B) | As an addition to net income of $40,000 in order to arrive at cash flows from operating activities |

|  | C) | As a deduction from net income of $20,000 in order to arrive at cash flows from operating activities |

|  | D) | As a deduction from net income of $60,000 in order to arrive at cash flows from operating activities |

|

|

|

| 2 |  |

How would an increase in the Prepaid Insurance account of $5,000 over the course of a year be shown on the company's statement of cash flows prepared under the indirect method? |

|  | A) | As an addition of $5,000 under financing activities |

|  | B) | As a deduction of $5,000 under financing activities |

|  | C) | As an addition to net income of $5,000 in order to arrive at net cash provided by operating activities |

|  | D) | As a deduction from net income of $5,000 in order to arrive at net cash provided by operating activities |

|

|

|

| 3 |  |

How would an increase in the Income Taxes Payable account of a company from $20,000 at the beginning of the year to $60,000 at the end of the year be shown on the company's statement of cash flows prepared under the indirect method? |

|  | A) | As an addition to net income of $40,000 in order to arrive at cash flows from operating activities |

|  | B) | As a cash flow of $40,000 under the investing activities heading |

|  | C) | As a cash flow of $40,000 under the financing activities heading |

|  | D) | As a deduction from net income of $40,000 in order to arrive at cash flows from operating activities |

|

|

|

| 4 |  |

Which of the following would be deducted from net income for purposes of constructing a statement of cash flows using the indirect method? |

|  | A) | An increase in accounts payable |

|  | B) | An increase in accrued liabilities |

|  | C) | An increase in accumulated depreciation |

|  | D) | An increase in prepaid expenses |

|

|

|

| 5 |  |

When using the indirect method to prepare the statement of cash flows, depreciation expense should be presented as a(n): |

|  | A) | investing and financing activity not affecting cash. |

|  | B) | addition to net income. |

|  | C) | deduction from net income. |

|  | D) | cash flow from financing activities. |

|  | E) | cash flow from investing activities. |

|

|

|

| 6 |  |

McGill Company recorded the following events for the year just ended.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (85.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (85.0K)</a>

What was the net cash provided (used) by investing activities during the year? |

|  | A) | ($5,000) |

|  | B) | $10,000 |

|  | C) | $40,000 |

|  | D) | $260,000 |

|

|

|

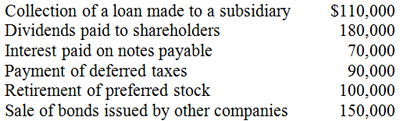

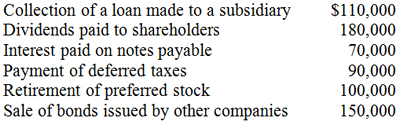

| 7 |  |

McGill Company recorded the following events for the year just ended.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (83.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (83.0K)</a>

(Note that this is the same data that was provided for the previous question.) What was the net cash used by financing activities during the year? |

|  | A) | $70,000 |

|  | B) | $90,000 |

|  | C) | $190,000 |

|  | D) | $280,000 |

|

|

|

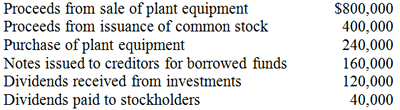

| 8 |  |

Korsak Company recorded the following activity for the year just ended:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (79.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (79.0K)</a>

The net cash provided by investing activities for the year was: |

|  | A) | $560,000. |

|  | B) | $760,000. |

|  | C) | $800,000. |

|  | D) | $820,000. |

|

|

|

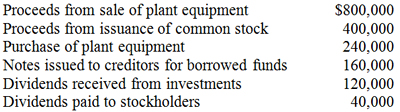

| 9 |  |

Korsak Company recorded the following activity for the year just ended:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (80.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802563x/1029179/ch14_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (80.0K)</a>

(Note that this is the same data that was provided for the previous question.) What was the net cash provided by financing activities during the year? |

|  | A) | $400,000 |

|  | B) | $520,000 |

|  | C) | $560,000 |

|  | D) | $600,000 |

|

|

|

| 10 |  |

Assume that equipment is sold at a gain during the year. How are the cash proceeds and the gain realized in this transaction shown on the statement of cash flows prepared under the indirect method? |

|  | A) | The cash received would be reported as an adjustment to net income; the gain would not appear on the statement of cash flows. |

|  | B) | The cash received would be reported under the Investing Activities section; the gain would not appear on the statement of cash flows. |

|  | C) | The cash received would be reported under the Investing Activities section; the gain would be added to net income in the Operating Activities section. |

|  | D) | The cash received would be reported under the Investing Activities section; and the gain would be deducted from net income in the Operating Activities section. |

|

|