|

| 1 |  |

A capital investment decision is essentially a decision to: |

|  | A) | exchange current assets for current liabilities. |

|  | B) | exchange current cash outflows for the expectation of receiving future cash inflows. |

|  | C) | exchange current cash flow from operations for future decrease in equity |

|  | D) | exchange current cash inflows for future cash outflows. |

|

|

|

| 2 |  |

In addition to incremental revenues, cash inflows from capital investments can be generated from all of the following sources except: |

|  | A) | debt financing |

|  | B) | cost savings |

|  | C) | salvage value |

|  | D) | reduction in the amount of working capital |

|

|

|

| 3 |  |

Ajax invested $120,000 in a machine with a 4-year useful life. The machine will generate a net cash flow of $40,000 per year.

What is the unadjusted rate of return? |

|  | A) | 16.67% |

|  | B) | 300% |

|  | C) | 33.3% |

|  | D) | 66.67% |

|

|

|

| 4 |  |

A $300,000 investment can save $60,000 a year for 6 years. Should this investment be accepted if alternative investments achieve a 10% return? |

|  | A) | No, the project should be accepted only if it saved $65,000 or more a year. |

|  | B) | No, the net present value is a negative value. |

|  | C) | Yes, the project has a payback of five years. |

|  | D) | Yes the project pays back more than the $300,000 invested. |

|

|

|

| 5 |  |

Ajax Rentals has an opportunity to purchase a truck for $130,000 with a useful life of 5 years and a $20,000 salvage value. Spare parts totaling $4,000 must be purchased when the truck is acquired and this cost will be recovered at the end of the truck's useful life. After two years a $25,000 major overhaul is needed. Ajax can generate $75,000 a year in delivery revenues, and operating expenses will be $35,000 a year, without depreciation. Cost of capital is 8%.

What is the present value of cash outflows? |

|  | A) | $176,683 |

|  | B) | $290,178 |

|  | C) | $293,735 |

|  | D) | $509,992 |

|

|

|

| 6 |  |

Ajax Rentals has an opportunity to purchase a truck for $130,000 with a useful life of 5 years and a $20,000 salvage value. Spare parts totaling $4,000 must be purchased when the truck is acquired and this cost will be recovered at the end of the truck's useful life. After two years a $25,000 major overhaul is needed. Ajax can generate $75,000 a year in delivery revenues, and operating expenses will be $35,000 a year, without depreciation. Cost of capital is 8%.

Assuming Ajax has a 40% tax rate, would it accept the project? |

|  | A) | Yes, taxes paid will cost $36,000 over 5 years. |

|  | B) | No, but the net present value of the project will be lower. |

|  | C) | Yes, depreciation expense is $110,000 over 5 years. |

|  | D) | No, depreciation does not have a cash flow impact. |

|

|

|

| 7 |  |

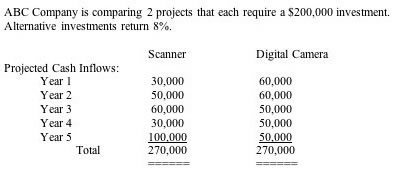

Which project shown below would be selected based upon the net present value?

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch10_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch10_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

|

|  | A) | Digital camera |

|  | B) | Scanner |

|  | C) | Neither project as they produce a negative net present value. |

|  | D) | Both projects have the same net present value. |

|

|

|

| 8 |  |

A company earns an income of $200 from a project that requires a $1,500 investment. The $200 represents: |

|  | A) | Recovery of Investment |

|  | B) | Return of Investment |

|  | C) | Recovery on Investment |

|  | D) | Return on Investment. |

|

|

|

| 9 |  |

The unadjusted rate of return: |

|  | A) | is the most accurate investment evaluation technique. |

|  | B) | is somewhat misleading because it does not recognize recovery of the cost of the asset. |

|  | C) | is not useful because it does not include cash remitted for taxes. |

|  | D) | calculates the amount of time to recover the cost of the asset purchase. |

|

|

|

| 10 |  |

Candy Cups is considering whether to purchase either a machine that manufactures cups with names printed on them or a bow tying machine. The cup machine will cost $5,000 and, over its 5 year life, will provide net cash inflows of $1,800 per year. The bow tier costs $3,000 and will save $1,200 net cash outflow per year for 5 years.

What is the IRR, internal rate of return for the cup machine? |

|  | A) | 2.3% |

|  | B) | 23% |

|  | C) | 2.9% |

|  | D) | 29% |

|

|

|

| 11 |  |

Candy Cups is considering whether to purchase either a machine that manufactures cups with names printed on them or a bow tying machine. The cup machine will cost $5,000 and, over its 5 year life, will provide net cash inflows of $1,800 per year. The bow tier costs $3,000 and will save $1,200 net cash outflow per year for 5 years.

What is the IRR, internal rate of return for the bow tying machine? |

|  | A) | 2.3% |

|  | B) | 23% |

|  | C) | 2.9% |

|  | D) | 29% |

|

|

|

| 12 |  |

Candy Cups is considering whether to purchase either a machine that manufactures cups with names printed on them or a bow tying machine. The cup machine will cost $5,000 and, over its 5 year life, will provide net cash inflows of $1,800 per year. The bow tier costs $3,000 and will save $1,200 net cash outflow per year for 5 years.

What is the payback period for the cup machine? |

|  | A) | sometime in September in the third year. |

|  | B) | 3 years. |

|  | C) | sometime in October in the fourth year. |

|  | D) | 4 years. |

|

|

|

| 13 |  |

Candy Cups thinks that offering delivery will increase their sales. Candy is considering whether to purchase a used delivery truck or hire a delivery service. The truck will cost $12,000 and last roughly 5 years. The delivery service will charge $3,600 per year for the next five years. Candy can borrow from the bank at 8%.

What is the net present value of the truck purchase? |

|  | A) | $1,200/month |

|  | B) | $2,400/year |

|  | C) | $12,000 |

|  | D) | $18,000 |

|

|

|

| 14 |  |

Candy Cups thinks that offering delivery will increase their sales. Candy is considering whether to purchase a used delivery truck or hire a delivery service. The truck will cost $12,000 and last roughly 5 years. The delivery service will charge $3,600 per year for the next five years. Candy can borrow from the bank at 8%.

Should Candy invest in the truck or use the delivery service? |

|  | A) | buy the truck for a savings of $2,373. |

|  | B) | hire the delivery service for $200 a month. |

|  | C) | buy the truck, although it costs more than the delivery as the eventual savings will increase the IRR. |

|  | D) | none of the above. |

|

|

|

| 15 |  |

Candy Cups thinks that offering delivery will increase their sales. Candy is considering whether to purchase a used delivery truck costing $12,000. Net cash inflow from the delivery service will be $3,400. The truck will last roughly 5 years.

What is the unadjusted rate of return? |

|  | A) | about 7.2% |

|  | B) | about 8.3% |

|  | C) | about 18.3% |

|  | D) | about 72% |

|

|