|

| 1 |  |

To provide information that is useful for decision making, accountants must give consideration to all of the following except the: |

|  | A) | users of the information. |

|  | B) | purpose of creating the information. |

|  | C) | process by which the information will be analyzed. |

|  | D) | fact that the analysis only contains economic data. |

|

|

|

| 2 |  |

Ratio analysis involves: |

|  | A) | specific expectations for each computation. |

|  | B) | each ratio providing an explicit answer. |

|  | C) | use of minimal amounts of data. |

|  | D) | individual judgment |

|

|

|

| 3 |  |

Which of the following statements regarding horizontal and vertical analysis is true? |

|  | A) | Horizontal analysis uses percentages and absolute numbers. |

|  | B) | Horizontal analysis compares many items within the same time period. |

|  | C) | Vertical analysis uses absolute numbers, but not percentages. |

|  | D) | Vertical analysis compares items over many time periods. |

|

|

|

| 4 |  |

Which of the following ratios would not be used to draw a conclusion about a company's managerial effectiveness? |

|  | A) | Net margin |

|  | B) | Price-earnings ratio |

|  | C) | Return on equity |

|  | D) | Return on investment |

|

|

|

| 5 |  |

The industry average number of days to collect accounts receivable is 35. ABC Company has sales of $2,400,000 and an average accounts receivable balance of $250,000. What conclusions, if any, can be reached regarding ABC's handling of their receivables based on this information? |

|  | A) | ABC is collecting its receivables better than the industry average. |

|  | B) | ABC is collecting its receivables worse than the industry average. |

|  | C) | ABC is collecting its receivables at about the same as the industry average. |

|  | D) | Not enough information to draw a conclusion. |

|

|

|

| 6 |  |

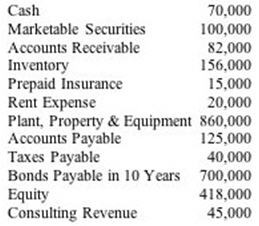

The Camp Corporation has the following account balances: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

what is the effect of the current ratio if Camp paid the taxes payable in full? |

|  | A) | Current assets decrease by $40,000, therefore the current ratio decreases. |

|  | B) | Current liabilities decrease by $40,000, therefore the current ratio decreases. |

|  | C) | Current assets and current liabilities each decrease by $40,000, and the current ratio increases. |

|  | D) | Current assets and current liabilities decrease by $40,000, therefore there is no impact on the current ratio. |

|

|

|

| 7 |  |

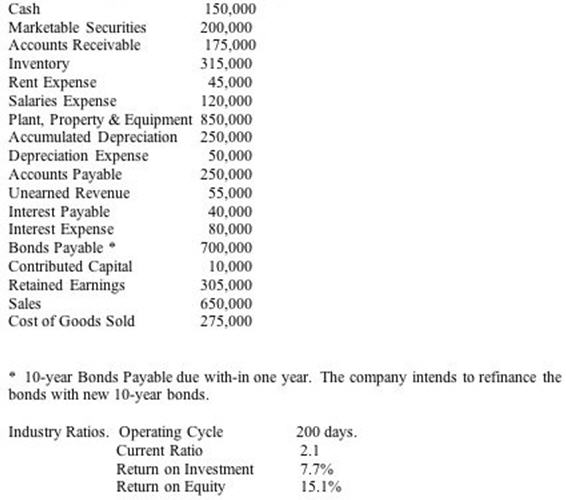

The Camp Corporation has the following account balances: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (36.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (36.0K)</a>

Compared to the industry, Camp takes better advantage of leverage because: |

|  | A) | The company has higher return on investment but a lower return on equity. |

|  | B) | The company has lower return on investment but a higher return on equity. |

|  | C) | The company has higher return on investment and a higher return on equity. |

|  | D) | The company has lower return on investment and a lower return on equity. |

|

|

|

| 8 |  |

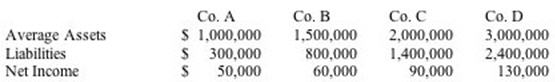

Which company had the highest return on its investment?  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

|

|  | A) | Co. A |

|  | B) | Co. B |

|  | C) | Co. C |

|  | D) | Co. D |

|

|

|

| 9 |  |

Which of the following is typically true related to comparing similar sized companies based upon the number of times interest is earned ratio? |

|  | A) | A company with more equity should have a lower ratio and therefore, less risk. |

|  | B) | A company with more equity should have a higher ratio and therefore, less risk. |

|  | C) | A company with more debt should have a higher ratio and therefore, less risk. |

|  | D) | A company with more debt should have a lower ratio and therefore, more risk. |

|

|

|

| 10 |  |

Price-earnings ratio equals: |

|  | A) | Book value per share/earnings per share. |

|  | B) | Market value per share/earnings per share. |

|  | C) | Par value per share/earnings per share. |

|  | D) | Stated value per share/earnings per share. |

|

|

|

| 11 |  |

Allen Company's sales for January and February were $40,000 and $50,000, respectively. By what percentage did Allen's sales increase from January to February? |

|  | A) | 10% |

|  | B) | 18% |

|  | C) | 20% |

|  | D) | 25% |

|

|

|

| 12 |  |

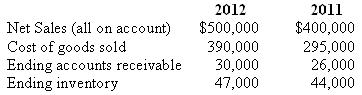

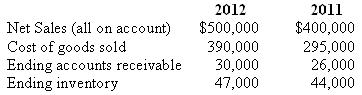

The following information relates to Bongo Beets: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_12_13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_12_13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

What is Bongo's 2012 accounts receivable turnover? |

|  | A) | 17.86 |

|  | B) | 17.95 |

|  | C) | 19.23 |

|  | D) | 21.00 |

|

|

|

| 13 |  |

The following information relates to Bongo Beets: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_12_13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch13_12_13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

What is Bongo's 2012 average days to sell inventory? |

|  | A) | 26 days |

|  | B) | 1 month |

|  | C) | 41 days, 3 hours |

|  | D) | 43 days |

|

|

|

| 14 |  |

Which of the following statements regarding financial statement analysis is true? |

|  | A) | External users may rely solely on financial statement analysis when making decisions regarding a particular company. |

|  | B) | External users must take into account industry characteristics when comparing companies in different industries. |

|  | C) | External users may ignore economic trends and inflation when analyzing companies. |

|  | D) | Conservatism and the historical cost concept ensure that financial statement analysis results are not distorted. |

|

|

|

| 15 |  |

Which of the following is not a ratio typically used to measure a company's ability to generate earnings? |

|  | A) | Net margin. |

|  | B) | Debt to equity. |

|  | C) | Return on investment. |

|  | D) | Asset turnover. |

|

|