|

| 1 |  |

The balance in Weston Corporation's accounts payable increased during the year. This increase would be reflected in which section of Weston's statement of cash flows? |

|  | A) | Operating activities |

|  | B) | Investing activities |

|  | C) | Financing activities |

|  | D) | Non-cash investing and financing transactions |

|

|

|

| 2 |  |

Lee Corporation had a $20,000 beginning balance in accounts receivable and an ending balance of $15,000. If the company's credit sales for the year were $220,000, what was the amount of cash collected? |

|  | A) | $185,000 |

|  | B) | $205,000 |

|  | C) | $225,000 |

|  | D) | $255,000 |

|

|

|

| 3 |  |

Murphy Corporation had a beginning balance of $5,500 in its land account. During the year Murphy sold some of its land, reducing the balance in the land account at the end of the year to $1,500. Murphy also recognized a $500 gain on the sale of land on its current year income statement. What is the effect of this sale on the statement of cash flows? |

|  | A) | $ 500 cash inflow from operating activities |

|  | B) | $ 500 cash inflow from investing activities |

|  | C) | $4,500 cash inflow from operating activities |

|  | D) | $4,500 cash inflow from investing activities |

|

|

|

| 4 |  |

Hanson Company had a beginning balance of $9,000 in its bonds payable account. Hanson issued additional bonds during the year, increasing the balance in bonds payable to $14,000 at the end of the year. What is the effect of this change on the statement of cash flows? |

|  | A) | $ 5,000 cash inflow from investing activities |

|  | B) | $ 5,000 cash inflow from financing activities |

|  | C) | $14,000 cash inflow from investing activities |

|  | D) | $14,000 cash inflow from financing activities |

|

|

|

| 5 |  |

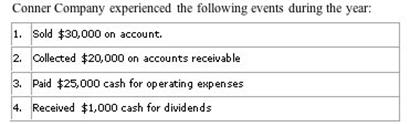

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch14_5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch14_5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (12.0K)</a>

What is the effect of these transactions on the statement of cash flows? |

|  | A) | $4,000 cash outflow from operating activities |

|  | B) | $6,000 cash inflow from operating activities |

|  | C) | $5,000 cash outflow from operating activities and $1,000 cash inflow from Financing Activities |

|  | D) | $5,000 cash inflow from operating activities and $1,000 cash inflow from Financing Activities |

|

|

|

| 6 |  |

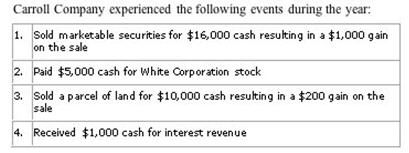

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch14_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch14_6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

What is the effect of these transactions on Carroll's statement of cash flows? |

|  | A) | $2,800 cash outflow from investing activities |

|  | B) | $3,800 cash inflow from investing activities and $ 1,000 cash inflow from operating activities |

|  | C) | $21,000 cash inflow from investing activities and $ 1,000 cash inflow from operating activities |

|  | D) | $5,000 cash inflow from operating activities and $ 1,000 cash inflow from Financing Activities |

|

|

|

| 7 |  |

What is the major difference between the direct method and the indirect method for preparing the statement of cash flows? |

|  | A) | The presentation of the investing activities |

|  | B) | The presentation of the operating activities. |

|  | C) | The presentation of the financing activities. |

|  | D) | The presentation of the schedule of non-cash investing and financing activities |

|

|

|

| 8 |  |

Inventory had a beginning balance less than its ending balance. What is the required adjustment to determine cash flow from operating activities using the indirect method? |

|  | A) | The inventory balance increased and must be deducted from net income. |

|  | B) | The inventory balance increased and must be added to net income. |

|  | C) | The inventory balance decreased and must be deducted from net income. |

|  | D) | The inventory balance decreased and must be added to net income. |

|

|

|

| 9 |  |

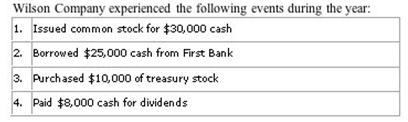

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch14_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862044/ch14_9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (13.0K)</a>

What amount is shown on the company's financing activities section of the statement of cash flows? |

|  | A) | $20,000 cash inflow |

|  | B) | $37,000 cash inflow |

|  | C) | $75,000 cash inflow |

|  | D) | $80,000 cash inflow |

|

|

|

| 10 |  |

Bedrock, Inc., had a beginning balance of $12,800 in its accounts receivable account. During the accounting period, Hammer earned $320,000 of net income. The ending balance in the accounts receivable account was $14,200. Based on this information alone, determine the amount of cash flow from operating activities. |

|  | A) | $1,400 |

|  | B) | $12,800 |

|  | C) | $307,200 |

|  | D) | $318,600 |

|

|

|

| 11 |  |

Sanders Tubing had a beginning balance of $2,300 in its prepaid insurance account. Sanders recognized $1,200 in insurance expense during the period. Its ending balance is $1,700. Which statement is true? |

|  | A) | There is a $200 increase in cash flow and it should be added to net income. |

|  | B) | There is a $200 decrease in cash flow and it should be added to net income. |

|  | C) | $600 worth of insurance was purchased. |

|  | D) | $2,200 worth of insurance was purchased. |

|

|

|

| 12 |  |

Sanders Tubing had a beginning balance of $8,500 in its salaries payable account. Sanders recognized $12,000 in salary expense during the period. Its ending balance is $2,500. |

|  | A) | There is a $6,000 increase in cash flow and should be added to net income. |

|  | B) | There is a $6,000 decrease in cash flow and should be added to net income. |

|  | C) | There is a $6,000 increase in cash flow and should be subtracted from net income. |

|  | D) | There is a $6,000 decrease in cash flow and should be subtracted from net income. |

|

|

|

| 13 |  |

Paulie's Partments had a beginning balance of $3,730 in its unearned rent account. Sanders recognized $9,000 in rent revenue during the period. Its ending balance is $2,770. |

|  | A) | There is a $960 increase in cash flow and should be added to net income when determining cash flows from operating activities. |

|  | B) | There is a $960 decrease in cash flow and should be added to net income when determining cash flows from operating activities. |

|  | C) | There is a $960 increase in cash flow and should be subtracted from net income when determining cash flows from operating activities. |

|  | D) | There is a $960 decrease in cash flow and should be subtracted from net income when determining cash flows from operating activities. |

|

|

|

| 14 |  |

Monaco's beginning balance in the store equipment account was $5,600. The ending balance was $6,800. Monaco's income statement showed a $600 gain on sale of store equipment. Book value of the equipment that was sold was $1,300. Which statement is true? |

|  | A) | Cash inflow from the sale was $1,300 and is classed as an investing activity. |

|  | B) | Cash inflow from the sale was $1,900 and is classed as an investing activity. |

|  | C) | Equipment purchased (with cash) amounted to $1,200. |

|  | D) | Equipment purchased (with cash) amounted to $2,200. |

|

|

|

| 15 |  |

Increases in short-term notes payable or long-term debt balances suggest: |

|  | A) | cash inflows occurred from issuing debt instruments (notes or bonds). |

|  | B) | cash outflows to purchase assets. |

|  | C) | cash outflows occurred for payment of debt (notes or bonds). |

|  | D) | cash outflows or inflows occurred to purchase or sell a company's own stock. |

|

|