|

| 1 |  |

Relevant information is: |

|  | A) | Focused on the past and differs between the alternatives under consideration. |

|  | B) | Focused on the past and not related to the decision under consideration. |

|  | C) | Focused on the future and differs between the alternatives under consideration. |

|  | D) | Focused on the future and not related to the decision under consideration. |

|

|

|

| 2 |  |

Which of the following is not considered to be a unit-level cost? |

|  | A) | Cost of the condenser put in the air conditioner. |

|  | B) | Cost of assembling the air conditioner. |

|  | C) | Cost of moving the box of condensers to be assembled in the air conditioner. |

|  | D) | Cost of inspecting the air conditioner. |

|

|

|

| 3 |  |

In evaluating the differences between two printers, which of the following would be a qualitative characteristic of making the decision? |

|  | A) | The number of copies produced per minute is different. |

|  | B) | The dimensions of one of the printers require purchasing a new table. |

|  | C) | The printers will collate output at different rates. |

|  | D) | The color of one of the printers. |

|

|

|

| 4 |  |

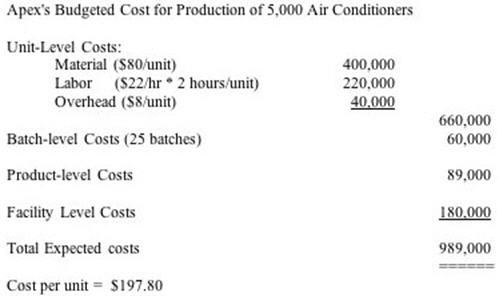

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862043/ch6_4_5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862043/ch6_4_5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a>

Apex received an order for 400 units from a new customer in a country in which Apex has never done business. This customer would like to spend $160 per air conditioner. Apex has capacity to produce 5,500 units.

Apex is evaluating an opportunity to rent the space it has for its excess capacity for $5,000. Should it accept the special order? |

|  | A) | No, there are risks in accepting the order related to waste and warranty; Apex is better off taking the rental income. |

|  | B) | No, the opportunity cost of not accepting the rental income is greater than the revenue from the special order. |

|  | C) | Yes, the contribution to income from the special order is larger than the opportunity cost from renting the space. |

|  | D) | Yes, the opportunity cost related to the rent is not relevant to this decision. |

|

|

|

| 5 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862043/ch6_4_5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862043/ch6_4_5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a>

Apex received an offer from another company to manufacture the same quality air conditioners for $165. Apex realized it could rent their manufacturing space for $50,000. Should Apex outsource the manufacture of the air conditioners? |

|  | A) | No, Apex should control the manufacturing process. |

|  | B) | No, Apex can expect profitability to decline if they outsource production. |

|  | C) | Yes, Apex can expect profitability to increase $34,000 if they outsource production. |

|  | D) | Yes, Apex can expect profitability to increase $50,000 if they outsource production. |

|

|

|

| 6 |  |

ABC Company has a machine with a 7 year useful life with an expected $6,000 salvage value. It paid $160,000 for the machine on January 2, 2009. On January 2, 2012, ABC found a technologically advanced machine that cost $80,000. The machine has a 4-year useful life and $12,000 salvage value. It will save $10,000 a year in operating expenses. The current machine can be sold for $40,000.

The issue faced by ABC Company is whether to acquire the new machine or continue to use the original machine. Which of the following is a relevant factors to be included in the decision? |

|  | A) | The original cost of the machine was $160,000. |

|  | B) | The old machine has a salvage value of $6,000 and the new machine has a salvage value of $12,000. |

|  | C) | The old machine has depreciation expense of $22,000 and the new machine would have depreciation expense of $17,000. |

|  | D) | The old machine has only been used for 3 years and has a lot of productivity left. |

|

|

|

| 7 |  |

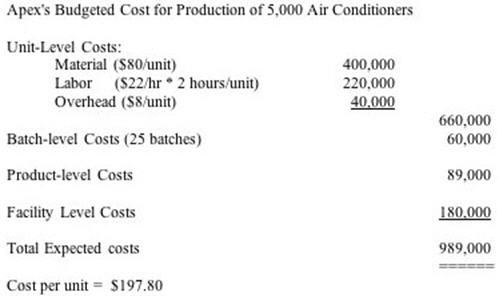

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862043/ch6_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862043/ch6_7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

The President of Smithtown wants to close the Filter Division. He has given you the above information. What is your best recommendation based upon the information presented? |

|  | A) | Recommend closure because the Filter Division is not covering total expenses. |

|  | B) | Recommend closure because all divisions must be able to cover their fair share of corporate allocated expenses. |

|  | C) | Recommend against closure because the division has a lot of employees that would be out of work if the Filter Division closed. |

|  | D) | Recommend against closure because the Filter Division can cover its operating expenses. |

|

|

|

| 8 |  |

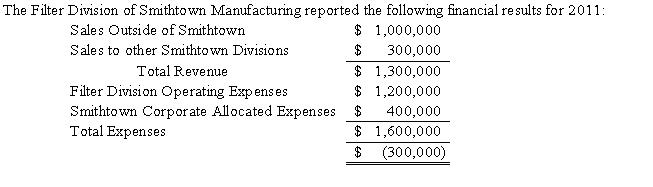

Your supervisor hands you the following analysis: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862020/ch6_8.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (32.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862020/ch6_8.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (32.0K)</a>

You know that her goal is to maximize current year income to provide the highest bonus to her. Based upon this analysis what is your recommendation? |

|  | A) | To not acquire the new equipment because it has higher annual operating expenses in 2013-2015 than 2011-2012. |

|  | B) | To not acquire the new equipment because total expenses and losses in 2011 would be higher if the old equipment is replaced than if it were not replaced. |

|  | C) | To acquire the new equipment because new equipment always produces better products than the old equipment. |

|  | D) | To acquire the new equipment because the net cost over the five year period is lower. |

|

|

|

| 9 |  |

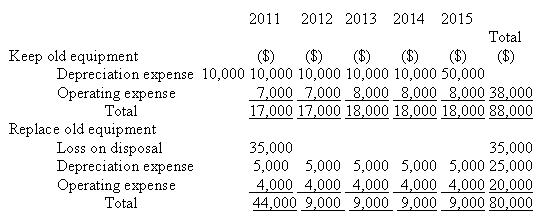

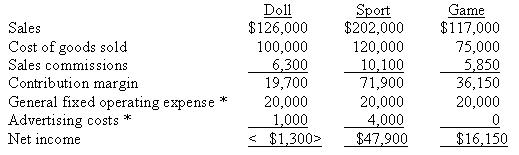

Segment information for Toyco follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862020/ch6_9.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025656/862020/ch6_9.JPG','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

* General fixed operating expense consists of only the allocated president's salary; advertising costs are specific to each department.

Should the Doll department be eliminated? |

|  | A) | Yes. It is losing money. |

|  | B) | No. It is contributing towards fixed costs and profit. |

|  | C) | Yes. It is sharing an avoidable cost. |

|  | D) | No. The opportunity costs of eliminating the Doll department exceeds its contribution. |

|

|

|

| 10 |  |

Cost information for Walter's Wigs follows:

Advertising $23,000

Supervisor's salary 40,000

Original cost of building 60,000

Accumulated depreciation 32,000

Book value of building 28,000

Market value of building 80,000

Taxes on building 2,000

Allocated facility-wide costs 22,000

Walter is considering eliminating men's wig manufacturing division. If it is eliminated, the men's manufacturing building will be sold to a floor mop manufacturer.

What is the total avoidable cost in this decision? |

|  | A) | $65,000 |

|  | B) | $100,000 |

|  | C) | $145,000 |

|  | D) | $262,000 |

|

|

|

| 11 |  |

A sunk cost is: |

|  | A) | Focused on the past and differs between the alternatives under consideration. |

|  | B) | Focused on the past and not relevant to the decision under consideration. |

|  | C) | Focused on the future and differs between the alternatives under consideration. |

|  | D) | Focused on the future and not related to the decision under consideration. |

|

|

|

| 12 |  |

All of the following are reasons not to outsource a product except: |

|  | A) | variable costs of the supplier may be less. |

|  | B) | loss of control of the outsourced product. |

|  | C) | questionable reliability of the supplier. |

|  | D) | delivery complications. |

|

|

|

| 13 |  |

All of the following are reasons not to close a segment or division except: |

|  | A) | disruption of employee lives. |

|  | B) | the division has a negative contribution to fixed cost and profit. |

|  | C) | employees may be reassigned or terminated. |

|  | D) | the division has a positive contribution to fixed cost and profit. |

|

|

|

| 14 |  |

Walter's Wigs is considering a special order for 30,000 blue wigs. What hierarchy of costs will Walter examine in this decision? |

|  | A) | unit-level costs and batch-level costs |

|  | B) | unit-level costs, batch-level costs and product-level costs. |

|  | C) | unit-level costs, batch-level costs, product-level costs and facility-level costs. |

|  | D) | all costs must be examined regardless of hierarchy. |

|

|

|

| 15 |  |

The factor limiting a firm's ability to sell its products is called: |

|  | A) | unit-level cost. |

|  | B) | restraints. |

|  | C) | constraint. |

|  | D) | limiting factor. |

|

|