|

| 1 |  |

Which of the following statements is correct? |

|  | A) | The payback period is the length of time it takes for an investment to recoup its own initial cost out of the cash receipts it generates. |

|  | B) | Projects with shorter payback periods are always more profitable than projects with longer payback periods. |

|  | C) | The payback method of making capital budgeting decisions gives full consideration to the time value of money. |

|  | D) | If new equipment is replacing old equipment, any salvage received from sale of the old equipment should not be considered in computing the payback period of the new equipment. |

|

|

|

| 2 |  |

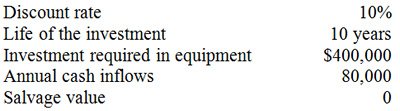

Hogan Company has gathered the following data on a proposed investment project.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (54.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (54.0K)</a>

What is the payback period for the proposed investment? |

|  | A) | 0.2 years |

|  | B) | 1.0 years |

|  | C) | 3.0 years |

|  | D) | 5.0 years |

|

|

|

| 3 |  |

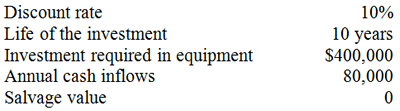

Hogan Company has gathered the following data on a proposed investment project.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (55.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (55.0K)</a>

(Note that this is the same data that was provided for the previous question.) What is the net present value on the proposed investment? |

|  | A) | $96,720 |

|  | B) | $80,000 |

|  | C) | $91,600 |

|  | D) | $491,600 |

|

|

|

| 4 |  |

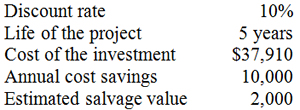

The following data pertain to an investment that is being considered by the management of Pria Company.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (59.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (59.0K)</a>

What is the net present value of the proposed investment? |

|  | A) | ($6,860) |

|  | B) | $0 |

|  | C) | $1,242 |

|  | D) | $6,710 |

|

|

|

| 5 |  |

An increase in the discount rate will: |

|  | A) | compensate for reduced risk. |

|  | B) | have no effect on net present value. |

|  | C) | increase the present value of future cash flows. |

|  | D) | reduce the present value of future cash flows. |

|

|

|

| 6 |  |

Which of the following does the net present value method take into account? |

|  | A) | The cash flow over the life of the project and the time value of money |

|  | B) | The cash flow over the life of the project but not the time value of money |

|  | C) | The time value of money but not the cash flow over the life of the project |

|  | D) | None of the above |

|

|

|

| 7 |  |

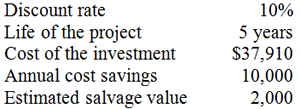

The following data pertain to an investment that is being considered by the management of Pria Company.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (56.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (56.0K)</a>

The net present value of the proposed investment is: |

|  | A) | ($6,860). |

|  | B) | $-0-. |

|  | C) | $1,242. |

|  | D) | $6,710. |

|

|

|

| 8 |  |

In comparing two investment alternatives, the difference between the net present values of the two alternatives obtained using the total-cost approach will be: |

|  | A) | less than the net present value obtained using the incremental cost approach. |

|  | B) | the same as the net present value obtained using the incremental cost approach. |

|  | C) | greater than the net present value obtained using the incremental cost approach. |

|  | D) | indeterminable. |

|

|

|

| 9 |  |

The preference rule for ranking projects by the profitability index is: |

|  | A) | the higher the profitability index, the more desirable the project. |

|  | B) | the lower the profitability index, the more desirable the project. |

|  | C) | the higher the sunk cost, the more desirable the project. |

|  | D) | the lower the sunk cost, the more desirable the project. |

|

|

|

| 10 |  |

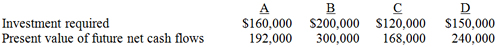

Bracco Company is considering the following investment proposals.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (40.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (40.0K)</a>

How should management rank the proposals in terms of preference using the profitability index? |

|  | A) | D, B, C, A |

|  | B) | B, D, C, A |

|  | C) | B, D, A, C |

|  | D) | A, C, B, D |

|

|

|

| 11 |  |

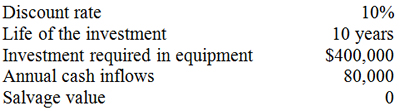

Harrington Company has gathered the following data on a proposed investment project.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (55.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch13_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (55.0K)</a>

Assume that excess of incremental revenues over the incremental expenses (including depreciation) equal the annual cash inflows. What is the simple rate of return on the proposed investment? |

|  | A) | 10% |

|  | B) | 20% |

|  | C) | 30% |

|  | D) | 40% |

|

|