|

| 1 |  |

Assume that a company reports accounts receivable, inventory, and prepaid expenses on its balance sheet. Which of those accounts should be included in the calculation of the company's acid-test ratio? |

|  | A) | Accounts receivable and prepaid expenses, but not inventory |

|  | B) | Accounts receivable, but not inventory or prepaid expenses |

|  | C) | Inventory and prepaid expenses, but not accounts receivable |

|  | D) | Inventory, but not accounts receivable or prepaid expenses |

|

|

|

| 2 |  |

Major Company converts a short-term note payable into a long-term note payable. How does this transaction affect the following ratios? |

|  | A) | Decrease the current ratio; decrease the acid-test ratio |

|  | B) | Decrease working capital; increase the current ratio |

|  | C) | Decrease working capital; decrease the current ratio |

|  | D) | Increase working capital; increase the current ratio |

|

|

|

| 3 |  |

Firenze Company had $360,000 in sales on account last year. The beginning accounts receivable balance was $20,000 and the ending accounts receivable balance was $36,000. What is the company's average collection period (rounded to two decimal points)? |

|  | A) | 20.28 days |

|  | B) | 28.39 days |

|  | C) | 36.50 days |

|  | D) | 56.78 days |

|

|

|

| 4 |  |

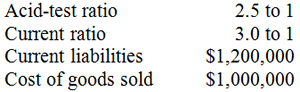

Selected year-end data for Tailgate Company are presented below:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (49.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (49.0K)</a>

The company has no prepaid expenses and inventories remained unchanged during the year. What is the company's inventory turnover ratio for the year? |

|  | A) | 1.20 times |

|  | B) | 1.67 times |

|  | C) | 2.33 times |

|  | D) | 2.40 times |

|

|

|

| 5 |  |

Financial leverage is negative when: |

|  | A) | the return on total assets is less than the rate of return on common stockholders' equity. |

|  | B) | the return on total assets is less than the rate of return demanded by creditors. |

|  | C) | total liabilities are less than stockholders' equity. |

|  | D) | total liabilities are less than total assets. |

|

|

|

| 6 |  |

Madison Company reported net income of $150,000 and interest expense of $20,000. Total assets were $1,300,000 at the beginning of the year and $1,220,000 at the end of the year. The company's income tax rate was 30%. What is the company's return on total assets for the year? |

|  | A) | 13.5% |

|  | B) | 13.0% |

|  | C) | 12.4% |

|  | D) | 11.9% |

|

|

|

| 7 |  |

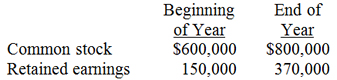

Selected financial data for Nicto Company appear below:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a>

During the year, the company did not pay any dividends on its common stock. The company's net income for the year was $220,000. What is the company's return on equity for the year (rounded to the nearest whole percentage)? |

|  | A) | 25%. |

|  | B) | 23%. |

|  | C) | 19%. |

|  | D) | 17%. |

|

|

|

| 8 |  |

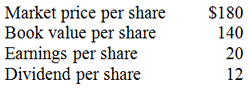

The following data have been taken from Hobart Company's financial records for the current year:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (42.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (42.0K)</a>

What is the price-earnings ratio? |

|  | A) | 15.0 to 1 |

|  | B) | 9.0 to 1 |

|  | C) | 7.0 to 1 |

|  | D) | 1.67 to 1 |

|

|

|

| 9 |  |

The market price of the common stock of Stem Company dropped from $550 to $325 per share. The dividend paid per share remained unchanged. The company's dividend payout ratio would: |

|  | A) | be unchanged. |

|  | B) | increase. |

|  | C) | decrease. |

|  | D) | be impossible to determine without additional information. |

|

|

|

| 10 |  |

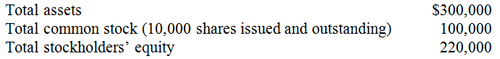

The records of Kenzie Enterprises include the following account balances as of the end of the most recent year:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (45.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0027162757/1029179/ch15_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (45.0K)</a>

What is the company's book value per share? |

|  | A) | $28 |

|  | B) | $25 |

|  | C) | $22 |

|  | D) | $20 |

|

|