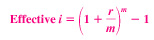

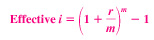

Since many real-world situations involve cash flow frequencies and compounding periods other than one year, it is necessary to use nominal and effective interest rates. When a nominal rate r is stated, the effective interest rate per payment period is determined by using the effective interest rate equation.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072432349/22710/ch4_objectives_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0072432349/22710/ch4_objectives_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (5.0K)</a>

The m is the number of compounding periods (CP) per payment period (PP). If interest compounding becomes more and more frequent, the length of a CP approaches zero, continuous compounding results, and the effective i is er - 1. All engineering economy factors require the use of an effective interest rate.

The i and n values placed in a factor depend upon the type of cash flow series. If only single amounts (P and F) are present, there are several ways to perform

equivalence calculations using the factors. However, when series cash flows

(A, G, and g) are present, only one combination of the effective rate i and number of periods n is correct for the factors. This requires that the relative lengths of PP and CP be considered as i and n are determined. The interest rate and payment periods must have the same time unit for the factors to correctly account for the time value of money. From one year (or interest period) to the next, interest rates will vary. To accurately perform equivalence calculations for P and A when rates vary significantly, the applicable interest rate should be used, not an average or constant rate. Whether performed by hand or by computer, the procedures and factors are the same as those for constant interest rates; however, the number of calculations increases. |

2002 McGraw-Hill Higher Education

2002 McGraw-Hill Higher Education