|

| 1 |  |

Of the following fiscal policies, which one is most expansionary? |

|  | A) | $100 billion tax cut |

|  | B) | $100 billion increase in government spending |

|  | C) | $100 billion increase in both government spending and taxes |

|  | D) | $100 billion decrease in both government spending and taxes |

|

|

|

| 2 |  |

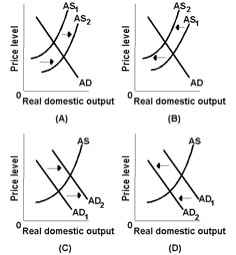

Answer the next question on the basis of the following diagram.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz11c_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz11c_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

An expansionary fiscal policy is best represented by graph: |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|

|

| 3 |  |

In 2005, the debt held by the public as a percentage of GDP was about: |

|  | A) | 17% |

|  | B) | 69% |

|  | C) | 31% |

|  | D) | 116% |

|

|

|

| 4 |  |

The majority of the public debt does not represent a burden on future generations because: |

|  | A) | future generations need pay back only the interest on borrowed funds, not the principal |

|  | B) | the debt can be paid off by selling government land, buildings, and other real assets |

|  | C) | the debt can be paid off by printing new money |

|  | D) | the majority of the debt is owned by the U.S. public and institutions |

|

|

|

| 5 |  |

Compared to a proportional tax, a progressive tax system: |

|  | A) | increases built-in stability |

|  | B) | reduces built-in stability |

|  | C) | increases the size of the standardized budget deficit |

|  | D) | shifts the aggregate supply curve to the right |

|

|

|

| 6 |  |

A strict rule requiring a constantly balanced actual budget would: |

|  | A) | increase the effectiveness of built-in stabilizers |

|  | B) | be impossible with a progressive tax system |

|  | C) | produce a standardized budget surplus when the economy is producing beyond its potential GDP |

|  | D) | produce a standardized budget surplus when the economy is in a recession |

|

|

|

| 7 |  |

Which of the following exemplifies the crowding-out effect? An increase in government spending: |

|  | A) | is financed by increasing the money supply, reducing interest rates and causing net exports to fall |

|  | B) | is financed by borrowing, raising interest rates and causing private investment to fall |

|  | C) | causes taxes to rise automatically, reducing consumption spending |

|  | D) | causes the price level to rise, reducing net exports |

|

|

|

| 8 |  |

A very high level of U.S. public debt to GDP: |

|  | A) | may bankrupt the U.S. |

|  | B) | cannot bankrupt the U.S. because of its ability to tax and to refinance its debt |

|  | C) | is, by itself, evidence of the burden of the debt on future generations |

|  | D) | will offset any attempts at expansionary fiscal policy |

|

|

|

| 9 |  |

Built-in stabilizers arise from the fact that tax revenues vary directly with GDP. |

|  | A) | True |

|  | B) | False |

|

|

|

| 10 |  |

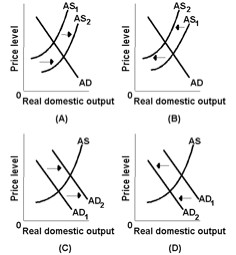

Answer the next question on the basis of the following diagram.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz11c_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz11c_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

Refer to the diagram. A contractionary fiscal policy is best represented by graph: |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|