|

| 1 |  |

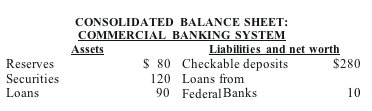

Answer the next question using the following data. All amounts are in billions of dollars.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz14a_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz14a_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a>

Suppose the reserve requirement is 20%. Further suppose the Federal Reserve Banks buy $5 billion in securities from the public, who deposits this amount into their checking accounts. As a result of these transactions, the supply of money will: |

|  | A) | be unaffected, but the money-creating potential of the commercial banking system will increase by $25 billion |

|  | B) | directly increase by $5 billion and the money-creating potential of the commercial banking system will increase by $20 billion |

|  | C) | directly increase by $25 billion and the money-creating potential of the commercial banking system will increase by $125 billion |

|  | D) | directly decrease by $5 billion and the money-creating potential of the commercial banking system will be unaffected |

|

|

|

| 2 |  |

If the current interest rate is below the equilibrium rate: |

|  | A) | the money supply exceeds the quantity of money demanded |

|  | B) | the money supply will increase and the interest rate will rise |

|  | C) | the money supply will decrease and the interest rate will rise |

|  | D) | the interest rate will rise and the quantity of money demanded will decrease |

|

|

|

| 3 |  |

An increase in the required reserve ratio will reduce both excess reserves and the size of the monetary multiplier. |

|  | A) | True |

|  | B) | False |

|

|

|

| 4 |  |

A decrease in the money supply will: |

|  | A) | raise interest rates, reducing investment and GDP |

|  | B) | raise interest rates, increasing investment and lowering GDP |

|  | C) | reduce interest rates, increasing investment and GDP |

|  | D) | reduce interest rates, reducing investment and GDP |

|

|

|

| 5 |  |

Fed purchases of bonds from the public will: |

|  | A) | raise interest rates and increase aggregate demand |

|  | B) | lower interest rates and increase aggregate demand |

|  | C) | lower interest rates and decrease aggregate demand |

|  | D) | raise interest rates and decrease aggregate demand |

|

|

|

| 6 |  |

Morton Bank goes to the Fed to borrow funds. The interest rate charged by the Fed is known as the: |

|  | A) | prime rate |

|  | B) | Federal funds rate |

|  | C) | bond rate |

|  | D) | discount rate |

|

|

|

| 7 |  |

If the Fed buys bonds from the public: |

|  | A) | both the price of bonds and the interest rate received by bond holders will increase |

|  | B) | both the price of bonds and the interest rate received by bond holders will decrease |

|  | C) | the price of bonds will decrease and the interest rate received by bond holders will increase |

|  | D) | the price of bonds will increase and the interest rate received by bond holders will decrease |

|

|

|

| 8 |  |

By targeting the Federal funds rate, the Fed: |

|  | A) | can generally push the prime rate in the opposite direction |

|  | B) | can generally push the prime rate in the same direction |

|  | C) | has little control over other interest rates |

|  | D) | can generally push investment in the same direction |

|

|

|

| 9 |  |

Suppose the interest rate is 10% and a particular bond is priced at $1000. If the interest rate falls to 8%, which of the following represents a possible price for the bond? |

|  | A) | $1000 |

|  | B) | $800 |

|  | C) | $920 |

|  | D) | $1080 |

|

|

|

| 10 |  |

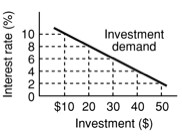

Refer to the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz14a_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384258/quiz14a_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (8.0K)</a>

Suppose the interest rate is currently 6% and the Fed determines that investment of $40 is required to reach full employment GDP. To target this outcome, the Fed might: |

|  | A) | sell bonds to the public |

|  | B) | lower the discount rate |

|  | C) | raise the reserve requirement |

|  | D) | announce a restrictive monetary policy |

|

|