(See related pages)

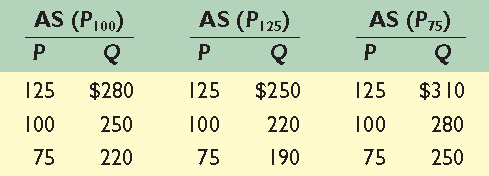

1. Suppose the full-employment level of real output (Q) for a hypothetical economy is $250 and the price level (P) initially is 100. Use the short-run aggregate supply schedules below to answer the questions that follow:

2. Use graphical analysis to show how each of the following would affect the economy first in the short run and then in the long run. Assume that the United States is initially operating at its full-employment level of output, that prices and wages are eventually flexible both upward and downward, and that there is no counteracting fiscal or monetary policy.

3. Suppose the government misjudges the natural rate of unemployment to be much lower than it actually is, and thus undertakes expansionary fiscal and monetary policy to try to achieve the lower rate. Use the concept of the short-run Phillips Curve to explain why these policies might at first succeed. Use the concept of the long-run Phillips Curve to explain the long-run outcome of these policies. 4. What is the Laffer Curve, and how does it relate to supply-side economics? Why is determining the location where the economy is on the curve so important in assessing tax policy? |