|

| 1 |  |

While researching a stock for your school's investment club, you discover that it carries 1.5 times the non-diversifiable risk of the overall market. Accordingly, you report to the club that the stock: |

|  | A) | should earn a risk premium of 1.5 percentage points |

|  | B) | has a beta of 1.5 |

|  | C) | is preferable to an alternative stock with the same risk but the same expected return |

|  | D) | is never preferable to alternative stocks with lower risks, regardless of their returns |

|

|

|

| 2 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384261/quiz14webb_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384261/quiz14webb_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (16.0K)</a>

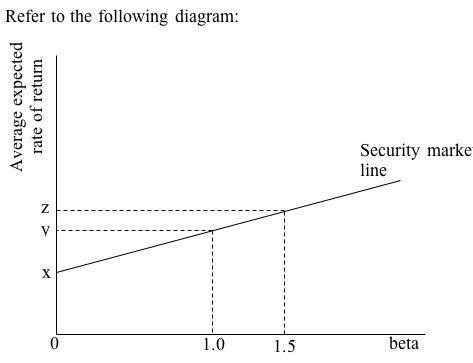

The risk-free interest rate is given by: |

|  | A) | x% |

|  | B) | y% |

|  | C) | z% |

|  | D) | (y - x)% |

|

|

|

| 3 |  |

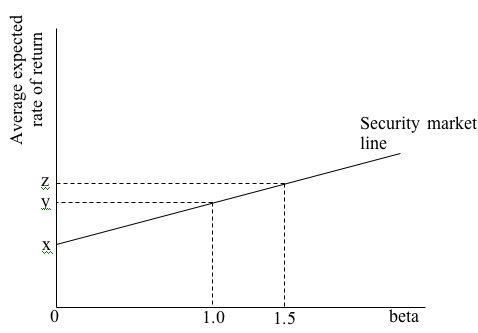

Refer to the following diagram:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384261/quiz14webb_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073273082/384261/quiz14webb_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a>

A stock with a beta of 1.5 will pay a risk premium of: |

|  | A) | z% |

|  | B) | (z - x)% |

|  | C) | (z - y)% |

|  | D) | 0.5% |

|

|

|

| 4 |  |

Gary is considering investing in a financial asset that represents a debt contract by a large corporation. For a price of $1000, the firm promises to pay Gary a $50 every six months for ten years and return the $1000 at the end of the ten years. This type of investment is known as a: |

|  | A) | stock |

|  | B) | bond |

|  | C) | mutual fund |

|  | D) | portfolio |

|

|

|

| 5 |  |

Consider a financial investment priced at $100. At the end of one year, it is equally likely that the asset will be worth $90, $109, or $122. The expected rate of return on this asset is: |

|  | A) | $21 |

|  | B) | $321 |

|  | C) | 4% |

|  | D) | 7% |

|

|

|

| 6 |  |

Which of the following purchases best illustrates the concept of diversification? |

|  | A) | Jonah invests $500 in each of two companies: one makes umbrellas and the other makes sunscreen lotion |

|  | B) | Sarah invests $500 in each of two companies: one whose share price is $10 and one whose share price is $100 |

|  | C) | Sharifa invests in a mutual fund consisting of shares of over 100 firms in the housing industry |

|  | D) | Jose invests in both Coca Cola and Pepsico |

|

|

|

| 7 |  |

Because bonds represent a promise to pay, they carry no risk. |

|  | A) | True |

|  | B) | False |

|

|

|

| 8 |  |

You notice that of two stocks have recently been selling for the same price. Stock A has a beta of 1.3 and stock B has a beta of 1.7. From this information, you can infer that: |

|  | A) | Stock A will have a higher expected rate of return than stock B |

|  | B) | Stock B will have a higher expected rate of return than stock A |

|  | C) | investing in both A and B will raise your risk relative to either one alone |

|  | D) | arbitrage will force the price of A down and the price of B up. |

|

|

|

| 9 |  |

Which of the following illustrates a financial investment? |

|  | A) | The city of Tacoma authorizes the sale of $500 million in bonds to fund the construction of a new bridge |

|  | B) | The South Tacoma Women's Investment Club purchases $5000 of the city's bonds to add to its portfolio |

|  | C) | The Tacoma city council releases a portion of the bond proceeds to pay the stadium's general contractor for completion of the first stage of bridge construction |

|  | D) | The city of Tacoma pays its first interest obligations to holders of the bonds |

|

|

|

| 10 |  |

If the risk-free interest rate is 4%, what is the present value of a financial asset that will pay $2000 two years from now? |

|  | A) | $160 |

|  | B) | $1840 |

|  | C) | $1849 |

|  | D) | $2163 |

|

|