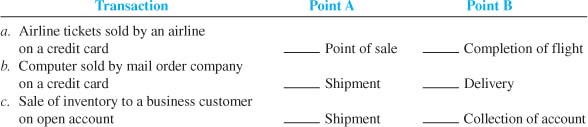

Indicate the most likely time you expect sales revenue to be recorded for each of the listed transactions.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg313_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg313_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| M6-1

Interpreting the Revenue Principle

LO1 |

Merchandise invoiced at $9,500 is sold on terms 1/10, n/30. If the buyer pays within the discount period, what amount will be reported on the income statement as net sales? | M6-2

Reporting Net Sales with Sales Discounts

LO2 |

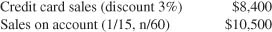

Total gross sales for the period include the following:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg313_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg313_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Sales returns related to sales on account were $500. All returns were made before payment. One-half of the remaining sales on account was paid within the discount period. The company treats all discounts and returns as contra-revenues. What amount will be reported on the income statement as net sales? | M6-3

Reporting Net Sales with Sales Discounts, Credit Card Discounts, and Sales Returns

LO2 |

Net sales for the period was $49,000 and cost of sales was $28,000. Compute gross profit percentage for the current year. What does this ratio measure? | M6-4

Computing and Interpreting the Gross Profit Percentage

LO3 |

Prepare journal entries for each transaction listed. During the period, bad debts are written off in the amount of $22,000. At the end of the period, bad debt expense is estimated to be $13,000.

| M6-5

Recording Bad Debts

LO4 |

Using the following categories, indicate the effects of the following transactions. Use + for increase and − for decrease and indicate the accounts affected and the amounts.

At the end of the period, bad debt expense is estimated to be $17,000. During the period, bad debts are written off in the amount of $7,000.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg313_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg313_3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| M6-6

Determining Financial Statement Effects of Bad Debts

LO4 |

Indicate the most likely effect of the following changes in credit policy on the receivables turnover ratio (+ for increase, − for decrease, and NE for no effect).

Granted credit with shorter payment deadlines. Increased effectiveness of collection methods. Granted credit to less creditworthy customers.

| M6-7

Determining the Effects of Credit Policy Changes on Receivables Turnover Ratio

LO5 |

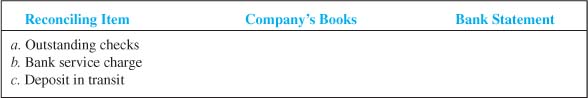

Indicate whether the following items would be added (+) or subtracted (-) from the company’s books or the bank statement during the construction of a bank reconciliation.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg314_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg314_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| M6-8

Matching Reconciling Items to the Bank Reconciliation

LO6 |

A sale is made for $8,000; terms are 1/10, n/30. At what amount should the sale be recorded under the gross method of recording sales discounts? Give the required entry. Also give the collection entry, assuming that it is during the discount period. | M6-9

(Supplement A) Recording Sales Discounts |