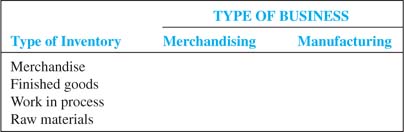

Match the type of inventory with the type of business in the following matrix:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg374_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg374_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

| M7-1

Matching Inventory Items to Type of Business

LO1 |

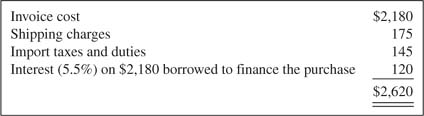

Elite Apparel purchased 90 new shirts and recorded a total cost of $2,620 determined as follows:  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg374_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg374_2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Required: Make the needed corrections in this calculation. Give the journal entry(ies) to record this purchase in the correct amount, assuming a perpetual inventory system. Show computations. | M7-2

Recording the Cost of Purchases for a Merchandiser

LO1 |

Operating costs incurred by a manufacturing company become either (1) part of the cost of inventory to be expensed as cost of goods sold at the time the finished goods are sold or (2) expenses at the time they are incurred. Indicate whether each of the following costs belongs in category 1 or 2. ____________ a. Wages of factory workers ____________ b. Sales salaries ____________ c. Costs of raw materials purchased ____________ d. Heat, light, and power for the factory building ____________ e. Heat, light, and power for the headquarters office building

| M7-3

Identifying the Cost of Inventories for a Manufacturer

LO1 |

JCPenney Company, Inc., is a major retailer with department stores in all 50 states. The dominant portion of the company’s business consists of providing merchandise and services to consumers through department stores that include catalog departments. In a recent annual report, JCPenney reported cost of goods sold of $10,969 million, ending inventory for the current year of $3,062 million, and ending inventory for the previous year of $2,969 million. Required: Is it possible to develop a reasonable estimate of the merchandise purchases for the year? If so, prepare the estimate; if not, explain why. | M7-4

Inferring Purchases Using the Cost of Goods Sold Equation

LO1JCPenney |

Indicate whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. Rising costs

Highest net income ____________ Highest inventory ____________

Declining costs

Highest net income ____________ Highest inventory ____________

| M7-5

Matching Financial Statement Effects to Inventory Costing Methods

LO2 |

Indicate whether the FIFO or LIFO inventory costing method would normally be selected when inventory costs are rising. Explain why. | M7-6

Matching Inventory Costing Method Choices to Company Circumstances

LO3 |

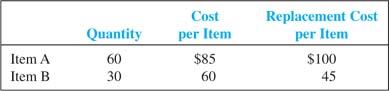

Kinney Company had the following inventory items on hand at the end of the year.  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg375_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/pg375_1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

Computing the lower of cost or market on an item-by-item basis, determine what amount would be reported on the balance sheet for inventory. | M7-7

Reporting Inventory Under Lower of Cost or Market

LO4 |

Indicate the most likely effect of the following changes in inventory management on the inventory turnover ratio (+ for increase, − for decrease, and NE for no effect). ____________ a. Parts inventory delivered daily by suppliers instead of weekly. ____________ b. Shorten production process from 10 days to 8 days. ____________ c. Extend payments for inventory purchases from 15 days to 30 days.

| M7-8

Determining the Effects of Inventory Management Changes on Inventory Turnover Ratio

LO5 <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/key.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073324833/key.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (K)</a>

|

Assume the 2009 ending inventory was understated by $100,000. Explain how this error would affect the 2009 and 2010 pretax income amounts. What would be the effects if the 2009 ending inventory were overstated by $100,000 instead of understated? | M7-9

Determining the Financial Statement Effects of Inventory Errors

LO7 |