|

| 1 |  |

The effectiveness of an expansionary fiscal policy will be reduced if: |

|  | A) | borrowing increases interest rates and crowds out private investment. |

|  | B) | the dollar depreciates because of an increased outflow of currency. |

|  | C) | the price level falls. |

|  | D) | stock prices rise. |

|

|

|

| 2 |  |

Built-in stabilizers: |

|  | A) | automatically increase the size of deficits when the economy experiences demand-pull inflation. |

|  | B) | avoid the problems associated with the administrative lag of discretionary fiscal policy. |

|  | C) | automatically produce a cyclically balanced budget. |

|  | D) | tend to offset the impact of discretionary fiscal policy. |

|

|

|

| 3 |  |

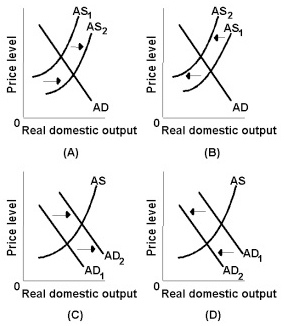

Answer the question on the basis of the following diagrams. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch13_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (41.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch13_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (41.0K)</a>

Refer to the diagrams. A contractionary fiscal policy is best represented by graph: |

|  | A) | A |

|  | B) | B |

|  | C) | C |

|  | D) | D |

|

|

|

| 4 |  |

A very high level of U.S. public debt to GDP: |

|  | A) | may bankrupt the United States. |

|  | B) | cannot bankrupt the United States because of its ability to refinance the debt and its ability to tax. |

|  | C) | is, by itself, evidence of the burden of the debt on future generations. |

|  | D) | will offset any attempts at expansionary fiscal policy. |

|

|

|

| 5 |  |

Which of the following exemplifies the crowding-out effect? An increase in government spending: |

|  | A) | is financed by increasing the money supply, reducing interest rates, and causing net exports to fall. |

|  | B) | is financed by borrowing, raising interest rates, and causing investment to fall. |

|  | C) | causes taxes to rise automatically, reducing consumption spending. |

|  | D) | causes the price level to rise, reducing net exports. |

|

|

|

| 6 |  |

Of the following groups, the largest proportion of the public debt is held by: |

|  | A) | foreign individuals and institutions. |

|  | B) | U.S. government agencies, including the Federal Reserve. |

|  | C) | state and local governments. |

|  | D) | U.S. individuals, banks, and other financial institutions. |

|

|

|

| 7 |  |

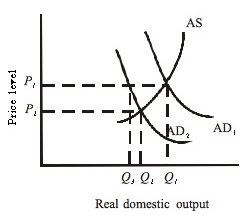

Answer the question using the following graph: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch13_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch13_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a>

Refer to the graph. If AD1 represents the current level of expenditures and Q2 is the full-employment level of GDP, the economy is: |

|  | A) | in a recession and expansionary fiscal policy is in order. |

|  | B) | in a recession and contractionary fiscal policy is in order. |

|  | C) | experiencing demand-pull inflation and expansionary fiscal policy is in order. |

|  | D) | experiencing demand-pull inflation and contractionary fiscal policy is in order. |

|

|

|

| 8 |  |

Use the following table to answer the next question:

- Treasury bills, notes, and bonds

- Federal Reserve Notes

- State and local government bonds

- Corporate bonds

- Corporate stock certificates

- U.S. savings bonds

Refer to the table. The public debt consists of item(s): |

|  | A) | 1 and 6 only |

|  | B) | 1, 2, and 6 only |

|  | C) | 1, 2, 3, and 6 only |

|  | D) | 1, 2, 3, 4, 5, and 6 |

|

|

|

| 9 |  |

All else equal, the economic burden of a deficit (an increase in the public debt) will be higher the: |

|  | A) | greater the increase in the interest rate. |

|  | B) | greater the increase in public investment. |

|  | C) | smaller the crowding-out effect. |

|  | D) | greater the increase in the money supply. |

|

|

|

| 10 |  |

An economy currently is experiencing a negative GDP gap of $500 billion, or 3 percent of its GDP. An appropriate fiscal policy would be: |

|  | A) | a decrease in taxes. |

|  | B) | a decrease in government spending. |

|  | C) | an equal decrease in taxes and government spending. |

|  | D) | an increase in interest rates. |

|

|