|

| 1 |  |

Which of the following is not part of the U.S. money supply (M1)? |

|  | A) | Coins |

|  | B) | Paper currency |

|  | C) | Checkable deposits |

|  | D) | Time deposits ("CDs") |

|

|

|

| 2 |  |

Writing a check to purchase a new computer is an example of using money primarily as a: |

|  | A) | unit of account. |

|  | B) | standard of value. |

|  | C) | medium of exchange. |

|  | D) | store of value. |

|

|

|

| 3 |  |

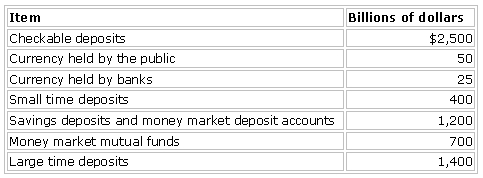

Use the following to answer the next question: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch14_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (35.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch14_q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (35.0K)</a>

Refer to the table. The size of the M2 money supply is: |

|  | A) | $2,950 billion. |

|  | B) | $4,850 billion. |

|  | C) | $4,875 billion. |

|  | D) | $6,275 billion. |

|

|

|

| 4 |  |

During the financial crisis of 2007–2008, the Federal Deposit Insurance Corporation (FDIC) increased deposit insurance. What is the new maximum amount per account? |

|  | A) | $50,000 |

|  | B) | $100,000 |

|  | C) | $250,000 |

|  | D) | $1,000,000 |

|

|

|

| 5 |  |

Other things equal, a dramatic decrease in the money supply would: |

|  | A) | increase the price level. |

|  | B) | reduce the purchasing power of each dollar. |

|  | C) | increase the purchasing power of each dollar. |

|  | D) | have an ambiguous impact on the purchasing power of each dollar. |

|

|

|

| 6 |  |

Money is created when: |

|  | A) | loans are repaid. |

|  | B) | the net worth of the banking system is increased. |

|  | C) | banks acquire physical capital. |

|  | D) | banks make additional loans. |

|

|

|

| 7 |  |

Which of the following is not a routine function of the Federal Reserve Banks? |

|  | A) | Issuing currency |

|  | B) | Providing for check collection |

|  | C) | Regulating the supply of money |

|  | D) | Collecting tax revenue |

|

|

|

| 8 |  |

The group responsible for setting policy on buying and selling government securities (bills, notes, and bonds) is the: |

|  | A) | Securities and Exchange Commission. |

|  | B) | U.S. Treasury Board. |

|  | C) | Federal Open Market Committee. |

|  | D) | 12 Federal Reserve Bank presidents. |

|

|

|

| 9 |  |

Answer the next question on the basis of the following information: the required reserve ratio is 10 percent; the system initially has no excess reserves; $20 billion in new currency is deposited into the system. The $20 billion in new deposits will initially create excess reserves of: |

|  | A) | $2 billion |

|  | B) | $18 billion |

|  | C) | $20 billion |

|  | D) | $200 billion |

|

|

|

| 10 |  |

In the U.S. Federal Reserve System: |

|  | A) | members of the Board of Governors also sit on the Federal Open Market Committee. |

|  | B) | there is a Federal Reserve branch bank located in each state. |

|  | C) | there are 14 regional Federal Reserve Banks. |

|  | D) | the vice chair of the Board of Governors chairs the Federal Open Market Committee. |

|

|