|

| 1 |  |

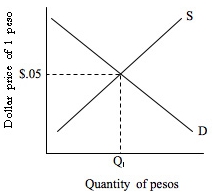

Use the following diagram to answer the question: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch16_q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch16_q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

Refer to the diagram. Suppose the United States increases its imports from Mexico. All else equal, this would: |

|  | A) | shift the demand curve to the left, causing the dollar to depreciate. |

|  | B) | shift the demand curve to the right, causing the dollar to depreciate. |

|  | C) | shift the supply curve to the right, causing the dollar to appreciate. |

|  | D) | shift the supply curve to the left, causing the peso to appreciate. |

|

|

|

| 2 |  |

If the U.S. dollar appreciates against other currencies: |

|  | A) | currency speculators will sell dollars. |

|  | B) | U.S. imports will become more expensive to U.S. consumers. |

|  | C) | U.S. exports will become more expensive to foreign consumers. |

|  | D) | the demand for the dollar will fall. |

|

|

|

| 3 |  |

For a nation to gain from trade, it must have: |

|  | A) | no tariffs or other trade barriers. |

|  | B) | an absolute advantage in the production of at least one good. |

|  | C) | an absolute advantage in the production of at least two goods. |

|  | D) | a comparative advantage in the production of at least one good. |

|

|

|

| 4 |  |

One major outcome of the North American Free Trade Agreement is: |

|  | A) | massive investment by Asian companies in Mexico to exploit reduced tariffs. |

|  | B) | increased unemployment in Mexico. |

|  | C) | higher living standards in Canada, Mexico, and the United States. |

|  | D) | reduced exports from the United States to Mexico and Canada. |

|

|

|

| 5 |  |

Consider the following hypothetical exchange rates: $1 = .50 British pound; 1 French franc = $.20. We can conclude that: |

|  | A) | 1 pound = 10 francs |

|  | B) | 1 pound = 5 francs |

|  | C) | 1 franc = .2 pound |

|  | D) | 1 franc = .05 pound |

|

|

|

| 6 |  |

A decrease in the U.S. demand for Mexican goods will: |

|  | A) | increase the demand for pesos and increase its dollar price. |

|  | B) | increase the supply of pesos and decrease its dollar price. |

|  | C) | decrease the supply of pesos and increase its dollar price. |

|  | D) | decrease the demand for pesos and decrease its dollar price. |

|

|

|

| 7 |  |

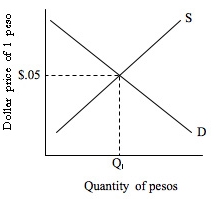

Use the following diagram to answer the question: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch16_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch16_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

Refer to the diagram. At the equilibrium exchange rate: |

|  | A) | $1 will buy 20 pesos. |

|  | B) | $1 will buy 5 pesos. |

|  | C) | 95 pesos will buy one dollar. |

|  | D) | 5 pesos will buy one dollar. |

|

|

|

| 8 |  |

The United States: |

|  | A) | leads the world in the percentage of its GDP that is traded. |

|  | B) | leads the world in the dollar volume of exports and imports. |

|  | C) | exports more than it imports. |

|  | D) | is importing a smaller percentage of its GDP now compared with 40 years ago. |

|

|

|

| 9 |  |

A tariff: |

|  | A) | raises the price of imported goods, increasing the demand for domestic substitutes. |

|  | B) | lowers the cost of producing domestic goods. |

|  | C) | offsets the effect of a quota. |

|  | D) | raises the price of domestic goods, lowering the demand for them. |

|

|

|

| 10 |  |

When traveling in Ireland, you pay the equivalent of $5 for a pint of Guinness priced at 2 pounds. The exchange rate is: |

|  | A) | $1 = 2.5 pounds |

|  | B) | 1 pound = $.25 |

|  | C) | $1 = .4 pound |

|  | D) | 1 pound = $4 |

|

|