|

| 1 |  |

Which of the following taxes is progressive? |

|  | A) | The federal income tax |

|  | B) | State sales taxes |

|  | C) | Gasoline excise taxes |

|  | D) | Property taxes |

|

|

|

| 2 |  |

A public good exhibits the characteristics of: |

|  | A) | rivalry and excludability. |

|  | B) | nonrivalry and excludability. |

|  | C) | rivalry and nonexcludability. |

|  | D) | nonrivalry and nonexcludability. |

|

|

|

| 3 |  |

The Coase theorem suggests that government intervention is least likely to be needed to correct which of the following spillovers? |

|  | A) | Individuals who outfit their cars with Lojack antitheft devices provide benefits to themselves and other car owners in the community. |

|  | B) | A large brewery discharges its wastewater into a creek, killing many fish that a downstream resort relies on to attract fishermen. |

|  | C) | Automobiles discharge greenhouse gases that potentially reduce the ozone layer and contribute to global warming. |

|  | D) | Hundreds of ranchers pay below-market rates for their cattle to graze on public land, resulting in overgrazing. |

|

|

|

| 4 |  |

Most states tax gasoline and use the proceeds to build and maintain highways. This tax best reflects: |

|  | A) | the ability-to-pay principle. |

|  | B) | the benefits-received principle. |

|  | C) | the comparative advantage principle. |

|  | D) | the diminishing returns principle. |

|

|

|

| 5 |  |

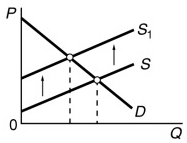

Use the following diagram to answer the question. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch5_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch5_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (11.0K)</a>

Refer to the diagram. Assume S is a market supply curve comprising all private costs of production and D is a demand curve representing all private benefits. Further assume that property rights are well defined. In which of the following circumstances is the appropriate government response most likely to be a tax that shifts the supply curve to S1? |

|  | A) | Production of this good generates a substantial spillover benefit and the number of affected parties is small. |

|  | B) | Production of this good generates a substantial spillover benefit and the number of affected parties is large. |

|  | C) | Production of this good generates a substantial spillover cost and the number of affected parties is small. |

|  | D) | Production of this good generates a substantial spillover cost and the number of affected parties is large. |

|

|

|

| 6 |  |

External benefits are most likely to be found in the production of: |

|  | A) | illegal drugs. |

|  | B) | DVD recording devices. |

|  | C) | milk and dairy products. |

|  | D) | secondary education. |

|

|

|

| 7 |  |

An externality is: |

|  | A) | a cost or benefit incurred by someone who is not directly involved in the production or consumption of a good or service. |

|  | B) | never relevant to the production of goods and services. |

|  | C) | a cost that is incurred by consumers. |

|  | D) | a benefit that is incurred by producers. |

|

|

|

| 8 |  |

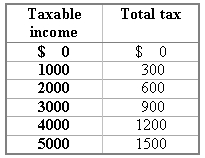

Refer to the following: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch5_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch5_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

The tax represented in the accompanying table is: |

|  | A) | regressive. |

|  | B) | proportional. |

|  | C) | progressive. |

|  | D) | optimal. |

|

|

|

| 9 |  |

Which of the following markets is likely to be characterized by substantial positive externalities (spillover benefits)? |

|  | A) | Flu vaccine |

|  | B) | Salmon |

|  | C) | Newsprint |

|  | D) | Concrete |

|

|

|

| 10 |  |

Free markets will tend to underallocate resources to the production of goods that: |

|  | A) | are public goods. |

|  | B) | are characterized by rivalry and excludability. |

|  | C) | generate spillover costs. |

|  | D) | are subject to the principal-agent problem. |

|

|