|

| 1 |  |

A particular firm would most likely be classified as a monopoly if: |

|  | A) | it produces a good for which market demand is highly elastic. |

|  | B) | it has very little control over the price. |

|  | C) | entry into the industry is blocked. |

|  | D) | it produces a good for which there are many close substitutes. |

|

|

|

| 2 |  |

The allocative inefficiency of nondiscriminating monopoly arises from the fact that: |

|  | A) | price exceeds marginal cost. |

|  | B) | output falls short of the output at which average cost is minimized. |

|  | C) | output exceeds that where average cost is minimized. |

|  | D) | price exceeds minimum average cost. |

|

|

|

| 3 |  |

In order to sell more output, the monopolist: |

|  | A) | should advertise more extensively. |

|  | B) | must lower its costs of production. |

|  | C) | has to lower the product's price. |

|  | D) | should produce more. |

|

|

|

| 4 |  |

A profit-maximizing, nondiscriminating monopolist will set its price: |

|  | A) | equal to minimum average total cost. |

|  | B) | so as to maximize profit per unit. |

|  | C) | on the inelastic portion of its demand curve. |

|  | D) | so as to equate marginal revenue and marginal cost. |

|

|

|

| 5 |  |

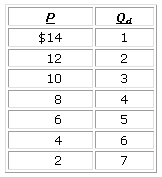

Answer the question on the basis of the following table showing the demand schedule facing a nondiscriminating monopolist. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Refer to the data. The marginal revenue of the fourth unit of output is: |

|  | A) | $10. |

|  | B) | $8. |

|  | C) | $4. |

|  | D) | $2. |

|

|

|

| 6 |  |

Which combination of price, marginal cost, and marginal revenue is consistent with a pure monopolist maximizing profit? |

|  | A) | P = $30, MR = $10, MC = $10 |

|  | B) | P = $8, MR = $5, MC = $8 |

|  | C) | P = $15, MR = –$2, MC = $2 |

|  | D) | P = $40, MR = $20, MC = $10 |

|

|

|

| 7 |  |

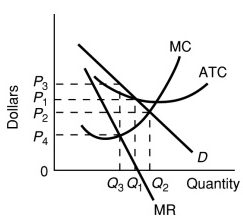

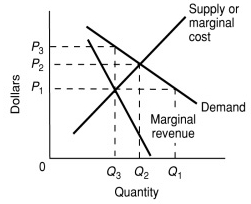

Use the following diagram to answer the question. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a>

Refer to the diagram. If this monopolist could engage in perfect price discrimination, it would produce: |

|  | A) | Q3 units, selling the last one at price P3. |

|  | B) | Q1 units, selling the last one at price P1. |

|  | C) | Q2 units, selling the last one at price P3. |

|  | D) | Q2 units, selling the last one at price P2. |

|

|

|

| 8 |  |

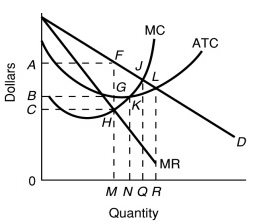

Use the following diagram to answer the question: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

Refer to the diagram. If this firm produces its profit-maximizing output, its potential profit is: |

|  | A) | zero. |

|  | B) | area AFHC. |

|  | C) | area AFGB. |

|  | D) | area BGHC. |

|

|

|

| 9 |  |

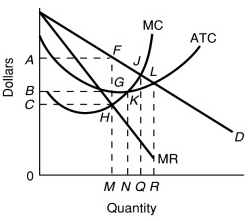

Use the following diagram to answer the question: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a>

Refer to the diagram. This nondiscriminating monopolist will produce: |

|  | A) | M units at price A and make a profit. |

|  | B) | N units at price B and earn zero profit. |

|  | C) | M units at price C and incur a loss. |

|  | D) | Q units at price J and earn zero profit. |

|

|

|

| 10 |  |

Use the following diagram to answer the question. <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0073511455/991476/ch08_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

Refer to the diagram. Suppose this industry is initially competitive but that all the firms merge to become a pure monopoly. The result of the mergers is that output: |

|  | A) | falls from Q2 to Q3 and price rises from P2 to P3. |

|  | B) | remains the same, but price rises from P1 to P3. |

|  | C) | falls from Q1 to Q3 and price rises from P1 to P3. |

|  | D) | falls from Q2 to Q3, but price remains the same. |

|

|