FINANCIAL ANALYSIS

Background:

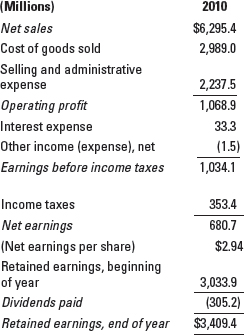

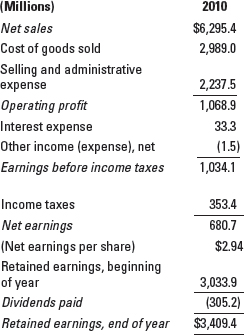

The income statement for Western

Grain Company, a producer of agricultural

products for industrial as well as

consumer markets, is shown below. Western

Grain's total assets are $4,237.1 million, and its equity

is $1,713.4 million. Consolidated Earnings and Retained Earnings Year Ended December 31  <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0076735192/948876/Ch14_t1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (42.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0076735192/948876/Ch14_t1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (42.0K)</a>Task:

Calculate the following profitability ratios: profit margin,

return on assets, and return on equity. Assume that the

industry averages for these ratios are as follows: profit

margin, 12 percent; return on assets, 18 percent; and

return on equity, 25 percent. Evaluate Western Grain's

profitability relative to the industry averages. Why is this

information useful? |