|

| 1 |  |

If consumption and disposable income are equal at a particular level of income: |

|  | A) | the MPC must be one at this point. |

|  | B) | the MPS must be zero at this point. |

|  | C) | the APC must be less than one at this point. |

|  | D) | saving must be zero at this point. |

|

|

|

| 2 |  |

Suppose that for the entire economy, no investment projects will yield an expected real return of more than 12%. However, $10 billion worth of projects will yield expected real returns of 9.1% to 12%, an additional $10 billion will yield expected real returns of 6.1% to 9%, an additional $10 billion will yield expected real returns of 3.1% to 6%, and an additional $10 billion will yield expected real returns of 0% to 3%. If the real rate of interest is 6%, desired investment spending will be: |

|  | A) | $0 billion. |

|  | B) | $10 billion. |

|  | C) | $20 billion. |

|  | D) | $30 billion. |

|

|

|

| 3 |  |

The investment demand curve will shift to the left if: |

|  | A) | the interest rate decreases. |

|  | B) | the interest rate increases. |

|  | C) | expected returns on investment increase. |

|  | D) | business taxes increase. |

|

|

|

| 4 |  |

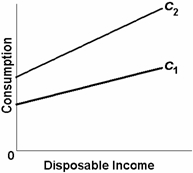

Use the following diagram for this question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883755/ch27_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883755/ch27_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

Which of the following might have caused the shift from consumption schedule C1 to schedule C2? |

|  | A) | An increase in disposable income |

|  | B) | An increase in household wealth |

|  | C) | An increase in household debt |

|  | D) | An increase in taxes |

|

|

|

| 5 |  |

Suppose the MPC is ¾. If investment spending falls by $10 billion, the level of GDP will: |

|  | A) | fall by $40 billion. |

|  | B) | fall by $30 billion. |

|  | C) | fall by $10 billion. |

|  | D) | fall by $7.5 billion. |

|

|

|

| 6 |  |

If the slope of the consumption line is .8: |

|  | A) | the MPC is .8. |

|  | B) | the MPS is .8. |

|  | C) | the MPC is 1/.2. |

|  | D) | the MPS is 1/.2. |

|

|

|

| 7 |  |

If the MPC is .63, the multiplier is: |

|  | A) | 1 / .63. |

|  | B) | 1 – .37. |

|  | C) | 1 / .37. |

|  | D) | .63 / .37. |

|

|

|

| 8 |  |

All else equal, if the interest rate rises: |

|  | A) | planned investment spending will decrease. |

|  | B) | the investment demand curve will shift upward. |

|  | C) | the investment demand curve will shift to the left. |

|  | D) | the investment demand curve will shift to the right. |

|

|

|

| 9 |  |

The consumption schedule is: |

|  | A) | an inverse relationship between consumption and the price level. |

|  | B) | a direct relationship between consumption and disposable income. |

|  | C) | an inverse relationship between consumption and saving. |

|  | D) | an inverse relationship between consumption and the tax rate. |

|

|

|

| 10 |  |

Along a particular saving schedule, each change in disposable income of $15 billion generates an additional $3 billion in saving. Therefore: |

|  | A) | the MPS is .3. |

|  | B) | the MPS is .2. |

|  | C) | the APC is .8. |

|  | D) | the slope of the consumption schedule is .7. |

|

|