|

| 1 |  |

Consider an initial investment of $1000 earning 5% annual interest. At the end of three years, this investment will grow to a value of: |

|  | A) | $1000 x (1.05)3. |

|  | B) | $1000 x (1.15). |

|  | C) | ($1000)3 x (1.05). |

|  | D) | $1000 / (1.05)3. |

|

|

|

| 2 |  |

Highly traded assets such as stocks and bonds with similar risks will earn the same rate of return. The process by which this occurs is known as: |

|  | A) | the Beta process. |

|  | B) | arbitrage. |

|  | C) | risk-sharing. |

|  | D) | diversification. |

|

|

|

| 3 |  |

Compared to the overall market portfolio, a financial investment with a beta of 3.0 implies that the investment: |

|  | A) | has a rate of return three percentage points higher. |

|  | B) | has a rate of return three times higher. |

|  | C) | carries 3% more non-diversifiable risk. |

|  | D) | carries 3 times more non-diversifiable risk. |

|

|

|

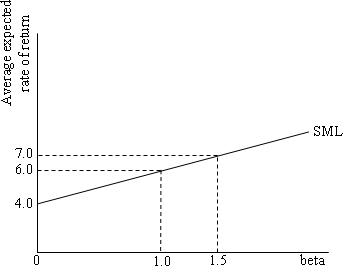

| 4 |  |

Refer to the following diagram, which portrays the security market line:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883762/ch34_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883762/ch34_q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

The risk-free interest rate is: |

|  | A) | 4%. |

|  | B) | 6%. |

|  | C) | 7%. |

|  | D) | 2%. |

|

|

|

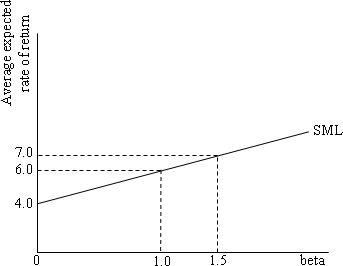

| 5 |  |

Refer to the following diagram, which portrays the security market line:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883762/ch34_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883762/ch34_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

A stock with a beta of 1.5 will pay a risk premium of: |

|  | A) | 1%. |

|  | B) | 3%. |

|  | C) | 4%. |

|  | D) | 7%. |

|

|

|

| 6 |  |

You notice that two stocks have recently been selling for the same price. Stock A has a beta of 1.3 and stock B has a beta of 1.7. From this information, you can infer that: |

|  | A) | Stock A will have a higher expected rate of return than stock B. |

|  | B) | Stock B will have a higher expected rate of return than stock A. |

|  | C) | investing in both A and B will raise your risk relative to investing in either one alone. |

|  | D) | arbitrage will force the price of A down and the price of B up. |

|

|

|

| 7 |  |

Consider a stock that is currently priced at $500. At the end of one year, there is a 10% chance that the firm will go bankrupt and the stock will be worthless. However, there is a 60% chance that the stock price will rise to $700 and a 30% chance that it will fall to $400. The expected rate of return on this asset is: |

|  | A) | –4%. |

|  | B) | 4%. |

|  | C) | 8%. |

|  | D) | 16%. |

|

|

|

| 8 |  |

All else equal, an asset's expected rate of return is: |

|  | A) | inversely related both to its price and its level of risk. |

|  | B) | directly related both to its price and its level of risk. |

|  | C) | directly related to its price and inversely related to its level of risk. |

|  | D) | inversely related to its price and directly related to its level of risk. |

|

|

|

| 9 |  |

The steeper the security market line, the: |

|  | A) | higher the risk-free interest rate. |

|  | B) | the greater the risk level of the overall market. |

|  | C) | the greater the compensation investors demand for any increase in risk. |

|  | D) | higher is beta. |

|

|

|

| 10 |  |

If the risk-free interest rate is 8%, what is the present value of a financial asset that is guaranteed to pay $1000 one year from now? |

|  | A) | $80 |

|  | B) | $1080 |

|  | C) | $964.11 |

|  | D) | $925.93 |

|

|