|

| 1 |  |

"A recession became the Great Depression because the Fed allowed the money supply to fall by 35% during the 1930s." This statement is most closely associated with which school of thought? |

|  | A) | Mainstream view |

|  | B) | Real business cycle theory |

|  | C) | Rational expectations theory |

|  | D) | Monetarism |

|

|

|

| 2 |  |

The inability of outsiders to underbid insiders for jobs suggests that: |

|  | A) | the economy will self-correct only slowly, if at all. |

|  | B) | the natural rate of unemployment will fall during a recession. |

|  | C) | the Phillips curve will be vertical. |

|  | D) | work-place morale can be improved with "two-tier" wage systems. |

|

|

|

| 3 |  |

The new classical view suggests that: |

|  | A) | wages are inflexible downward. |

|  | B) | coordination failures lead to persistent unemployment. |

|  | C) | the long-run aggregate supply curve is vertical. |

|  | D) | the long-run Phillips curve is downsloping. |

|

|

|

| 4 |  |

Suppose nominal GDP is $5000 billion, real GDP is $4000 billion, and the money supply is $1000 billion. In this hypothetical economy, the velocity of money is: |

|  | A) | 5. |

|  | B) | 4. |

|  | C) | 4.5. |

|  | D) | $1000. |

|

|

|

| 5 |  |

According to the monetarist view: |

|  | A) | changes in money velocity are small and predictable. |

|  | B) | velocity is inversely proportional to nominal GDP. |

|  | C) | the equation of exchange holds true only at full-employment GDP. |

|  | D) | adverse supply shocks are the primary cause of monetary instability. |

|

|

|

| 6 |  |

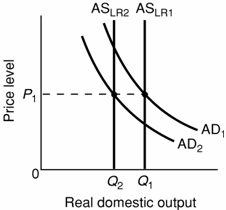

Use the following diagram to answer the next question.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883764/ch36_q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0077337727/883764/ch36_q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a>

According to the real business cycle theory of recessions, a leftward shift in aggregate supply from ASLR1 to ASLR2: |

|  | A) | would be caused by the decrease in aggregate demand from AD1 to AD2. |

|  | B) | would lead to a subsequent decrease in aggregate demand from AD1 to AD2. |

|  | C) | would cause a drop in resource prices and lead to a subsequent return to the original aggregate supply curve. |

|  | D) | could never happen. |

|

|

|

| 7 |  |

According to the new classical view, shifts in aggregate demand: |

|  | A) | are always anticipated, and as such, have no effect on real output. |

|  | B) | are never anticipated, and as such, have no effect on real output. |

|  | C) | have no effect on real output if they are fully anticipated. |

|  | D) | have no effect on real output if they are unanticipated. |

|

|

|

| 8 |  |

According to the "coordination failure" theory, a recession: |

|  | A) | cannot occur if demand shocks are fully anticipated. |

|  | B) | is a direct outcome of failed macro policies. |

|  | C) | can occur if everyone expects everyone else to curtail spending. |

|  | D) | is typically caused by adverse aggregate supply shocks. |

|

|

|

| 9 |  |

According to the mainstream view of the economy, macro instability arises primarily from changes in aggregate demand caused by: |

|  | A) | changes in the money supply. |

|  | B) | adverse productivity shocks. |

|  | C) | changes in investment spending. |

|  | D) | changes in fiscal policy. |

|

|

|

| 10 |  |

Monetarist thought differs from the new classical rational expectations view in that the latter assumes: |

|  | A) | the economy will eventually self-correct. |

|  | B) | the velocity of money is unstable. |

|  | C) | a gradual adjustment of expectations as events and experience unfold. |

|  | D) | an almost instantaneous adjustment of expectations in response to announced changes in policy. |

|

|