|

| 1 |  |

Goods in the process of being manufactured, but not yet completed, are called: |

|  | A) | work in process inventory. |

|  | B) | raw materials inventory. |

|  | C) | unfinished goods inventory. |

|  | D) | merchandise inventory. |

|

|

|

| 2 |  |

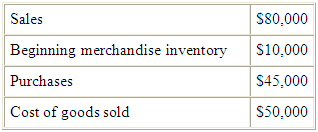

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (33.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (33.0K)</a>

What is the value of the ending merchandise inventory? |

|  | A) | $10,000 |

|  | B) | $15,000 |

|  | C) | $5,000 |

|  | D) | $25,000 |

|

|

|

| 3 |  |

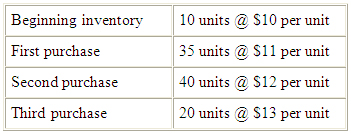

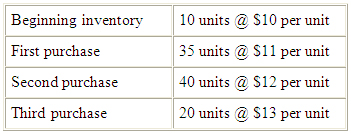

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q3_q4_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q3_q4_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a>

Eighty-three units were sold. Using the LIFO method of inventory costing, what is the value assigned to cost of goods sold? |

|  | A) | $993 |

|  | B) | $968 |

|  | C) | $962 |

|  | D) | $941 |

|

|

|

| 4 |  |

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q3_q4_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q3_q4_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a>

Eighty-three units were sold. Using the FIFO method of inventory costing, what is the value assigned to inventory? |

|  | A) | $260 |

|  | B) | $232 |

|  | C) | $284 |

|  | D) | $268 |

|

|

|

| 5 |  |

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q3_q4_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q3_q4_q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a>

Eighty-three units were sold. Using the average method of inventory costing, what is the value assigned to cost of goods sold? |

|  | A) | $993 |

|  | B) | $969 |

|  | C) | $962 |

|  | D) | $941 |

|

|

|

| 6 |  |

During periods of rising prices, which of the following is true? |

|  | A) | The use of FIFO will result in smaller net income than LIFO. |

|  | B) | The use of FIFO will result in a larger cost of goods sold than LIFO. |

|  | C) | The use of LIFO will result in a smaller cost of goods sold than FIFO. |

|  | D) | The use of FIFO will result in a higher ending inventory than LIFO. |

|

|

|

| 7 |  |

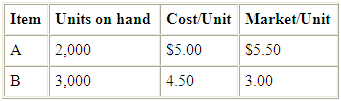

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

Using the lower of cost or market rule applied on an item-by-item basis, what will be the value of the ending inventory reported on the balance sheet? |

|  | A) | $23,500 |

|  | B) | $20,00 |

|  | C) | $19,000 |

|  | D) | $24,500 |

|

|

|

| 8 |  |

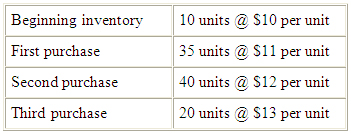

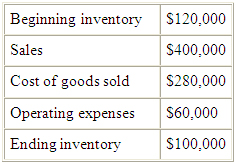

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025559/1014252/ch07_q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a>

What is the inventory turnover? |

|  | A) | 2.55 |

|  | B) | 2.80 |

|  | C) | 2.33 |

|  | D) | 2.00 |

|

|

|

| 9 |  |

Inventory at the end of the current period was understated because one bin of inventory was not counted and its value not included in the ending inventory totals. Because of this error: |

|  | A) | net income for the period was overstated. |

|  | B) | net income for the following period will be overstated. |

|  | C) | the cost of goods sold for the current period was understated. |

|  | D) | total equity for the current year is overstated. |

|

|

|

| 10 |  |

Company A uses LIFO, while Company B uses FIFO. In a period of rising prices, which company will have a higher inventory turnover ratio? |

|  | A) | Company A. |

|  | B) | Company B. |

|  | C) | They will be the same. |

|  | D) | Cannot determine without more information. |

|

|