|

| 1 |  |

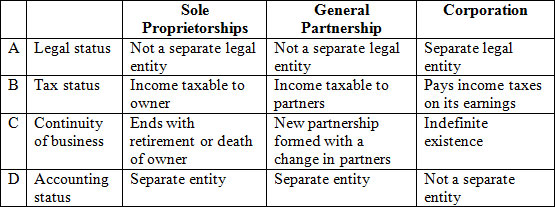

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/AppC_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (55.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/AppC_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (55.0K)</a>

Which line (A, B, C, or D) is incorrect? |

|  | A) | Line A |

|  | B) | Line B |

|  | C) | Line C |

|  | D) | Line D |

|

|

|

| 2 |  |

A corporation has 200,000 shares of common stock outstanding. The corporation's income before taxes was $160,000. The income tax rate of the corporation is 25%. The corporation declared a cash dividend of $120,000. You own 5,000 shares of the common stock and your income tax rate is 20%. Calculate the total amount of income taxes paid on your pro rata share of the corporation's net income before taxes and on your individual dividend. |

|  | A) | $1,600 |

|  | B) | $1,800 |

|  | C) | $2,000 |

|  | D) | $1,350 |

|

|

|

| 3 |  |

When are journal entries required for events related to cash dividends? |

|  | A) | Declaration date |

|  | B) | Record date |

|  | C) | Payment date |

|  | D) | Only the date of declaration and the date of payment. |

|

|

|

| 4 |  |

The reduction in stockholders' equity resulting from a cash dividend occurs with which event? |

|  | A) | A dividend is declared |

|  | B) | A divided is paid |

|  | C) | The dividend account is closed to the Retained Earnings account |

|  | D) | Both (A) and (C) |

|

|

|

| 5 |  |

Which of the following require that corporations be interpreted differently than those of an unincorporated business? |

|  | A) | Compensation to the owners |

|  | B) | Evaluating liquidity |

|  | C) | Loan guarantees |

|  | D) | All of the above |

|

|

|

| 6 |  |

When an existing business is reorganized as a corporation, the assets of the existing business are recorded in the ledger of the newly formed corporation at which value? |

|  | A) | Book values as shown in the balance sheet of the existing business |

|  | B) | Cost to the existing business |

|  | C) | Current market value |

|  | D) | Estimated values as determined by the board of directors of the new corporation |

|

|

|

| 7 |  |

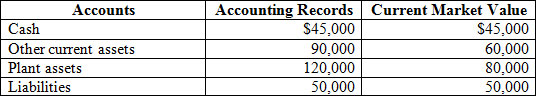

Consider the following schedule of the accounts of a sole proprietorship:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/AppC_Q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/AppC_Q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (23.0K)</a>

At what amount will the capital stock account be credited if the sole proprietorship is reorganized as a corporation? |

|  | A) | $205,000 |

|  | B) | $185,000 |

|  | C) | $135,000 |

|  | D) | $70, 000 |

|

|

|

| 8 |  |

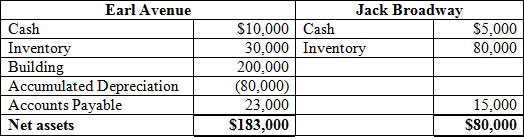

Consider the following balance sheets:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/AppC_Q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (31.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/AppC_Q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (31.0K)</a>

Avenue and Broadway are going to form a partnership. The inventories of both entities are determined to have a fair market value of 80% of their book value. The fair market value of Earl's building is $150,000. When the journal entry is made to record the investment by Earl Avenue, it will include which of the following? |

|  | A) | A credit to Accumulated Depreciation, Building, for $80,000 |

|  | B) | A debit to Inventory for $24,000 |

|  | C) | A debit to Building for $70,000 |

|  | D) | A credit to Avenue, Capital, for $81,000 |

|

|

|

| 9 |  |

The partnership of Earl Avenue and Jack Broadway reported net income of $24,000. The capital investments of Avenue and Broadway were $161,000 and $54,000, respectively. Because of the marketing talents of Broadway, they decided to allocate net income and net loss equally. The journal entry to record the distribution of income to the partners will include which of the following? |

|  | A) | A debit to Retained Earnings for $24,000 |

|  | B) | A credit to Income Summary for $24,000 |

|  | C) | A credit to Avenue, Capital, for $12,000 |

|  | D) | A credit to Broadway, Capital, for $6,027 |

|

|

|

| 10 |  |

The income statement for a partnership may disclose which of the following? |

|  | A) | Salaries paid to partners. |

|  | B) | Income taxes payable on net income. |

|  | C) | The division of net income. |

|  | D) | The dollar amount of drawings made by each partner. |

|

|