|

| 1 |  |

Which of the following is one reason of greatest importance for businesses to incorporate? |

|  | A) | Continuity of existence |

|  | B) | Participation in dividends |

|  | C) | Limited personal liability |

|  | D) | Prospect of high profits |

|

|

|

| 2 |  |

A publicly owned corporation is required by law to do which of the following? |

|  | A) | Prepare and issue financial statements in conformity with generally accepted accounting principles. |

|  | B) | Have their annual statements audited by an independent firm of certified public accountants. |

|  | C) | Comply with federal securities laws. |

|  | D) | Do all of the above. |

|

|

|

| 3 |  |

Who has the primary function of setting corporate policies? |

|  | A) | Stockholders |

|  | B) | Board of directors |

|  | C) | Operations officers |

|  | D) | Chief executive officer (CEO) |

|

|

|

| 4 |  |

Ten thousand shares of common stock with a par value of $5 per share are issued at a price of $7 per share. The journal entry to record this transaction will include which of the following? |

|  | A) | A debit to Cash for $50,000 |

|  | B) | A credit to Additional Paid-in Capital for $20,000 |

|  | C) | A credit to Capital Stock for $70,000 |

|  | D) | A debit to Discount on Capital Stock for $20,000 |

|

|

|

| 5 |  |

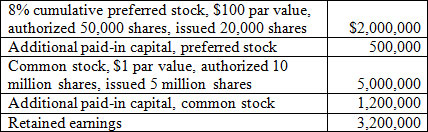

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH11_Q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (38.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH11_Q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (38.0K)</a>

Calculate the total paid-in capital of the corporation. |

|  | A) | $8,700,000 |

|  | B) | $1,700,000 |

|  | C) | $4,900,000 |

|  | D) | $11,900,000 |

|

|

|

| 6 |  |

Preferred Stock, with a par value of $50 per share and a dividend preference of 10%, is listed in the balance sheet with a total equity balance of $1,000,000. If dividends are declared and paid at the end of the year, what amount of dividends will be paid to the preferred shareholders? |

|  | A) | $100,000 |

|  | B) | $200,000 |

|  | C) | $225,000 |

|  | D) | $250,000 |

|

|

|

| 7 |  |

The dividend yield on preferred stock is 10% on a market price of $80 per share at the end of Year One. The preferred stock is selling for $40 at the end of Year Two. What is its dividend yield at the end of Year Two? |

|  | A) | 20% |

|  | B) | 10% |

|  | C) | 8% |

|  | D) | 16% |

|

|

|

| 8 |  |

Which of the following is false? |

|  | A) | Book value is a historical concept. |

|  | B) | Investors' confidence in a company's management can be measured. |

|  | C) | Book value excludes amounts earned and retained by the corporation. |

|  | D) | The sign of a successful corporation is when the market price of its stock exceeds the book value of its stock. |

|

|

|

| 9 |  |

Anchor, Incorporated has 100,000 shares of $50 par value common stock authorized and issued. The board of directors has authorized a 5-for-1 stock split. After the stock split, what will be the total number of shares issued and the par value per share? |

|  | A) | 50,000 shares with a par value of $10 per share |

|  | B) | 500,000 shares with a par value of $100 per share |

|  | C) | 500,000 shares with a par value of $10 per share |

|  | D) | 5,000,000 shares with a par value of $1 per share |

|

|

|

| 10 |  |

A corporation purchased treasury stock for $50,000 cash. The journal entry for this transaction included which of the following? |

|  | A) | A debit to Cash and a credit to Common stock. |

|  | B) | A debit to Treasury Stock and a credit to Cash. |

|  | C) | A debit to Retained Earnings and a credit to Treasury Stock. |

|  | D) | A debit to Treasury Stock and a credit to Preferred Stock. |

|

|