|

| 1 |  |

A company had a $230,000 operating loss on discontinued operations of one of its production segments. The income tax benefit from the loss was $103,000. The gain on the sale of the production segment was $150,000, net of $50,000 income taxes. What amount would be reported as the net result of discontinued operations? |

|  | A) | $127,000 |

|  | B) | $150,000 |

|  | C) | $23,000 |

|  | D) | $183,000 |

|

|

|

| 2 |  |

The company had 48,000 shares outstanding for the first two months of the year, 66,000 shares outstanding for the next three months of the year, and 72,000 shares outstanding for the last seven months of the year. There were 5,000 of $8 noncumulative preferred shares outstanding during the year. Net income was $339,150. Calculate the earnings per share of common stock to the nearest cent. |

|  | A) | $5.23 |

|  | B) | $4.62 |

|  | C) | $5.67 |

|  | D) | $5.10 |

|

|

|

| 3 |  |

Which of the following is true about diluted earnings per share? |

|  | A) | It alerts common stockholders to what could have happened. |

|  | B) | It is computed as if convertible preferred stock has been converted. |

|  | C) | It represents a hypothetical case. |

|  | D) | All of the above are true about diluted earnings per share. |

|

|

|

| 4 |  |

Which of the following are requirements for the payment of a cash dividend? |

|  | A) | Adequate retained earnings to absorb the dividend without creating a deficit in retained earnings. |

|  | B) | Adequate cash on hand at the date of payment |

|  | C) | Approval by the stockholders |

|  | D) | Both (A) and (B). |

|

|

|

| 5 |  |

On July 1, Penryn Corporation has outstanding 150,000 shares of $10 par common stock with a market value of $24 per share. On this date, the company declares a 12% stock dividend, distributable on August 15 to stockholders of record on July 20. The entry on July 1 would include which of the following? |

|  | A) | A debit to Retained Earnings for $180,000. |

|  | B) | A credit to Stock Dividend to be Distributed, $180,000. |

|  | C) | A credit to Additional Paid-in Capital Stock Dividends, $252,000. |

|  | D) | Both (B) and (C). |

|

|

|

| 6 |  |

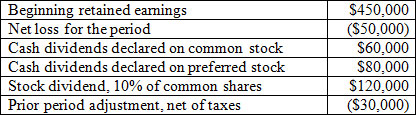

Consider the following information:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH12_Q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (33.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH12_Q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (33.0K)</a>

What is the ending balance of retained earnings in a Statement of Retained Earnings prepared from the information above? |

|  | A) | $170,000 |

|  | B) | $110,000 |

|  | C) | $140,000 |

|  | D) | $230,000 |

|

|

|

| 7 |  |

Prior period adjustments occur as a result of which of the following? |

|  | A) | Extraordinary gains or losses |

|  | B) | Discontinued operations |

|  | C) | Material errors in the reporting of income in a prior period |

|  | D) | Issuing large stock dividends after declaring a cash dividend |

|

|

|

| 8 |  |

Which of the following changes in financial position, as identified by the FASB, should be recorded but should not enter into the determination of net income? |

|  | A) | Events that are recognized but not realized. |

|  | B) | Events that are recognized and realized. |

|  | C) | Events that are realized but not recognized. |

|  | D) | Events that are not realized or recognized. |

|

|

|

| 9 |  |

A company reported the following events and transactions during a year:- Beginning balance of total stockholders' equity was $4,500,000.

- Recognized prior period adjustment (gain), net of $10,000 income taxes, of $50,000.

- Issued 100,000 shares of $5 par value common stock at $25 per share.

- Distributed a 10% stock dividend on common stock of 1,500 shares when the market value was $30 per share.

- Reported net income for the year of $900,000.

- Paid total cash dividends on common stock, $400,000.

- Paid total cash dividends on preferred stock, $200,000.

Assume the beginning balance in the Retained Earnings account was $925,000, calculate the ending balance of Retained Earnings. |

|  | A) | $3,730,000 |

|  | B) | $1,230,000 |

|  | C) | $1,275,000 |

|  | D) | $1,180,000 |

|

|

|

| 10 |  |

Which of the following is true regarding marketing and sales personnel of customers who falsely confirm to the external auditors of the seller that they owe amounts that are in fact not owed? |

|  | A) | Such behavior is not considered a crime. |

|  | B) | The customer's representatives cannot be prosecuted for giving false confirmations. |

|  | C) | The U.S. Department of Justice is more likely to prosecute individuals for this behavior than it has in the past. |

|  | D) | Such behavior is expected and accepted. |

|

|