|

| 1 |  |

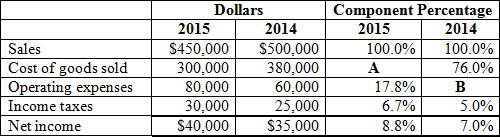

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (37.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (37.0K)</a>

Calculate the component percentages of (A) and (B). |

|  | A) | 66.7% and 13.0%, respectively |

|  | B) | 66.7% and 12.0%, respectively |

|  | C) | 84.4% and 12.0%, respectively |

|  | D) | 66.7% and 16.0%, respectively |

|

|

|

| 2 |  |

The quality of earnings can be affected by which of the following? |

|  | A) | The condition and liquidity of assets |

|  | B) | The accounting principles and methods selected by management |

|  | C) | Profitability versus ability to pay obligations |

|  | D) | All of the above |

|

|

|

| 3 |  |

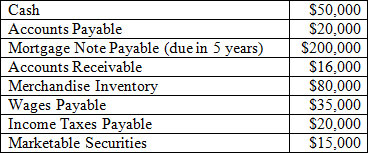

Consider the following account balances presented in no particular order:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (32.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q3.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (32.0K)</a>

Calculate the working capital. |

|  | A) | $86,000 |

|  | B) | $66,000 |

|  | C) | $6,000 |

|  | D) | ($114,000) |

|

|

|

| 4 |  |

Working capital was $42,000. The company subsequently collected an account receivable previously written off against the Allowance for Doubtful Accounts account. |

|  | A) | Assuming no other transactions occurred, the current ratio: |

|  | B) | remained unchanged. |

|  | C) | increased. |

|  | D) | became less than 1 to 1. |

|

|

|

| 5 |  |

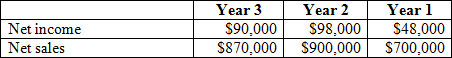

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (15.0K)</a>

Which of the following statements is false? |

|  | A) | The percentage of net sales increased between Year 1 and Year 2. |

|  | B) | The percentage of net income to net sales was 10.0% in Year 2. |

|  | C) | The percentage of net income to net sales was 10.3% in Year 3. |

|  | D) | Both (A) and (C) are false. |

|

|

|

| 6 |  |

Which of the following would most likely remain relatively constant on a year-to-year basis? |

|  | A) | Net sales |

|  | B) | Selling expenses |

|  | C) | General and administrative expenses |

|  | D) | Operating income |

|

|

|

| 7 |  |

The price-earnings (P/E) ratio is 5. The earnings per share over the last twelve months was $5.20. Common stock has a par value of $1 per share and was issued at $9 per share. What is the current market price of the stock? |

|  | A) | $46.80 |

|  | B) | $45.00 |

|  | C) | $5.00 |

|  | D) | $26.00 |

|

|

|

| 8 |  |

Which of the following is of particular interest to stockholders? |

|  | A) | Interest coverage ratio |

|  | B) | Price earnings ratio |

|  | C) | Operating cycle |

|  | D) | Working capital |

|

|

|

| 9 |  |

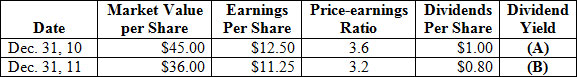

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH14_Q9.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

Calculate the values of (A) and (B). |

|  | A) | 27.8% and 31.3%, respectively |

|  | B) | 2.2% and 2.2%, respectively |

|  | C) | 8.0% and 7.1 %, respectively |

|  | D) | 3.6% and 2.6%, respectively |

|

|

|

| 10 |  |

Which of the following is not a measure of short-term liquidity? |

|  | A) | Quick ratio |

|  | B) | Free cash flow |

|  | C) | Working capital |

|  | D) | Operating income |

|

|