|

| 1 |  |

What are the methods and techniques used by enterprises to track resources in creating and delivering products and services to customers called? |

|  | A) | Cost systems |

|  | B) | Cost accounting systems |

|  | C) | Cost control systems |

|  | D) | Overhead accounting |

|

|

|

| 2 |  |

Which of the following business is least likely to use job order costing? |

|  | A) | Automobile manufacturer |

|  | B) | House paint manufacturer |

|  | C) | Automotive repair shop |

|  | D) | Oil refiner |

|

|

|

| 3 |  |

How is the overhead application rate computed? |

|  | A) | Estimated Overhead Costs/Estimated Units in the Activity Base |

|  | B) | Actual Overhead Costs/Estimated Units in the Activity Base |

|  | C) | Actual Overhead Costs/Actual Units in the Activity Base |

|  | D) | Estimated Overhead Costs/Actual Units in the Activity Base |

|

|

|

| 4 |  |

What is the major criterion for an activity base to be a cost driver? |

|  | A) | It must be material in amount |

|  | B) | It must be totally consumed within the accounting period. |

|  | C) | It must have a definitive causal factor in the incurrence of overhead costs |

|  | D) | It must be related to direct labor or direct labor hours |

|

|

|

| 5 |  |

When is the overhead application rate determined? |

|  | A) | After actual overhead costs are recorded. |

|  | B) | After paid and incurred overhead costs are recorded. |

|  | C) | At the beginning of the period before actual overhead costs are determined. |

|  | D) | On a day-to-day basis. |

|

|

|

| 6 |  |

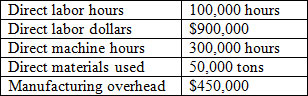

Consider the following estimations:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

Using the formula for computing the overhead application rate, determine which of the following rates is incorrect? |

|  | A) | Based on direct labor hours, $4.50 per direct-labor hour. |

|  | B) | Based on labor dollars, 200% of direct labor dollars. |

|  | C) | Based on materials used, $9 per ton. |

|  | D) | Based on machine hours, $1.50 per machine hour. |

|

|

|

| 7 |  |

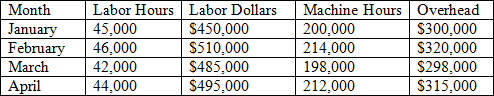

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (31.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (31.0K)</a>

Using the first four months of operation, which activity (labor hours, labor dollars, or machine hours) is the most appropriate for computing an overhead application rate? |

|  | A) | Labor hours |

|  | B) | Labor dollars |

|  | C) | Machine hours |

|  | D) | None of the above |

|

|

|

| 8 |  |

The typical job cost sheet used in a job order costing system is used to accumulate which of the following for each particular job? |

|  | A) | Direct labor |

|  | B) | Direct materials |

|  | C) | Manufacturing overhead applied |

|  | D) | All of the above |

|

|

|

| 9 |  |

Issuing a materials requisition results in which of the following journal entries? |

|  | A) | A debit to Work in Process Inventory and a credit to Materials Inventory. |

|  | B) | A debit to Materials Inventory and a credit to Work in Process Inventory. |

|  | C) | A debit to Materials Inventory and a credit to Accounts Payable. |

|  | D) | A debit to Manufacturing Overhead and a credit to Materials Inventory. |

|

|

|

| 10 |  |

Time cards show total direct labor of $50,000. Payroll records show factory salaries at $12,000 and factory maintenance salaries at $6,000. Making the month-end entry to record labor to the Work in Process Inventory account will require a debit for which amount? |

|  | A) | $67,000 |

|  | B) | $56,000 |

|  | C) | $62,000 |

|  | D) | $50,000 |

|

|

|

| 11 |  |

The Manufacturing Overhead account has total debits of $320,000. Direct labor hours for the month were 12,000. At the end of the month, the Manufacturing Overhead account has an underapplied balance of $8,000. What was the overhead application rate, based on direct labor hours? |

|  | A) | $27.33 |

|  | B) | $26.00 |

|  | C) | $26.66 |

|  | D) | $25.00 |

|

|

|

| 12 |  |

The Direct Labor account was debited for $234,500 during the period and credited for $123,000 and $120,000 during the period. Which of the following is true? |

|  | A) | There was an error made in recording the direct material for the period. |

|  | B) | The balance of the Direct Labor account is reported as a prepaid expense in the balance sheet. |

|  | C) | The balance of the Direct Labor account is transferred to the Manufacturing Overhead account. |

|  | D) | The balance of the Direct Labor account is reported in the balance sheet as an accrued liability. |

|

|

|

| 13 |  |

Year-end balances of selected accounts:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a>

The overapplied balance in the Manufacturing Overhead account is considered to be a material dollar amount. Material amounts of overapplied Manufacturing Overhead are apportioned among the Work in Process, Finished Goods, and Cost of Goods Sold accounts. How much of the overapplied balance should be apportioned (credited) to the Finished Goods Inventory account? |

|  | A) | 2.5% |

|  | B) | 5.6% |

|  | C) | 4.8% |

|  | D) | 2.9% |

|

|

|

| 14 |  |

Which of the following accounts is not a control account in a job order costing system? |

|  | A) | Finished Goods Inventory |

|  | B) | Materials Inventory |

|  | C) | Work in Process Inventory |

|  | D) | Direct Labor |

|

|

|

| 15 |  |

By accident, coffee was spilled on the job cost sheet for Job D-987, smearing parts of the card. The only legible amounts were (1) 5,000 hours of direct labor at a cost of $50,000, and (2) cost of finished goods manufactured of $160,000. You know that the overhead application rate is 150% of direct labor cost. Calculate the manufacturing overhead applied and the cost of direct materials. |

|  | A) | $33,333 and $76,667, respectively |

|  | B) | $75,000 and $35,000, respectively |

|  | C) | $75,000 and $25,000, respectively |

|  | D) | $56,600 and $53,400, respectively |

|

|

|

| 16 |  |

Total debits made to the Work in Process Inventory account were $240,000. Total credits made to the Work in Process Inventory account were $200,000. The only unfinished job is Job C-341, which has been charged with $15,000 for direct materials and $10,000 for direct labor. What is the overhead application rate, assuming it is based on direct labor costs? |

|  | A) | Cannot be calculated from the information provided |

|  | B) | 100% |

|  | C) | 200% |

|  | D) | 150% |

|

|

|

| 17 |  |

Transfers from the Work in Process Inventory account included the transfers of Job A and Job B for $34,000 and $42,000, respectively. Job A consisted of 50 units of oak tables and Job B consisted of 2,000 units of oak chairs. Twenty units of the oak tables and 80 units of the oak chairs were sold at a price of 150% of cost. The journal entries to record the sale would include which of the following? |

|  | A) | A debit to Accounts Receivable for $10,817 |

|  | B) | A credit to Finished Goods for $15,280 |

|  | C) | A credit to Finished Goods Inventory for $76,000 |

|  | D) | A debit to Cost of Goods Sold for $76,000 |

|

|

|

| 18 |  |

Which of the following is true about Activity-Based Costing (ABC)? |

|  | A) | It is used primarily where a single product is manufactured. |

|  | B) | It uses many activity bases or cost drivers. |

|  | C) | It is an overhead allocation method that uses a single overhead rate. |

|  | D) | It is of little use in pricing products. |

|

|

|

| 19 |  |

Stage One of an activity-based costing (ABC) system involves which of the following? |

|  | A) | Computing the overhead application rate. |

|  | B) | Allocating cost pools to products. |

|  | C) | Identifying activity cost pools. |

|  | D) | Determining unit costs. |

|

|

|

| 20 |  |

Stage Two of an activity-based costing (ABC) system involves which of the following? |

|  | A) | Identifying cost drivers. |

|  | B) | Allocating cost pools to products. |

|  | C) | Determining per-unit costs |

|  | D) | All of the above |

|

|

|

| 21 |  |

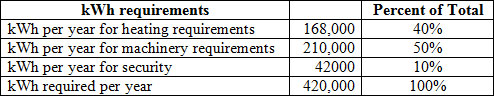

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q21.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q21.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

The total costs for electricity is $94,000. What was the amount of the electricity costs assigned to the machinery cost pool? |

|  | A) | $37,600 |

|  | B) | $56,400 |

|  | C) | $47,000 |

|  | D) | $25,200 |

|

|

|

| 22 |  |

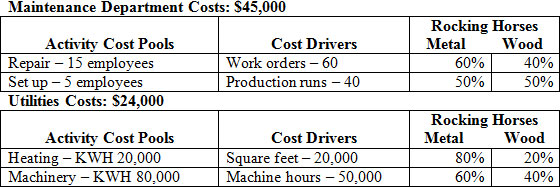

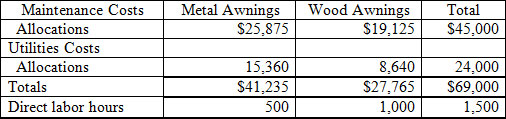

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (52.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (52.0K)</a>

The firm manufactures metal and wood rocking horses. Maintenance costs are allocated to the cost pools on the basis of employees. Utilities costs are allocated to the cost pools on the basis of KWH. Calculate the total amount of maintenance and utility cost allocated to the metal rocking horses? |

|  | A) | $33,750 |

|  | B) | $41,235 |

|  | C) | $29,715 |

|  | D) | $35,610 |

|

|

|

| 23 |  |

In an ABC system, after the allocation of cost pools to products, what will be the condition of the manufacturing overhead account? |

|  | A) | It may be underapplied |

|  | B) | It may be overapplied |

|  | C) | It will be zero |

|  | D) | It may be underapplied or overapplied |

|

|

|

| 24 |  |

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q24.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH17_Q24.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

There were 2,000 metal awnings produced and sold and 3,000 wood awnings produced and sold. What is the difference in the per-unit cost of overhead for metal awnings under the ABC calculations shown in the schedule above and allocating overhead costs to the metal awnings on the basis of direct labor hours? |

|  | A) | $4.38 less per unit |

|  | B) | $2.38 more per unit |

|  | C) | $3.00 less per unit |

|  | D) | $1.62 more per unit |

|

|