|

| 1 |  |

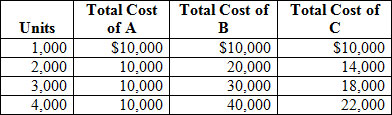

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH20_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH20_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a>

Which of the following is true about the each of the costs? |

|  | A) | Cost A is a fixed cost. |

|  | B) | Cost B is a variable cost. |

|  | C) | Cost C is a variable cost. |

|  | D) | Only A and B are true. |

|

|

|

| 2 |  |

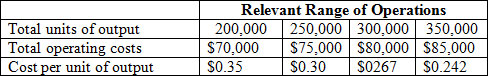

Consider the following schedule:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH20_Q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH20_Q2.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

What is the most likely cause of the decrease in the per-unit cost of output? |

|  | A) | Fixed costs remain constant over the relevant range. |

|  | B) | The fixed cost per unit is decreasing proportionately with increases in volume. |

|  | C) | The variable cost per unit is remaining relatively constant. |

|  | D) | All of the above. |

|

|

|

| 3 |  |

The term economies of scale refers to the savings accruing from which of the following? |

|  | A) | Reducing variable costs through large scale purchases |

|  | B) | Reducing unit costs through greater utilization of plant during the accounting period |

|  | C) | Reducing the volume of output |

|  | D) | Increasing contribution margin |

|

|

|

| 4 |  |

At the point at which the total revenue line intersects the total cost line in a graphic presentation of the break-even point, the area beyond this intersection and within the boundaries of the total revenue line and total cost line is which of the following? |

|  | A) | Profit area |

|  | B) | Net income |

|  | C) | Operating income |

|  | D) | Variable costs |

|

|

|

| 5 |  |

The selling price of Product A is $15. The variable costs to manufacture and sell the product are $6. What is the contribution margin ratio? |

|  | A) | 60% |

|  | B) | 40% |

|  | C) | 35% |

|  | D) | 50% |

|

|

|

| 6 |  |

Target operating income is $450,000 and fixed costs are $60,000. The sales price per unit is $15, with a contribution margin of 40%. What sales unit volume is required to achieve the target operating income? |

|  | A) | 100,000 units |

|  | B) | 85,000 units |

|  | C) | 30,000 units |

|  | D) | 34,000 units |

|

|

|

| 7 |  |

Product A sells for $24 and has a contribution margin ratio of 25%. Sales are expected to decline by 10,000 units over the next accounting period. What will be the net change in operating income? |

|  | A) | $240,000 |

|  | B) | $250,000 |

|  | C) | $25,000 |

|  | D) | $60,000 |

|

|

|

| 8 |  |

The Salmon Company currently sells its product for $15 a unit. The variable cost per unit is $8. Fixed costs are $59,500. Salmon has initiated a contract with its materials supplier that will reduce direct materials $1 per unit. To the nearest unit, how many fewer units will Salmon have to sell to achieve the break-even point? |

|  | A) | 1,000 fewer units |

|  | B) | 827 fewer units |

|  | C) | 1,062 fewer units |

|  | D) | 1,417 fewer units |

|

|

|

| 9 |  |

Rock-a-Way Gravel purchases raw gravel in 20-ton lots from which it manufactures 4 grades of gravel, which consists of its sales mix. The gravel grades are: 5 tons of Decorative Stone, 8 tons of Road Stone, 4 tons of Pea Gravel, and 3 tons of Construction Gravel. The contribution margin ratio on each product is, respectively, 50%, 40%, 60%, and 75%. What is the average contribution margin ratio for every 20 tons of gravel sold? |

|  | A) | 56.25% |

|  | B) | 51.75% |

|  | C) | 75.0% |

|  | D) | Greater than 75% |

|

|

|

| 10 |  |

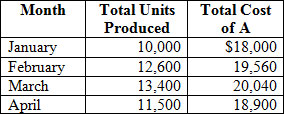

Consider the following, all within the relevant range:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH20_Q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH20_Q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (18.0K)</a>

Use the high-low method of analysis and calculate the variable cost component of total costs. |

|  | A) | $0.40 per unit |

|  | B) | $0.50 per unit |

|  | C) | $0.60 per unit |

|  | D) | $0.75 per unit |

|

|