|

| 1 |  |

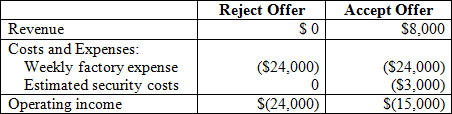

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q1.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (25.0K)</a>

What is the amount of the incremental revenue? |

|  | A) | $8,000 |

|  | B) | ($11,000) |

|  | C) | $3,000 |

|  | D) | $16,000 |

|

|

|

| 2 |  |

You are going to reduce your work week from 40 hours to 25 hours in order to take pilot training for helicopters. You hope this will lead to a job as a pilot of one of the helicopter tours that are flown in the Hawaiian Islands. The pilots of the tours can earn $1,000 to $3,000 a week. You are currently earning $15 an hour. What is your opportunity cost to complete the 8-week pilot training? |

|  | A) | $225 |

|  | B) | $2,225 |

|  | C) | $9,800 |

|  | D) | $1,800 |

|

|

|

| 3 |  |

Over the past two months you have spent the following amounts on your automobile: motor overhaul, $2,000, new tires, $400, body repair, $300, and brake work for $500. Shortly after completing the work you decide to purchase a new car. The best offer you have had on the refurbished car is a $1,500 trade-in toward the purchase of a new car. In making the decision to purchase the new car, which of the following is true? |

|  | A) | The $3,200 spent in the past two months is a sunk cost. |

|  | B) | The $1,500 trade-in is an opportunity cost. |

|  | C) | You will lose $1,700 ($3,200 - $1,500) on the purchase. |

|  | D) | The opportunity cost associated with the decision to purchase the new car is $1,700. |

|

|

|

| 4 |  |

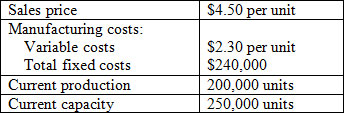

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q4.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

The manufacturer has received a special order for 50,000 units at $2.70 per unit. The special order will be sold in a foreign market under a different brand name and will not diminish domestic demand for the product. Which of the following is true regarding the special order? |

|  | A) | The special order should be rejected. |

|  | B) | The special order will increase gross profit by $20,000. |

|  | C) | The special order will increase gross profit by $135,000. |

|  | D) | The special order will increase gross profit by $110,000. |

|

|

|

| 5 |  |

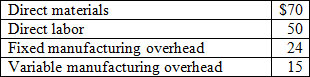

Unit product costs are:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q5.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (14.0K)</a>

The company has unused capacity. If it can add an extra material to its product, it can sell, on special order, 200 rolls. If the cost for the extra direct material is $2 and additional direct labor is $6, the company should do which of the following? |

|  | A) | Accept a bid in excess of $143. |

|  | B) | Accept a bid of $135 to $143. |

|  | C) | Accept a bid of $138. |

|  | D) | Reject a bid of $143. |

|

|

|

| 6 |  |

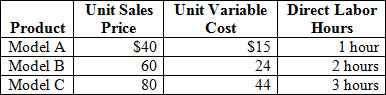

The Hip-Hop Toy Company makes three models of battery-powered model cars. The material cost is the same for each model. The difference in the models is primarily due to the amount of labor expended on detailing the models.

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q6.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a>

There is a labor constraint of 1,000 hours per month. There is no apparent demand of one model over another, and they are not complementary products. Which of the following is true? |

|  | A) | Model C should be manufactured, exclusively. |

|  | B) | Manufacturing should be divided evenly between models A and C. |

|  | C) | Model A should be manufactured, exclusively. |

|  | D) | Model C will generate total contribution margin of $44,000. |

|

|

|

| 7 |  |

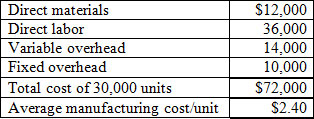

Costs to manufacture 30,000 units of a component of a product are:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q7.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (22.0K)</a>

Each unit can be purchased for $1.50 per unit, which will increase variable overhead costs by $1,000 and reduce fixed overhead costs by $2,000. Which of the following is true? |

|  | A) | The company should continue to manufacture the part. |

|  | B) | All of the costs are irrelevant costs. |

|  | C) | Only the variable overhead costs are relevant. |

|  | D) | The company should buy the part. |

|

|

|

| 8 |  |

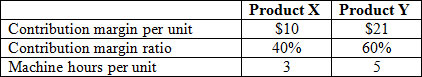

Consider the following:

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/007802577x/1036574/CH21_Q8.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a>

The firm has only 12,000 machine-hours available. Should demand for each product exceed the machine-hour capacity of the firm, the company should which of the following? |

|  | A) | Produce 1,500 units of Product X and 1,500 units of Product Y |

|  | B) | Produce 4,000 units of Product X |

|  | C) | Produce 2,400 units of Product Y |

|  | D) | Produce 2,000 units of Product X and 1,200 units of Product Y |

|

|

|

| 9 |  |

The selling price of Joint Product A is $14 per unit. The selling price of Joint Product B is $18 per unit. The joint costs at the split-off point are $12,000. Based on relative sales value, what is the amount of the joint costs allocated to Joint Product A? |

|  | A) | $6,750 |

|  | B) | $5,250 |

|  | C) | $6,000 |

|  | D) | $6,250 |

|

|

|

| 10 |  |

Which of the following statements is true? |

|  | A) | Decision making should rest entirely on financial information. |

|  | B) | Decision making should ignore nonfinancial factors. |

|  | C) | Opportunity costs seldom play a role in decision making. |

|  | D) | Decision making must take into account both quantitative and nonfinancial factors |

|

|