|

| 1 |  |

On January 1, 2016, Normal Plastics bought 15% of Model, Inc.'s common stock for $900,000. Model's net income for the years ended December 31, 2016, and December 31, 2017, were $600,000 and $1,500,000, respectively. During 2017, Model declared a dividend of $420,000. No dividends were declared in 2016. How much should Normal show on its 2017 income statement from this investment, assuming that it accounts for it as an available-for-sale investment? |

|  | A) | $0. |

|  | B) | $63,000. |

|  | C) | $288,000. |

|  | D) | $378,000. |

|

|

|

| 2 |  |

Fair value is used as the basis for valuation of a firm's investment securities when: |

|  | A) | Management's intention is to dispose of the securities within one year. |

|  | B) | The market value is less than cost for each equity security in the portfolio. |

|  | C) | The investment security is not classified as held-to-maturity. |

|  | D) | The investment security is classified as held-to-maturity. |

|

|

|

| 3 |  |

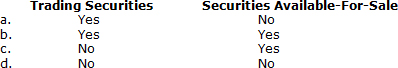

Unrealized holding gains and losses are included in an investor's earnings for: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter12_q03.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter12_q03.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (20.0K)</a>

|

|  | A) | a |

|  | B) | b |

|  | C) | c |

|  | D) | d |

|

|

|

| 4 |  |

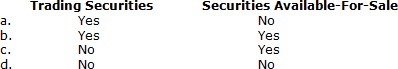

Investment securities are reported on a balance sheet at fair value for: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter12_q04.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter12_q04.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (21.0K)</a>

|

|  | A) | a |

|  | B) | b |

|  | C) | c |

|  | D) | d |

|

|

|

| 5 |  |

Which of the following statements is untrue regarding investments in equity securities? |

|  | A) | If the investor owns less than 20 percent of outstanding voting common stock, the equity method usually is not used. |

|  | B) | If the investor owns more than 50 percent of the outstanding voting common stock, the financial statements are consolidated. |

|  | C) | If the investor owns 20-50 percent of the outstanding voting common stock, the equity method always is required. |

|  | D) | If the investor owns less than 20 percent of outstanding voting common stock, the securities generally are reported at their fair value. |

|

|

|

| 6 |  |

Unrealized holding gains and losses for securities to be held-to-maturity are: |

|  | A) | Reported as a separate component of the shareholders' equity section of the balance sheet. |

|  | B) | Included in the determination of income from operations in the period of the change. |

|  | C) | Reported as extraordinary items. |

|  | D) | Not reported in the income statement nor the balance sheet. |

|

|

|

| 7 |  |

Unrealized holding gains and losses for securities available-for-sale are: |

|  | A) | Reported as a separate component of the shareholders' equity section of the balance sheet. |

|  | B) | Included in the determination of income from operations in the period of the change. |

|  | C) | Reported as extraordinary items. |

|  | D) | Not reported in the income statement nor the balance sheet. |

|

|

|

| 8 |  |

Unrealized holding gains and losses for trading securities are: |

|  | A) | Reported as a separate component of the shareholders' equity section of the balance sheet. |

|  | B) | Included in the determination of income from operations in the period of the change. |

|  | C) | Reported as extraordinary items. |

|  | D) | Not reported in the income statement nor the balance sheet. |

|

|

|

| 9 |  |

On January 12, Henderson Corporation purchased 4 million shares of Honeycutt Corporation common stock for $73 million and classified the securities as available-for-sale. At the close of the same year, the fair value of the securities is $81 million. Henderson Corporation should report: |

|  | A) | A gain of $8 million on the income statement. |

|  | B) | An increase in shareholders' equity of $8 million. |

|  | C) | An investment of $73 million. |

|  | D) | None of the above. |

|

|

|

| 10 |  |

Evans Company owns 4.5 million shares of stock of Frazier Company classified as available-for-sale. During 2016, the fair value of those shares increased by $9 million. What effect did this increase have on Evans' 2016 financial statements? |

|  | A) | Net assets increased. |

|  | B) | Total assets decreased. |

|  | C) | Net income increased. |

|  | D) | Shareholders' equity decreased. |

|

|

|

| 11 |  |

Level Company owns bonds of Leader Company classified as held-to-maturity. During 2016, the fair value of those bonds increased by $4 million. Interest was received of $3 million. What effect did the investment have on Level's 2016 financial statements? |

|  | A) | Total assets increased by $7 million. |

|  | B) | Total assets increased by $3 million. |

|  | C) | Net income increased by $7 million. |

|  | D) | Shareholders' equity increased by $4 million. |

|

|

|

| 12 |  |

If the investment described in the previous question had been classified as available-for-sale, what effect would the investment have on Level's 2016 financial statements? |

|  | A) | Total assets increased by $7 million. |

|  | B) | Total assets increased by $3 million. |

|  | C) | Net income increased by $7 million. |

|  | D) | Shareholders' equity increased by $1 million. |

|

|

|

| 13 |  |

On January 2, 2016, Garner, Inc. bought 10% of the outstanding common stock of Moody, Inc. for $60 million cash, and accounts for the investment using the cost method because fair value is not readily determinable. At the date of acquisition of the stock, Moody's net assets had a book value and fair value of $180 million. Moody's net income for the year ended December 31, 2016, was $30 million. During 2016, Moody declared and paid cash dividends of $6 million. On December 31, 2016, Garner's investment should be reported at: |

|  | A) | $60.0 million. |

|  | B) | $66.9 million. |

|  | C) | $69.0 million. |

|  | D) | $71.1 million. |

|

|

|

| 14 |  |

An OTT impairment for an equity investment is recognized if fair value declines below amortized cost and |

|  | A) | The company has incurred non-credit losses. |

|  | B) | The company does not have the intent and ability to hold the investment until fair value recovers. |

|  | C) | The company has incurred credit losses. |

|  | D) | None of the above. |

|

|

|

| 15 |  |

Under IFRS No. 9, equity investments can be classified as: |

|  | A) | Fair Value through Profit & Loss |

|  | B) | Held to Maturity |

|  | C) | Amortized Cost |

|  | D) | Available for Sale |

|

|

|

| 16 |  |

On January 2, 2016, Garner, Inc. bought 30% of the outstanding common stock of Moody, Inc. for $60 million cash. At the date of acquisition of the stock, Moody's net assets had a book value and fair value of $180 million. Moody's net income for the year ended December 31, 2016, was $30 million. During 2016, Moody declared and paid cash dividends of $6 million. On December 31, 2016, Garner's investment account should be reported at: |

|  | A) | $60.0 million. |

|  | B) | $67.2 million. |

|  | C) | $69.0 million. |

|  | D) | $71.1 million. |

|

|

|

| 17 |  |

The equity method is used when an investor can't control, but can exercise significant influence over the operating and financial policies of the investee. We presume, in the absence of evidence to the contrary, that this is so if: |

|  | A) | The investor classifies the investment as available-for-sale. |

|  | B) | The investor classifies the investment as held-to-maturity. |

|  | C) | The investor owns between 51% or more of the investee's voting shares. |

|  | D) | The investor owns between 20% and 50% of the investee's voting shares. |

|

|

|

| 18 |  |

On January 2, 2016, Germane, Inc. bought 30% of the outstanding common stock of Quality, Inc. for $56 million cash. At the date of acquisition of the stock, Quality's net assets had a book value and fair value of $120 million. Quality's net income for the year ended December 31, 2016, was $30 million. During 2016, Quality declared and paid cash dividends of $10 million. On December 31, 2016, Germane's should report investment revenue of: |

|  | A) | $3 million. |

|  | B) | $6 million. |

|  | C) | $9 million. |

|  | D) | $30 million. |

|

|

|

| 19 |  |

When applying the equity method, an investor should report dividends from the investee as: |

|  | A) | Dividend revenue. |

|  | B) | An extraordinary item. |

|  | C) | A reduction in the investment account. |

|  | D) | An increase in the investment account. |

|

|

|

| 20 |  |

Western Manufacturing Company owns 40% of the outstanding common stock of Eastern Supply Company. During 2016, Western received a $50 million cash dividend from Eastern. What effect did this dividend have on Western's 2016 financial statements? |

|  | A) | Total liabilities increased. |

|  | B) | Total assets decreased. |

|  | C) | Net income increased. |

|  | D) | Total assets are unchanged. |

|

|

|

| 21 |  |

The accounting for unrealized holding gains and losses will be different if the fair value option is elected for all of the following types of investments except: |

|  | A) | Held-to-maturity. |

|  | B) | Trading security. |

|  | C) | Available-for-sale. |

|  | D) | Equity method. |

|

|

|

| 22 |  |

The fair value option described by SFAS No. 159 |

|  | A) | Must be elected when a security is purchased, and is irrevocable. |

|  | B) | Can be traded on exchanges, similar to other options. |

|  | C) | For debt is available only if anticipated to not be held to maturity. |

|  | D) | Is not available for equity investments. |

|

|

|

| 23 |  |

This question is deal with Appendix 12-B Credit losses are calculated as the difference between the amortized cost of debt and: |

|  | A) | Current cash flows multiplied by the expected future discount rate. |

|  | B) | Expected future cash flows multiplied by the expected future discount rate. |

|  | C) | Expected future cash flows multiplied by the effective interest rate that existed when the investment was acquired. |

|  | D) | Current cash flows multiplied by the effective interest rate that existed when the investment was acquired. |

|

|

|

| 24 |  |

This question is deal with Appendix 12-B Which of the following is NOT a reason why an investor might view a debt impairment as "other than temporary"? |

|  | A) | The investor intends to sell the investment. |

|  | B) | The investor believes it is "more likely than not" that the investor will be required to sell the investment prior to recovering the amortized cost of the investment less any credit losses arising in the current year. |

|  | C) | The investor determines that a credit loss exists on the investment. |

|  | D) | The investor believes it is "more likely than not" that there is a non-credit loss on the investment. |

|

|