|

| 1 |  |

Which of the following leases would least likely be classified as an operating lease by the lessee? |

|  | A) | The lease term is 5 years and the economic life of the leased asset is 8 years. |

|  | B) | Ownership of the leased asset reverts to the lessor at the end of the lease term. |

|  | C) | The agreement permits the lessee to buy the leased asset for one dollar at the end of the lease term. |

|  | D) | The fair value of the leased asset is $20 million and the present value of the lease payments is $13 million. |

|

|

|

| 2 |  |

Which of the following is not a sufficient criterion for a lessee to classify a lease as a capital lease? |

|  | A) | The lease transfers ownership of the leased asset to the lessee at the end of the lease term. |

|  | B) | The lessee has the option of acquiring the asset during or at the end of the lease term at a bargain price. |

|  | C) | The lease term is greater than two-thirds of the economic life of the asset. |

|  | D) | The present value of the minimum lease payments is at least 90% of the fair value of the leased asset. |

|

|

|

| 3 |  |

For a lessor to consider a leasing arrangement to be a capital lease, collectibility of the lease payments must be reasonably assured and: |

|  | A) | There must be no bargain purchase option. |

|  | B) | The lessee must be responsible for all executory costs over the term of the lease. |

|  | C) | The lease term must be 75% or more of the economic life of the asset. |

|  | D) | Any costs to the lessor yet to be incurred must be reasonably predictable. |

|

|

|

| 4 |  |

In an operating lease in which the asset's economic life and lease term are different: |

|  | A) | The lessee depreciates the leased asset over the term of the lease. |

|  | B) | The lessor depreciates the leased asset over its economic life. |

|  | C) | The lessee should record a leased asset and a related obligation at the present value of the lease payments. |

|  | D) | The lessee depreciates the asset over its economic life. |

|

|

|

| 5 |  |

If a capital lease contains a bargain purchase option, the lessee should depreciate the leased asset: |

|  | A) | Over the term of the lease. |

|  | B) | Without reference to the economic life of the asset. |

|  | C) | Over the economic life of the asset. |

|  | D) | Without reference to the term of the lease. |

|

|

|

| 6 |  |

A necessary condition for a sales-type lease is: |

|  | A) | Legal title to the asset transfers to the lessee. |

|  | B) | The present value of minimum lease payments exceeds the lessor's cost. |

|  | C) | The lessor earns interest revenue instead of dealer's profit. |

|  | D) | The lessor earns dealer's profit instead of interest revenue. |

|

|

|

| 7 |  |

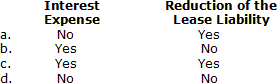

The inception of a six-year capital lease is December 31, 2016. The agreement specifies equal annual lease payments on December 31 of each year. For the lessee, the first payment on December 31, 2016, includes: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter15_q07.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter15_q07.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (19.0K)</a>

|

|  | A) | a |

|  | B) | b |

|  | C) | c |

|  | D) | d |

|

|

|

| 8 |  |

Universal Leasing Corp. leases farm equipment to its customers under direct-financing leases. Typically the equipment has no residual value at the end of leases and the contracts call for payments at the beginning of each year. Universal's target rate of return is 10%. On a five-year lease of equipment with a fair value of $485,100, Universal will earn interest revenue over the life of the lease of: |

|  | A) | $96,575 |

|  | B) | $114,900 |

|  | C) | $121,275 |

|  | D) | $194,040 |

|

|

|

| 9 |  |

In a ten-year capital lease, the portion of the annual lease payment in the lease's third year that represents interest is: |

|  | A) | The same as in the fourth year. |

|  | B) | The same as in the first year. |

|  | C) | Less than in the second year. |

|  | D) | dMore than in the second year. |

|

|

|

| 10 |  |

On January 1, 2016, Walter Scott Co. leased machinery under a 6-year lease. The machinery has a 9-year economic life. The present value of the monthly lease payments is determined to be 85% of the machinery's fair value. The lease contract includes neither a transfer of title to Scott nor a bargain purchase option. What amount should Scott report in its 2016 income statement? |

|  | A) | Depreciation expense equal to one-ninth of the equipment's fair value. |

|  | B) | Depreciation expense equal to one-sixth of the machinery's fair value. |

|  | C) | Rent expense equal to the 2016 lease payments. |

|  | D) | Rent expense equal to the 2016 lease payments minus interest. |

|

|

|

| 11 |  |

Pyramid Properties entered a lease that contains a bargain purchase option. When calculating the amount to capitalize as a leased asset at the inception of the lease term, the payment called for by the bargain purchase option should be: |

|  | A) | Subtracted at its exercise price. |

|  | B) | Subtracted at its present value. |

|  | C) | Added at its present value. |

|  | D) | Excluded from the calculation. |

|

|

|

| 12 |  |

Tucson Fruits leased farm equipment from Barr Machinery on July 1, 2016. The lease was recorded as a sales-type lease. The present value of the lease payments discounted at 10% was $40.5 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning July 1, 2016. Barr had purchased the equipment for $33 million. What amount of interest revenue from the lease should Barr report in its 2016 income statement? |

|  | A) | $2,025,000 |

|  | B) | $1,725,000 |

|  | C) | $1,650,000 |

|  | D) | $0 |

|

|

|

| 13 |  |

On January 1, 2016, Jackson Properties leased a warehouse to Jensen Distributors. The operating lease provided for a nonrefundable bonus paid by Jensen. Jackson should recognize the bonus in earnings: |

|  | A) | At the inception of the lease. |

|  | B) | When the bonus is received. |

|  | C) | Over the life of the lease. |

|  | D) | At the expiration of the lease. |

|

|

|

| 14 |  |

Grant Industries leased exercise equipment to Silver Gyms on July 1, 2016. Grant recorded the lease as a sales-type lease at $810,000, the present value of minimum lease payments discounted at 10%. The lease called for ten annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2016. Grant had manufactured the equipment at a cost of $750,000. The total increase in earnings (pretax) on Grant's 2016 income statement would be: |

|  | A) | $0 |

|  | B) | $93,000 |

|  | C) | $94,500 |

|  | D) | $100,500 |

|

|

|

| 15 |  |

Brown Properties entered into a sale-leaseback transaction. Brown retains the right to substantially all of the remaining use of the property. A gain resulting from the sale should be: |

|  | A) | Reported as part of the asset's cost. |

|  | B) | Offset against losses from similar transactions. |

|  | C) | Deferred at the time of the sale-leaseback and subsequently amortized. |

|  | D) | Recognized in earnings at the time of the sale-leaseback. |

|

|

|

| 16 |  |

A lease is a capital lease (called a finance lease under IFRS) if substantially all risks and rewards of ownership are transferred whether using US GAAP or IFRS. When making this determination, less judgment, more specificity is applied using |

|  | A) | U.S. GAAP. |

|  | B) | IFRS. |

|  | C) | Either U.S. GAAP or IFRS. |

|  | D) | Neither U.S. GAAP nor IFRS. |

|

|

|

| 17 |  |

When the leaseback in a sale-leaseback transaction is an operating lease, a company that prepares its financial statements using IFRS: |

|  | A) | immediately recognizes the gain on the sale. |

|  | B) | amortizes the gain over the lease term. |

|  | C) | recognizes the gain on the sale immediately only if the asset leased is land. |

|  | D) | does not record the gain. |

|

|

|

| 18 |  |

When recording a capital lease (called a finance lease under IFRS) Blue Company is aware that the implicit interest rate used by the Gray Company, the lessor, to calculate lease payments is 7%. Blue's incremental borrowing rate is 6%. Blue should record the leased asset and lease liability at the present value of the lease payments discounted at: |

|  | A) | 7% if using IFRS. |

|  | B) | 6% if using IFRS. |

|  | C) | 6% if using either U.S. GAAP or IFRS. |

|  | D) | 7% if using U.S. GAAP. |

|

|

|

| 19 |  |

Supplement

Respond to this question with the presumption that the guidance provided by the proposed Accounting Standards Update is being applied Which of the following would a lessee not record in connection with a lease? |

|  | A) | Lease revenue. |

|  | B) | Amortization expense. |

|  | C) | Interest expense. |

|  | D) | Right-of-use asset. |

|

|

|

| 20 |  |

Supplement

Respond to this question with the presumption that the guidance provided by the proposed Accounting Standards Update is being applied Which of the following would a lessor not record in connection with a lease? |

|  | A) | Lease revenue. |

|  | B) | Lease receivable. |

|  | C) | Interest revenue. |

|  | D) | Right-of-use asset. |

|

|

|

| 21 |  |

We classify a lease as a Type A lease if: |

|  | A) | the usual risks and rewards are retained by the lessor. |

|  | B) | the usual risks and rewards are transferred to the lessee. |

|  | C) | the present value of lease payments is less than the asset's book value. |

|  | D) | the present value of lease payments is less than the asset's fair value. |

|

|

|

| 22 |  |

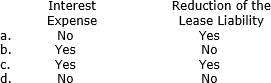

The beginning of a five-year lease is December 31, 2016. The agreement specifies equal annual lease payments on December 31 of each year. For the lessee, the first payment on December 31, 2016, includes: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter15_q22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter15_q22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (9.0K)</a>

|

|  | A) | a |

|  | B) | b |

|  | C) | c |

|  | D) | d |

|

|

|

| 23 |  |

Geron Co. recorded a right-of-use asset of $400,000 in a ten-year Type A lease. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset after two years will be: |

|  | A) | $324,000. |

|  | B) | $320,000. |

|  | C) | $440,000. |

|  | D) | $484,000. |

|

|

|

| 24 |  |

On January 1, 2016, Geron Co. recorded a right-of-use asset of $135,180 in a Type A lease. The lease calls for ten annual payments of $20,000 at the beginning of each year. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset at December 31, 2016, will be: |

|  | A) | $115,180. |

|  | B) | $121,662. |

|  | C) | $126,698. |

|  | D) | $135,180. |

|

|

|

| 25 |  |

On January 1, 2016, Geron Co. recorded a right-of-use asset of $135,180 in a Type B lease. The lease calls for ten annual payments of $20,000 at the beginning of each year. The interest rate charged the lessor was 10%. The balance in the right-of-use asset at December 31, 2016, will be: |

|  | A) | $115,180. |

|  | B) | $121,662. |

|  | C) | $126,698. |

|  | D) | $135,180. |

|

|

|

| 26 |  |

Nichols Fruits leased farm equipment from King Machinery on January 1, 2016. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2016. King had constructed the equipment recently for $33 million. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. What amount of interest revenue from the lease should King report in its 2016 income statement? |

|  | A) | $4,000,000. |

|  | B) | $3,750,000. |

|  | C) | $3,400,000. |

|  | D) | $0. |

|

|

|

| 27 |  |

Nichols Fruits leased farm equipment from King Machinery on January 1, 2016. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2016. King had constructed the equipment recently for $33 million. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. What amount did King record as a lease receivable? |

|  | A) | $6 million. |

|  | B) | $17 million. |

|  | C) | $33 million. |

|  | D) | $40 million. |

|

|

|

| 28 |  |

Nichols Fruits leased farm equipment from King Machinery on January 1, 2016. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2016. King had constructed the equipment recently for $33 million. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. What amount of profit did King record at the beginning of the lease? |

|  | A) | $6 million. |

|  | B) | $17 million. |

|  | C) | $33 million. |

|  | D) | $50 million. |

|

|

|

| 29 |  |

Nichols Fruits leased farm equipment from King Machinery on January 1, 2016. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2016. King had constructed the equipment recently for $33 million. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. The total increase in earnings (pretax) in King's 2016 income statement would be: |

|  | A) | $3.4 million. |

|  | B) | $6.0 million. |

|  | C) | $17.0 million. |

|  | D) | $20.4 million. |

|

|

|

| 30 |  |

Nichols Fruits leased farm equipment from King Machinery on January 1, 2016. The present value of the lease payments discounted at 10% was $40 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning January 1, 2016. King had constructed the equipment recently for $33 million. The total decrease in earnings (pretax) in Nichols' 2016 income statement would be: |

|  | A) | $3,400,000. |

|  | B) | $4,000,000. |

|  | C) | $6,066,667. |

|  | D) | $7,400,000. |

|

|

|

| 31 |  |

Crawford Industries leased exercise equipment to Woodson Gyms on July 1, 2016. Crawford recorded the lease receivable at $810,000, the present value of lease payments discounted at 10% and fair value of the equipment. The lease called for ten annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2016. Crawford had manufactured the equipment at a cost of $750,000. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. The total increase in earnings (pretax) on Crawford's 2016 income statement would be: |

|  | A) | $81,000. |

|  | B) | $94,500. |

|  | C) | $100,500. |

|  | D) | $120,000. |

|

|