|

| 1 |  |

In an employer-sponsored defined benefit pension plan, the interest cost included in the pension expense represents: |

|  | A) | The effective discount rate times the unamortized balance of prior service costs. |

|  | B) | The increase in the projected benefit obligation due to the passage of time. |

|  | C) | The increase in the fair value of plan assets due to the passage of time. |

|  | D) | The difference between the actual and expected returns on plan assets. |

|

|

|

| 2 |  |

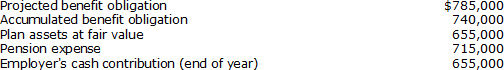

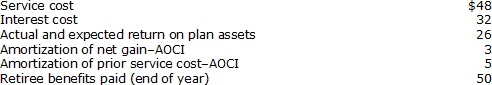

Van Nuen Inc. began a defined-benefit pension plan for its employees on January 1, 2016. The following data are provided for 2016, as of December 31, 2016: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q02.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (38.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q02.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (38.0K)</a>

What amount should Van Nuen report as its net pension liability at December 31, 2016? |

|  | A) | $45,000 |

|  | B) | $85,000 |

|  | C) | $130,000 |

|  | D) | $0 |

|

|

|

| 3 |  |

Dividends from stock investments by a pension plan are reported by the employer as: |

|  | A) | Investment revenue on an accrual basis. |

|  | B) | Investment revenue on a cash basis. |

|  | C) | A reduction of the periodic pension expense. |

|  | D) | A reduction of the projected benefit obligation (PBO). |

|

|

|

| 4 |  |

The component of periodic pension expense that represents the present value of the increase in an employer's pension obligation to employees because of their services rendered during the current period is the: |

|  | A) | Current cost. |

|  | B) | Service cost. |

|  | C) | Accumulated benefit obligation (ABO). |

|  | D) | Projected benefit obligation (PBO). |

|

|

|

| 5 |  |

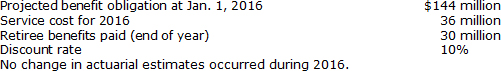

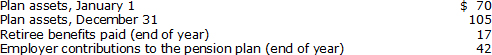

The Colorado Copper Company sponsors a defined benefit pension plan. The following information pertains to that plan: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q05.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (44.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q05.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (44.0K)</a>

What is CCC's projected benefit obligation at December 31, 2016? |

|  | A) | $164.4 million |

|  | B) | $158.4 million |

|  | C) | $150.0 million |

|  | D) | $128.4 million |

|

|

|

| 6 |  |

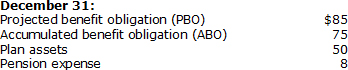

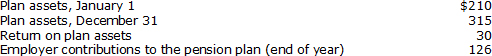

Panther Products sponsors a defined benefit pension plan. The following information pertains to that plan: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q06.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (47.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q06.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (47.0K)</a>

The pension expense that Panther should report in its 2016 income statement is: |

|  | A) | $510 million |

|  | B) | $540 million |

|  | C) | $630 million |

|  | D) | $750 million |

|

|

|

| 7 |  |

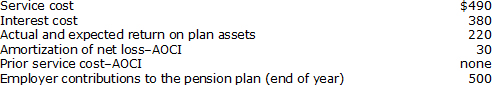

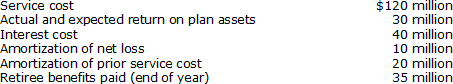

Information regarding the defined-benefit pension plan of Pauline Products included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q07.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (27.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q07.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (27.0K)</a>

No contributions were made to the pension plan assets during 2016. At December 31, 2016, what amount should Hall report as its net pension liability? |

|  | A) | $10 million |

|  | B) | $25 million |

|  | C) | $27 million |

|  | D) | $35 million |

|

|

|

| 8 |  |

Information regarding the defined benefit pension plan of Amber Beverages included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q08.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q08.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a>

Amber should report pension expense for 2016 in the amount of: |

|  | A) | $180 million |

|  | B) | $650 million |

|  | C) | $680 million |

|  | D) | $870 million |

|

|

|

| 9 |  |

Information regarding the defined benefit pension plan of Tri Cities Transport included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q09.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (40.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q09.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (40.0K)</a>

What is Tri Cities' pension expense for 2016? |

|  | A) | $56 million |

|  | B) | $62 million |

|  | C) | $98 million |

|  | D) | $164 million |

|

|

|

| 10 |  |

Information regarding the defined benefit pension plan of Certainty Services included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (31.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (31.0K)</a>

What was the actual return on plan assets for 2016? |

|  | A) | $10 million |

|  | B) | $24 million |

|  | C) | $35 million |

|  | D) | $60 million |

|

|

|

| 11 |  |

Information regarding the defined benefit pension plan of Neo Products included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (30.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q11.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (30.0K)</a>

What amount of retiree benefits was paid at the end of 2016? |

|  | A) | $21 million |

|  | B) | $51 million |

|  | C) | $72 million |

|  | D) | $105 million |

|

|

|

| 12 |  |

Information regarding the defined benefit pension plan of Melrose Products included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q12.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a>

What were the employer contributions to the pension plan at the end of 2016? |

|  | A) | $30 million |

|  | B) | $175 million |

|  | C) | $210 million |

|  | D) | $225 million |

|

|

|

| 13 |  |

Information regarding the defined benefit pension plan of Glavin Industries included the following for 2016 ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q13.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (43.0K)</a>

What was the amount of Glavin's plan assets at December 31, 2016? |

|  | A) | $156 million |

|  | B) | $207 million |

|  | C) | $216 million |

|  | D) | $516 million |

|

|

|

| 14 |  |

Accumulated other comprehensive income: |

|  | A) | is a liability. |

|  | B) | is a shareholders' equity account. |

|  | C) | is an asset. |

|  | D) | is reported in the income statement. |

|

|

|

| 15 |  |

A statement of comprehensive income does not include: |

|  | A) | return on plan assets. |

|  | B) | losses from the return on assets falling short of expectations. |

|  | C) | gains from changes in estimates regarding the PBO. |

|  | D) | net income. |

|

|

|

| 16 |  |

JL Health Services reported a net loss–AOCI in last year's balance sheet. This year, the company revised its estimate of future salary levels causing its PBO estimate to decline by $24. Also, the $48 million actual return on plan assets was less than the $54 million expected return. As a result: |

|  | A) | the statement of comprehensive income will report a $6 million gain and a $24 million loss. |

|  | B) | the net pension liability will increase by $18 million. |

|  | C) | accumulated other comprehensive income will increase by $18 million. |

|  | D) | the net pension liability will decrease by $24 million. |

|

|

|

| 17 |  |

On January 1, 2016, DeSoto Industries' accumulated postretirement benefit obligation was $75 million. Retiree benefits of $9 million were paid at the end of 2016. Service cost for 2016 is $21 million.Estimates and assumptions regarding future health care costs were revised in 2016, causing the actuary to revise downward the estimate of the APBO by $2 million. The actuary's discount rate is 8%. There were no other pertinent account balances at the end of 2016. What is the accumulated postretirement benefit obligation at December 31, 2016? |

|  | A) | $91 million |

|  | B) | $93 million |

|  | C) | $100 million |

|  | D) | $102 million |

|

|

|

| 18 |  |

On December 31, 2016, Staymore Inns' accumulated postretirement benefit obligation was $273 million. Retiree benefits of $27 million were paid at the end of 2016. Service cost for 2016 is $63 million.Estimates and assumptions regarding future health care costs were revised in 2016, causing the actuary to revise downward the estimate of the APBO by $6 million. The actuary's discount rate is 8%. There were no other significant accounts related to the plan at the end of 2016. What was the accumulated postretirement benefit obligation at January 1, 2016? |

|  | A) | $200 million |

|  | B) | $210 million |

|  | C) | $225 million |

|  | D) | $273 million |

|

|

|

| 19 |  |

On December 31, 2015, the expected postretirement benefit obligation was $300 million. The accumulated postretirement benefit obligation was $175 million. Service cost for 2016 was $60 million. The actuary's discount rate is 8%. What was the interest cost for 2016? |

|  | A) | $14.0 million |

|  | B) | $18.8 million |

|  | C) | $24.0 million |

|  | D) | $28.8 million |

|

|

|

| 20 |  |

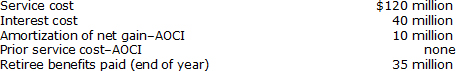

Imagine Publishers, Inc. sponsors a postretirement plan providing health care benefits. The following information relates to the current year's activity of Imagine's postretirement benefit plan: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q20.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (45.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q20.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (45.0K)</a>

What is Imagine's postretirement benefit expense? |

|  | A) | $140 million |

|  | B) | $150 million |

|  | C) | $160 million |

|  | D) | $185 million |

|

|

|

| 21 |  |

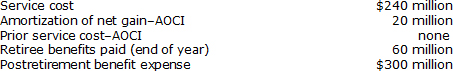

Expansion, Inc. sponsors an unfunded postretirement plan providing health care benefits. The following information relates to the current year's activity of Expansion's postretirement benefit plan: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q21.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (34.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q21.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (34.0K)</a>

What is Expansion's postretirement benefit expense? |

|  | A) | $115 million |

|  | B) | $150 million |

|  | C) | $160 million |

|  | D) | $170 million |

|

|

|

| 22 |  |

Starr Builders sponsors an unfunded postretirement plan providing health care benefits. The following information relates to the current year's activity of Starr's postretirement benefit plan: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (39.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter17_q22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (39.0K)</a>

What is Starr's interest cost for the year? |

|  | A) | $40 million |

|  | B) | $80 million |

|  | C) | $60 million |

|  | D) | $100 million |

|

|

|

| 23 |  |

Richmond Products, Inc. sponsors a postretirement plan providing health care benefits to employees who have completed at least 10 years service and are age 53 years or older at retirement. To date, the employees that have retired under the plan have an average age of 60. No employee has worked beyond age 65. Crystal Alicea was hired when she was 46 years old. The attribution period for accruing Richmond's expected postretirement health care benefit obligation to Alicea is during the period when Alicea is: |

|  | A) | 53 to 60 years old |

|  | B) | 53 to 65 years old |

|  | C) | 46 to 56 years old |

|  | D) | 46 to 65 years old |

|

|

|

| 24 |  |

Amortizing a net loss for pensions and other postretirement benefit plans will: |

|  | A) | increase retained earnings and increase accumulated other comprehensive income. |

|  | B) | decrease retained earnings and decrease accumulated other comprehensive income. |

|  | C) | increase retained earnings and decrease accumulated other comprehensive income. |

|  | D) | decrease retained earnings and increase accumulated other comprehensive income. |

|

|

|

| 25 |  |

Actuarial gains and losses are reported as OCI as they occur using |

|  | A) | IFRS. |

|  | B) | US GAAP. |

|  | C) | Both U.S. GAAP and IFRS. |

|  | D) | Neither U.S. GAAP and IFRS. |

|

|

|

| 26 |  |

Prior service cost is included among OCI items in the statement of comprehensive income and thus subsequently becomes part of AOCI where it is amortized over the average remaining service period using |

|  | A) | IFRS. |

|  | B) | U.S. GAAP. |

|  | C) | Either U.S. GAAP and IFRS. |

|  | D) | Neither U.S. GAAP and IFRS. |

|

|