|

| 1 |  |

Cash equivalents have each of the following characteristics except: |

|  | A) | Short-term. |

|  | B) | Highly liquid. |

|  | C) | Maturity of at least 3 months. |

|  | D) | Little risk of loss. |

|

|

|

| 2 |  |

Which of the following statements is untrue regarding the statement of cash flows? |

|  | A) | The statement of cash flows presents information about cash flows that the other statements either (a) do not provide or (b) provide only indirectly. |

|  | B) | Noncash transactions sometimes are reported also. |

|  | C) | Either the direct or the indirect method can be used to calculate and present the net cash increase or decrease from operating activities. |

|  | D) | The indirect method derives cash flows indirectly by starting with sales revenue and "working backwards" to convert that amount to a cash basis. |

|

|

|

| 3 |  |

Stock dividends are reported in connection with a statement of cash flows as: |

|  | A) | A financing activity. |

|  | B) | An investing activity. |

|  | C) | A noncash activity. |

|  | D) | Not reported on the statement of cash flows. |

|

|

|

| 4 |  |

Property dividends are reported in connection with a statement of cash flows as: |

|  | A) | A financing activity. |

|  | B) | An investing activity. |

|  | C) | A noncash activity. |

|  | D) | Not reported on the statement of cash flows. |

|

|

|

| 5 |  |

Interest paid to bondholders is reported in connection with a statement of cash flows as: |

|  | A) | An operating activity. |

|  | B) | An investing activity. |

|  | C) | A noncash activity. |

|  | D) | A financing activity. |

|

|

|

| 6 |  |

Investment revenue is reported in connection with a statement of cash flows as: |

|  | A) | An operating activity. |

|  | B) | An investing activity. |

|  | C) | A noncash activity. |

|  | D) | A financing activity. |

|

|

|

| 7 |  |

On January 4, Childers Corporation issued $200 million of bonds for $193 million. During the same year, $500,000 of the bond discount was amortized. On a statement of cash flows prepared by the indirect method, Childers Corporation should report: |

|  | A) | A financing activity of $200 million. |

|  | B) | An addition to net income of $500,000. |

|  | C) | An investing activity of $193 million. |

|  | D) | A deduction from net income of $500,000. |

|

|

|

| 8 |  |

Sun Company owns 14.5 million shares of stock of Center Company classified as available for sale. During 2016, the fair value of those shares increased by $19 million. What effect did this increase have on Sun's 2016 statement of cash flows? |

|  | A) | Cash from operating activities increased. |

|  | B) | Cash from investing activities increased. |

|  | C) | Cash from financing activities increased. |

|  | D) | No effect. |

|

|

|

| 9 |  |

Eastern Manufacturing Company owns 40% of the outstanding common stock of Southern Supply Company. During 2016, Eastern received a $50 million cash dividend from Southern. What effect did this dividend have on Eastern's 2016 statement of cash flows? |

|  | A) | Cash from operating activities increased. |

|  | B) | Cash from investing activities increased. |

|  | C) | Cash from financing activities increased. |

|  | D) | No effect. |

|

|

|

| 10 |  |

In determining cash flows from operating activities (indirect method), adjustments to net income should not include: |

|  | A) | An addition for depreciation expense. |

|  | B) | A deduction for bond premium amortization. |

|  | C) | An addition for a gain on sale of equipment. |

|  | D) | An addition for patent amortization. |

|

|

|

| 11 |  |

The net income for World Class Corporation was $140 million for the year ended December 31, 2016. Related information follows:Amortization of patent, $1 million.

Cash dividends paid, $14 million.

Decrease in accounts receivable, $9 million

Decrease in salaries payable, $1 million.

Depreciation expense, $20 million.

Increase in long-term notes payable, $13 million.

Sale of preferred stock for cash, $17 million. Cash flows from operating activities during 2016 should be reported as: |

|  | A) | $151 million. |

|  | B) | $169 million. |

|  | C) | $171 million. |

|  | D) | $182 million. |

|

|

|

| 12 |  |

A statement of cash flows and its related disclosure note typically do not report: |

|  | A) | Acquired use of a building with a lease agreement. |

|  | B) | The purchase of treasury stock. |

|  | C) | Stock dividends. |

|  | D) | Notes payable issued for a tract of land. |

|

|

|

| 13 |  |

Sean-McDonald Company sold a printer with a cost of $34,000 and accumulated depreciation of $21,000 for $10,000 cash. This transaction would be reported as: |

|  | A) | An operating activity. |

|  | B) | An investing activity. |

|  | C) | A financing activity. |

|  | D) | None of the above. |

|

|

|

| 14 |  |

In a statement of cash flows (indirect method), a decrease in inventory should be reported as: |

|  | A) | A deduction from net income in determining cash flows from operating activities. |

|  | B) | An addition to net income in determining cash flows from operating activities. |

|  | C) | An investing activity. |

|  | D) | Not reported. |

|

|

|

| 15 |  |

In a statement of cash flows (indirect method), an increase in available-for-sale securities should be reported as: |

|  | A) | A deduction from net income in determining cash flows from operating activities. |

|  | B) | An addition to net income in determining cash flows from operating activities. |

|  | C) | An investing activity. |

|  | D) | Not reported. |

|

|

|

| 16 |  |

If sales revenue is $20 million and accounts receivable increased by $3 million, the amount of cash received from customers: |

|  | A) | was $17 million. |

|  | B) | was $20 million. |

|  | C) | was $23 million. |

|  | D) | depends on the proportion of cash sales and credit sales. |

|

|

|

| 17 |  |

If bond interest expense is $400,000, bond interest payable increased by $4,000 and bond discount decreased by $1,000, cash paid for bond interest is: |

|  | A) | $395,000. |

|  | B) | $397,000. |

|  | C) | $403,000. |

|  | D) | $405,000. |

|

|

|

| 18 |  |

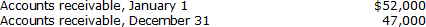

Sales revenue for Marshall Matches was $240,000. The following data are from the accounting records of Marshall: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter21_q18.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter21_q18.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (17.0K)</a>

The cash received from customers was: |

|  | A) | $235,000. |

|  | B) | $244,000. |

|  | C) | $240,000. |

|  | D) | $245,000. |

|

|

|

| 19 |  |

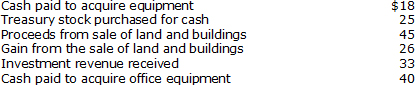

Selected information from Mercer Corporation's accounting records and financial statements for 2016 is as follows ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter21_q19.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter21_q19.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a>

On its statement of cash flows, Mercer should report net cash outflows from investing activities of: |

|  | A) | $13 million. |

|  | B) | $23 million. |

|  | C) | $38 million. |

|  | D) | $39 million. |

|

|

|

| 20 |  |

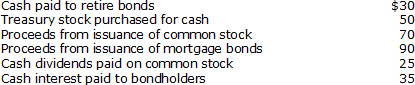

Selected information from Phillips Corporation's accounting records and financial statements for 2016 is as follows ($ in millions): <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter21_q20.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter21_q20.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (48.0K)</a>

On its statement of cash flows, Phillips should report net cash inflows from financing activities of: |

|  | A) | $20 million. |

|  | B) | $55 million. |

|  | C) | $70 million. |

|  | D) | $105 million. |

|

|

|

| 21 |  |

Consistent with U.S. GAAP, IFRS classifies cash flows as operating, investing, or financing. However, U.S. GAAP designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. IFRS |

|  | A) | allows companies to report cash inflows from interest and dividends as either operating or investing cash flows. |

|  | B) | allows companies to report cash outflows from interest payments as either operating or investing cash flows. |

|  | C) | allows companies to report dividends paid as either investing or operating cash flows. |

|  | D) | designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. |

|

|

|

| 22 |  |

A company can report interest payments and interest received as operating cash flows using |

|  | A) | Either U.S. GAAP and IFRS. |

|  | B) | IFRS. |

|  | C) | U.S. GAAP. |

|  | D) | Neither U.S. GAAP and IFRS. |

|

|

|

| 23 |  |

A company can report interest received and dividends received as investing activities using |

|  | A) | Either U.S. GAAP and IFRS. |

|  | B) | Neither U.S. GAAP and IFRS. |

|  | C) | U.S. GAAP. |

|  | D) | IFRS. |

|

|