|

| 1 |  |

Which of the following captions would more likely be found in a multiple-step income statement? |

|  | A) | Total expenses. |

|  | B) | Total revenues and gains. |

|  | C) | Operating income. |

|  | D) | All of these answer choices are incorrect. |

|

|

|

| 2 |  |

An item typically included in the income from continuing operations section of the income statement is: |

|  | A) | Discontinued operations. |

|  | B) | Restructuring costs. |

|  | C) | Prior period adjustment. |

|  | D) | All of these answer choices are incorrect. |

|

|

|

| 3 |  |

The application of intraperiod income taxes requires that income taxes be apportioned to each of the following items except: |

|  | A) | Income from continuing operations. |

|  | B) | Operating income. |

|  | C) | Discontinued operations. |

|  | D) | All of these answer choices are incorrect. |

|

|

|

| 4 |  |

For a manufacturing company, each of the following items would be considered nonoperating income for income statement purposes except: |

|  | A) | Income from investments. |

|  | B) | Cost of goods sold. |

|  | C) | Interest expense. |

|  | D) | Gain on sale of investments. |

|

|

|

| 5 |  |

On May 31, 2016, the Arlene Corporation adopted a plan to sell its cosmetics line of business, considered a component of the entity. The assets of the component were sold on October 13, 2016, for $1,120,000. The component generated operating income from January 1, 2016, through disposal of $300,000. In its income statement for the year ended December 31, 2016, the company reported before-tax income from operations of a discontinued component of $620,000. What was the book value of the assets of the cosmetics component? |

|  | A) | $800,000 |

|  | B) | $1,420,000 |

|  | C) | $300,000 |

|  | D) | All of these answer choices are incorrect. |

|

|

|

| 6 |  |

The Compton Press Company reported income before taxes of $250,000. This amount included a $50,000 loss on discontinued operation. The amount reported as income from continuing operations, assuming a tax rate of 40%, is: |

|  | A) | $250,000 |

|  | B) | $180,000 |

|  | C) | $120,000 |

|  | D) | $150,000 |

|

|

|

| 7 |  |

The Stibbe Construction Company switched from the completed contract method to the percentage-of-completion method of accounting for its long-term construction contracts. This is an example of: |

|  | A) | A change in accounting principle. |

|  | B) | A change in accounting estimate. |

|  | C) | An unusual item. |

|  | D) | A discontinued operation. |

|

|

|

| 8 |  |

Earnings per share should be reported for each of the following income statement captions except: |

|  | A) | Income from continuing operations. |

|  | B) | Discontinued operations. |

|  | C) | Operating income. |

|  | D) | Net income. |

|

|

|

| 9 |  |

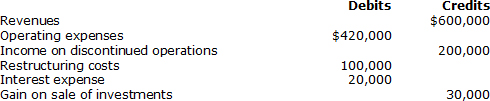

The following items appeared in the 2016 year-end trial balance for the Brown Coffee Company: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter04_09.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (44.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter04_09.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (44.0K)</a>

Income tax expense has not yet been accrued. The company's income tax rate is 40%. What amount should be reported in the company's year 2016 income statement as income from continuing operations? |

|  | A) | $90,000 |

|  | B) | $66,000 |

|  | C) | $34,800 |

|  | D) | $54,000 |

|

|

|

| 10 |  |

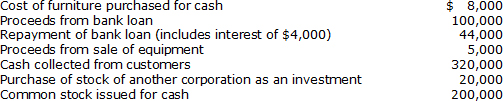

Selected information from the 2016 accounting records of Dunn's Auto Dealers is as follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter04_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (71.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter04_10.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (71.0K)</a>

In its 2016 statement of cash flows, Dunn's should report net cash inflows from financing activities of: |

|  | A) | $260,000 |

|  | B) | $265,000 |

|  | C) | $60,000 |

|  | D) | $256,000 |

|

|

|

| 11 |  |

Using the information in question 10, Dunn's should report net cash outflows from investing activities of: |

|  | A) | $27,000 |

|  | B) | $32,000 |

|  | C) | $28,000 |

|  | D) | $23,000 |

|

|

|

| 12 |  |

Which of the following items would not be included as a cash flow from operating activities in a statement of cash flows? |

|  | A) | Collections from customers. |

|  | B) | Interest on note payable. |

|  | C) | Purchase of equipment. |

|  | D) | Purchase of inventory. |

|

|

|

| 13 |  |

In a statement of cash flows, International Financial Reporting Standards allow companies to report interest paid as: |

|  | A) | Either an operating or investing cash flow. |

|  | B) | Either an investing or financing cash flow. |

|  | C) | An operating cash flow only. |

|  | D) | Either an operating or a financing cash flow. |

|

|