|

| 1 |  |

Which of the following is not one of the steps for recognizing revenue? |

|  | A) | Identify the performance obligations of the contract. |

|  | B) | Identify the contract with the customer. |

|  | C) | Estimate the total transaction price of the contract based on the sum of the stand-alone selling prices of the goods and services in the contract. |

|  | D) | Allocate the transaction price to the performance obligations. |

|

|

|

| 2 |  |

Which of the following is true about revenue recognition under ASU 2014-09? |

|  | A) | The realization principle guides the ASU. |

|  | B) | Construction contracts are typically broken into the various separate goods and services that are included in them for purposes of revenue recognition. |

|  | C) | The time value of money is considered when estimating all transaction prices. |

|  | D) | Collectibility of the receivable is considered when determining whether revenue can be recognized. |

|

|

|

| 3 |  |

Which of the following is not one of the characteristics of a contract for purposes of revenue recognition? |

|  | A) | Rights. |

|  | B) | Reasonable profit margin. |

|  | C) | Approval. |

|  | D) | Commercial substance. |

|

|

|

| 4 |  |

Which of the following is not an indicator that control of a good has passed from the seller to the buyer? |

|  | A) | Buyer has an unconditional obligation to pay. |

|  | B) | Buyer has legal title. |

|  | C) | Buyer has scheduled delivery. |

|  | D) | Buyer has assumed the risk and rewards of ownership. |

|

|

|

| 5 |  |

Which of the following is an indicator that revenue for a service can be recognized over time? |

|  | A) | The seller is enhancing an asset that the buyer controls as the service is performed. |

|  | B) | The seller is providing continuous effort to the buyer. |

|  | C) | The seller can estimate the percent of work completed. |

|  | D) | The sales price is fixed and determinable. |

|

|

|

| 6 |  |

Which of the following is not an indicator that revenue for a service can be recognized over time? |

|  | A) | The customer owns the asset as the seller is constructing it. |

|  | B) | The seller is providing continuous effort to the buyer. |

|  | C) | The asset being constructed has no alternative use to the seller, and the seller has the right to payment for progress to date even if the customer cancels the contract. |

|  | D) | The seller has significant experience with the customer and anticipates fulfillment of the contract. |

|

|

|

| 7 |  |

Which of the following is consistent with goods and services being distinct for purposes of identifying separate performance obligations? |

|  | A) | The seller regularly sells the good or service separately. |

|  | B) | The buyer could use the good or service on its own. |

|  | C) | The buyer could use the good or service in combination with goods or services the buyer could obtain elsewhere. |

|  | D) | All of the above. |

|

|

|

| 8 |  |

Which of the following is a separate performance obligation? |

|  | A) | An extended warranty. |

|  | B) | A prepayment. |

|  | C) | A right of return. |

|  | D) | An option for the customer to purchase additional products under the same terms |

|  | E) | enjoyed by other new customers. |

|

|

|

| 9 |  |

Which of the following is an acceptable way to estimate uncertain consideration? |

|  | A) | Most likely amount to be received. |

|  | B) | Minimum amount considered likely to be received. |

|  | C) | Expected value of the amount to be received. |

|  | D) | Both a and c are acceptable. |

|

|

|

| 10 |  |

Lewis is selling a product with some of the transaction price depending on the outcome of a future event. There is a 75% chance that the event will result in $100,000 of consideration to Lewis, and a 25% chance that the event will result in $40,000 of consideration to Lewis. Which of the following is not an appropriate estimate of the amount of uncertain consideration for purposes of Lewis estimating the transaction price? |

|  | A) | $100,000. |

|  | B) | $85,000. |

|  | C) | $70,000. |

|  | D) | a-c are all appropriate estimates. |

|

|

|

| 11 |  |

Assume a prepayment is made six months in advance of delivery of a product. The seller is likely to do which of the following with respect to the time value of money over the life of the contract? |

|  | A) | Recognize interest expense. |

|  | B) | Recognize interest revenue. |

|  | C) | Ignore the time value of money. |

|  | D) | None of the above. |

|

|

|

| 12 |  |

Bad debts: |

|  | A) | Must be recognized as an expense. |

|  | B) | Must be recognized as a contra-revenue. |

|  | C) | Are only a concern in the case of installment sales. |

|  | D) | Reduce the transaction price that is allocated to separate performance obligations. |

|

|

|

| 13 |  |

Allocation of the transaction price to performance obligations: |

|  | A) | Is based on relative standalone selling prices. |

|  | B) | Cannot be based on estimated selling prices. |

|  | C) | May not use the residual method when selling prices are uncertain. |

|  | D) | Is not allowed when bad debts are material. |

|

|

|

| 14 |  |

Winchell wrote a contract that involves two performance obligations. Product A has a stand-alone selling price of $50, and product B has a stand-alone selling price of $100. The price for the combined product is $120. How much of the transaction price would be allocated to the performance obligation for delivering product A? |

|  | A) | $50. |

|  | B) | $40. |

|  | C) | $30. |

|  | D) | $20. |

|

|

|

| 15 |  |

Winchell wrote a contract that involves two separate performance obligations. Winchell cannot estimate the stand-alone selling price of product A. Product B has a stand-alone selling price of $100. The price for the combined product is $120. How much of the transaction price would be allocated to the performance obligation for delivering product A? |

|  | A) | $50. |

|  | B) | $40. |

|  | C) | $30. |

|  | D) | $20. |

|

|

|

| 16 |  |

Which of the following is not an indicator that the seller may need to constrain recognition of variable consideration? |

|  | A) | Uncertainty will not resolve until far into the future. |

|  | B) | Based on much experience with the customer, the seller anticipates a more-than-remote chance that the receivable will prove uncollectible. |

|  | C) | The seller lacks experience selling similar products. |

|  | D) | Uncertain amounts are susceptible to important factors beyond the seller's control. |

|

|

|

| 17 |  |

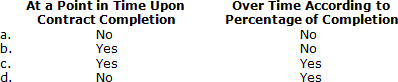

For profitable long-term contracts, income is recognized in each year when revenue is recognized: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_17.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_17.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (28.0K)</a>

|

|  | A) | a |

|  | B) | b |

|  | C) | c |

|  | D) | d |

|

|

|

| 18 |  |

When accounting for a long-term construction contract for which revenue is recognized over time according to the percentage of completion, gross profit is recognized in any year is debited to: |

|  | A) | Construction in progress. |

|  | B) | Billings on construction contract |

|  | C) | Deferred income |

|  | D) | Accounts receivable |

|

|

|

| 19 |  |

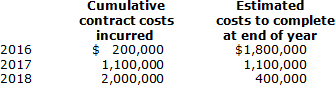

Hollywood Construction Company recognizes revenue over time according to percentage of completion for its long-term construction contracts. During 2016, Hollywood began work on a $3,000,000 fixed-fee construction contract, which was completed in 2019. The accounting records disclosed the following data at year-end: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_19.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (37.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_19.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (37.0K)</a>

For the 2018 year, Hollywood should have recognized gross profit on this contract of: |

|  | A) | $100,000 |

|  | B) | $500,000 |

|  | C) | $266,667 |

|  | D) | $225,000 |

|

|

|

| 20 |  |

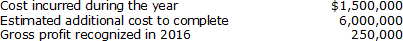

Sandlewood Construction Inc. recognizes revenue over time according to percentage of completion for its long-term construction contracts. In 2016, Sandlewood began work on a $10,000,000 construction contract, which was completed in 2017. The accounting records disclosed the following data at the end of 2016: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_20.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_20.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (24.0K)</a>

How much gross profit should Sandlewood have recognized in 2016? |

|  | A) | $700,000 |

|  | B) | $1,000,000 |

|  | C) | $600,000 |

|  | D) | $0 |

|

|

|

| 21 |  |

Based on the same data in question 20, in addition to accounts receivable, what would appear in the 2016 balance sheet related to the construction accounts? |

|  | A) | A current asset of $1,300,000 |

|  | B) | A current liability of $900,000 |

|  | C) | A current asset of $900,000 |

|  | D) | A current asset of $1,900,000 |

|

|

|

| 22 |  |

The Simpson Construction Company recognizes revenue over time according to percentage of completion for its long-term construction contracts. In 2016, Simpson began work on a construction contract. Information on this contract at the end of 2016 is as follows: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (26.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_22.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (26.0K)</a>

What is the contract price (total revenue) on this contract? |

|  | A) | $7,000,000 |

|  | B) | $8,750,000 |

|  | C) | $7,500,000 |

|  | D) | $9,000,000 |

|

|

|

| 23 |  |

Smith Company earns a 12% return on assets. If net income is $720,000, average total assets must be: |

|  | A) | $86,400 |

|  | B) | $6,000,000 |

|  | C) | $6,086,400 |

|  | D) | $3,000,000 |

|

|

|

| 24 |  |

The Esquire Company reported sales of $1,600,000 and cost of goods sold of $1,122,000 for the year ended December 31, 2016. Ending inventory for 2015 and 2016 was $420,000 and $460,000, respectively. Esquire's inventory turnover for 2016 is: |

|  | A) | 2.44 |

|  | B) | 2.55 |

|  | C) | 3.64 |

|  | D) | 3.48 |

|

|

|

| 25 |  |

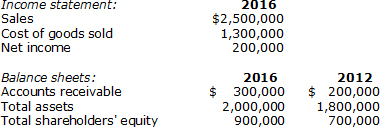

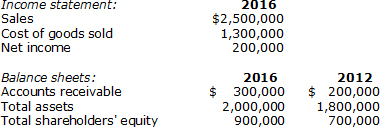

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_25.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (53.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_25.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (53.0K)</a>

The accounts receivable turnover for 2016 is: |

|  | A) | 10.0 |

|  | B) | 8.33 |

|  | C) | 5.2 |

|  | D) | 4.33 |

|

|

|

| 26 |  |

<a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_25.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (53.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_25.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (53.0K)</a>

The return on shareholders' equity for 2016 is: |

|  | A) | 20% |

|  | B) | 8% |

|  | C) | 22.22% |

|  | D) | 25% |

|

|

|

| 27 |  |

This question is based on the Appendix Under the realization principle, revenue is recognized as earned when there is reasonable certainty as to the collectibility of the asset to be received and: |

|  | A) | The sales price has been collected. |

|  | B) | The earnings process is virtually complete. |

|  | C) | Production is completed. |

|  | D) | A purchase order has been received. |

|

|

|

| 28 |  |

This question is based on the Appendix Under IFRS, revenue for the sale of goods is recognized when the seller has transferred to the buyer: |

|  | A) | A signed invoice. |

|  | B) | The risks and rewards of ownership. |

|  | C) | Compelling evidence that substantive installation has occurred. |

|  | D) | None of the above. |

|

|

|

| 29 |  |

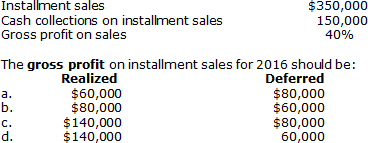

This question is based on the Appendix Western Appliance Company, which began business on January 1, 2016, appropriately uses the installment sales method of accounting. The following data are available for 2016: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_29.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (57.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_29.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (57.0K)</a>

|

|  | A) | a |

|  | B) | b |

|  | C) | c |

|  | D) | d |

|

|

|

| 30 |  |

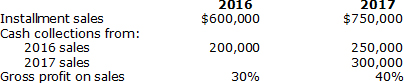

This question is based on the Appendix The Pattison Company began operations on January 2, 2016, and appropriately uses the installment sales method of accounting. The following data are available for 2016 and 2017: <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_30.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (33.0K)</a> <a onClick="window.open('/olcweb/cgi/pluginpop.cgi?it=jpg::::/sites/dl/free/0078025834/1061248/Chapter05_30.jpg','popWin', 'width=NaN,height=NaN,resizable,scrollbars');" href="#"><img valign="absmiddle" height="16" width="16" border="0" src="/olcweb/styles/shared/linkicons/image.gif"> (33.0K)</a>

The deferred gross profit that would appear in the 2017 balance sheet is: |

|  | A) | $180,000 |

|  | B) | $200,000 |

|  | C) | $285,000 |

|  | D) | $225,000 |

|

|

|

| 31 |  |

This question is based on the Appendix When accounting for a long-term construction contract under IFRS, if the percentage-of-completion method is not appropriate, the seller should account for revenue using: |

|  | A) | The cost recovery method. |

|  | B) | The completed contract method |

|  | C) | Either the cost recovery method or the completed contract method |

|  | D) | Neither the cost recovery method or the completed contract method |

|

|

|

| 32 |  |

This question is based on the Appendix When IFRS uses the cost recovery method to account for a long-term contract, |

|  | A) | Revenue typically is recognized in excess of costs incurred early in the life of the contract. |

|  | B) | Costs in excess of revenue are typically recognized early in the life of the contract. |

|  | C) | Revenue equal to costs are typically recognized early in the life of the contract. |

|  | D) | Revenue is based on contract completion, not on costs, early in the life of the contract |

|

|